A closer look: KraneShares CSI China Internet ETF

Jan 11, 2023

Holding Name: KraneShares CSI China Internet ETF (NYSE: KWEB)

Strategy: Offshore

Percent weighting of strategy: ~6.8%

TLDR: Reopening is fueling outperformance in China and important data points signal that growth may continue.

Position overview: KWEB tracks the CSI Overseas China Internet Index, which consists of China based companies whose primary business or businesses are focused on internet and internet-related technology. The Index is free float market capitalization weighted (in other words, weighted based on the market cap of the companies in relation to the available shares outstanding) and includes publicly traded securities on either the Hong Kong Stock Exchange, NASDAQ Stock Market, or New York Stock Exchange.

KWEB's largest holdings include companies that you are likely familiar with: Alibaba, JD.com, Baidu, Bilibili, and more.

Why we own it: KWEB is an ideal investment vehicle to invest in a diversified basket of Chinese technology companies. The position provides Titan investors exposure to companies benefitting from increasing domestic consumption by China's growing middle class - a trend we believe to persist over the next 10-15 years. As of the end of 2021, only 73% of China’s population had access to the internet. Contrasted with the United States' 97% penetration, we believe further adoption is on the horizon.

As local policies continue to loosen, we believe that the Chinese government is attempting to reduce the economic and social cost of its zero-Covid policy. KWEB has the potential to outperform while offering a diversified way to reap the potential benefits of reopening.

The largest holdings in KWEB are still trading near historically low valuations given the derating over the past ~2 years with many valued at historically low EV/EBITDA multiples. Although we believe much of the derating has been warranted, we believe that the pendulum has swung too far and that value can be found for long term holders.

Important to note, with 68% of the KWEB holdings already listed in Hong Kong, KWEB plans to fully convert the remaining American Depository Receipts (ADRs) by the end of the year. Although to a lesser degree today, the risk that Chinese ADRs become delisted in the United States still exists, owning Hong Kong local shares helps us sleep much better at night.

What’s the latest: Chinese authorities’ abrupt pivot away from zero-Covid policies has been matched by the quick shift in investor sentiment about Chinese stocks from the bearishness of the past year. The backdrop for Chinese stocks has changed markedly: for the first time in four years, economic, regulatory and Covid policies are aligned—and are a benefit rather than a hindrance to the market.

Covid cases have begun to plateau, reopening has remained steady and travel restrictions have been lifted - we believe that the reopening trends remain positive for continued outperformance. Not only this, but Chinese consumers are leaving pandemic restrictions with meaningful amounts of built up savings - JPMorgan estimates the three-year total excess savings since 2020 may have reached 5.6 trillion yuan, or about 4.7% of China’s 2022 GDP. This should provide a tailwind for Chinese technology companies in the coming quarters.

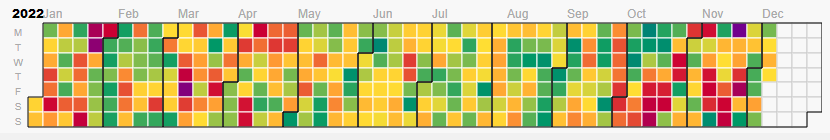

Sign posts moving forward: Knowing that data reported by the Chinese government can be rather subjective, we plan to closely monitor air quality degradation in China’s largest cities, which we believe to be an objective, high-signal data point, given economic activity directly affects air pollution (see chart below from Beijing - we expect to see more red here in the coming months).

We also plan to monitor covid spread and the continued downtrend of reported cases. While case load tolerance is likely to be more relaxed, reported cases may provide insight into pivots or continuation of policy. We acknowledge the potential unreliability of this data but will use this as a barometer for underwriting the risk of closures moving forward.

The content contained in this material is intended for general informational purposes only and is not meant to constitute legal, tax, accounting, solicitation of an offer, or investment advice.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.