Private Credit: Why and Why Now?

Oct 17, 2022

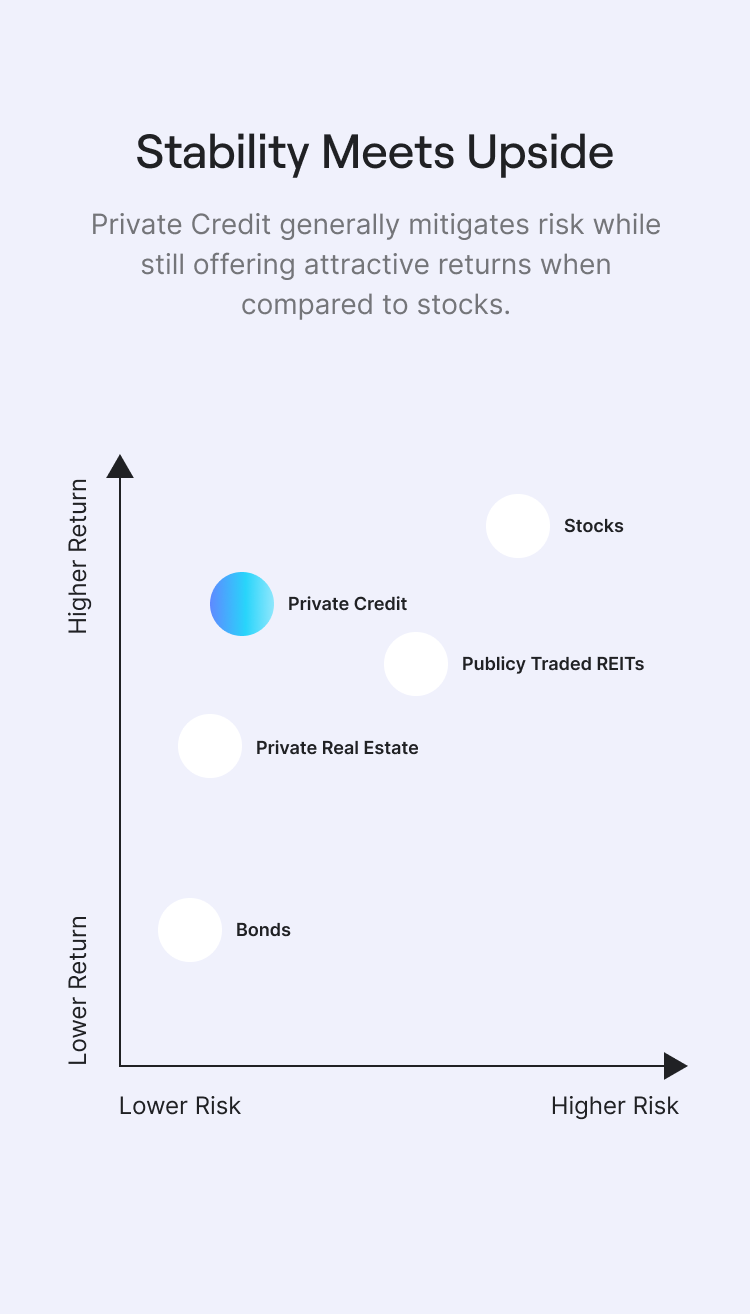

As a part of a diversified portfolio, we believe that investing in private credit can provide three distinct benefits to investors: predictable income, increased stability, and risk-adjusted returns.

Let’s dive in!

Predictable income: Investors have historically relied on Private Credit to pay regular income distributions, typically quarterly, much like a dividend. The income is paid from the contractual interest earned on the private debt assets within the Fund.

Increased stability: Private Credit products don’t trade on public exchanges, reducing their correlation to public markets as well as the overall volatility. Diversifying an equity-heavy portfolio with Private Credit should lead to less portfolio volatility.

Risk-adjusted returns: Private Credit targets higher returns than a traditional bond portfolio. Beneath the Private Credit “umbrella,” there are debt instruments that seek higher returns by lending money to a company in some financial distress at a high rate.

And Why Now?

We believe Private Credit is uniquely positioned to benefit from this rising rate environment for three main reasons.

Floating rate credit: With inflation at 40 year highs, Central Banks around the world are rising rates in an effort to combat inflation. The vast majority of credit assets that Carlyle invests in are floating rate assets; this means that as interest rates increase, Carlyle captures that increased amount they are being paid by their borrowers.

Higher yields: The yields that are being paid are the highest they have been since the Covid crisis, and since then, the Great Financial Crisis. Simply put, Carlyle is being paid more to take risk today than they have been in a very long time. To the extent that interest rates remain elevated/rise further, CTAC will be a benefactor of this trend.

Low default rates: Despite these changing market dynamics, default rates are still at historic lows. Additionally, interest coverage ratios, the measure to which a company can pay interest on the outstanding debt, remain strong compared to historical averages. This is to say that the risk associated with the investments remains steady while still being able to benefit from the increase in interest rate payments.

Carlyle Tactical Private Credit Fund (“Fund”) is a Registered Investment Company product offered by Carlyle Global Credit Investment Management and made available on Titan’s platform as one of many potential investment options available to Titan clients, that may or may not be recommended based on an individual client’s investment objectives and risk tolerance. Please review the following summary of risk factors, as well as the prospectus, for a full list of risks associated with investing in the Fund before making any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Titan is not registered. Please visit www.carlyle.com/fund for important additional disclosures.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.