Titan Flagship Excelling

May 30, 2023

Hope you had a great long weekend. Flagship continues to excel year to date, +14.15%¹ YTD vs. S&P 500 +10.29%, while over the last 12 months, Flagship is +10.29%¹ vs. the S&P 500 +5.45%. This is primarily driven by three factors:

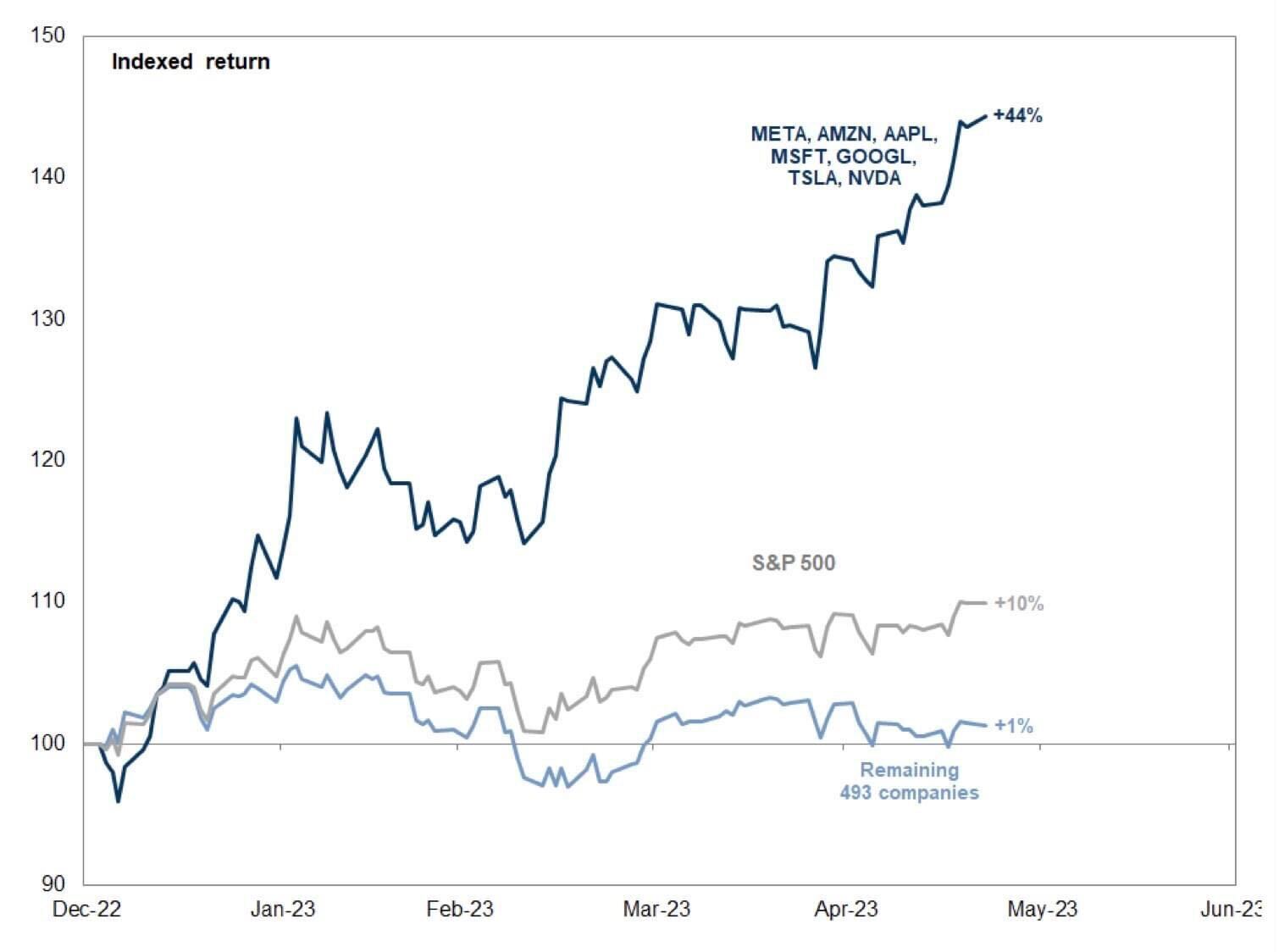

1) We placed big bets on tech “Generals” that are paying off: It’s a tale of two markets. The chart below says it all, and we have meaningful exposure to 5/7 names listed. Our thesis was that stormy market conditions would fuel the Generals’ ability to take share. There may be turbulence in the broader economy, but this is a stock picker’s market.

2) We’ve had good stock picking elsewhere. As the AI race heats up, Advanced Micro Devices (AMD) has nearly doubled (+98%) YTD as investors see AMD as a key enabler of AI proliferation. Uber (UBER) is up nearly 50% YTD after a successful Uber One rollout, combined with easing driver supply issues. Lastly, our high-quality industrial company Transdigm (TDG) is +26% YTD and near all-time highs, as our thesis that commercial aerospace would continue to recover post-covid plays out nicely. Laggards YTD include Charles Schwab (SCHW), which has been dragged down in the banking crisis, and Thermo Fisher (TMO), as healthcare has underperformed the broader market.

3) We’re employing thoughtful risk management. Most clients don’t know that we’re doing the above while running low net exposure. Of every $100 invested in Flagship, we’re holding ~$18 in opportunistic cash (earning 3.2% APY) to take advantage of downturns. When the market takes a dive, we take the opportunity to buy low. We believe several more opportunities will come.

After a challenging 2021, we still have some work to do on our all-time returns compared to the benchmark, but we’re in a great rhythm right now and feel great about our positioning moving forward.

We’ll be out with our full monthly recap in the coming days to discuss the other strategies on Titan.

–Your Flagship Investment Team

Performance represents a hypothetical account as 05/26/23, using Titan’s investment process for an Aggressive portfolio, and does not reflect actual performance of a Titan Client. Performance results are net of advisory fees and include the reinvestment of dividends.

Titan Global Capital Management USA LLC ("Titan") is an SEC registered investment adviser. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Both Titan and TGT are subsidiaries of Titan Global Capital Management, Inc.

All investments involve risk, and the past performance of a security, financial product, or Titan strategy does not guarantee future results or returns. Diversification is a portfolio allocation strategy that seeks to minimize inherent risks by holding assets that are not entirely correlated. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Please visit www.titan.com/legal for important disclosures.

Results for Titan Flagship as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”) is for informational purposes only. The S&P 500 is calculated and distributed exclusively by S&P Dow Jones Indices, and not by Titan, and thus Titan cannot guarantee the accuracy or completeness of the data. Account holdings are for illustrative purposes only and are not investment recommendations. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The investment program does not mirror this index and the volatility may be materially different from the volatility of the S&P 500. Reference or comparison to an index does not imply that the portfolio will be constructed in the same way as the index or achieve returns, volatility, or other results similar to the index. Indices are unmanaged, include the reinvestment of dividends and do not reflect transaction costs.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or other products offered by Titan, TGT, or any third party.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.