April in review

May 4, 2023

1/ There’s an old saying in investing: “Whenever the Fed hits the brakes, someone goes through the windshield.” In 2023, it's been the regional banks, with four banks going under since March.

You may have seen that the FDIC just seized First Republic and sold all of its deposits to J.P. Morgan. Many have been quick to say that this move marks the end of the banking uncertainty, which frankly feels a bit oxymoronic to us. However, at least for now, it appears that depositors have faith in the banking system, and sometimes perception is as good as reality.

2/ Any fears around the banking system or a recession have been overshadowed by strong first-quarter earnings reports, with Big Tech stealing the show. Through the end of April, more than 50% of S&P 500 companies had reported last quarter’s results, and there’s a consistent theme throughout: business trends are better than feared.

Apple, Amazon, Microsoft, and Google were collectively up an average of ~26% YTD through the end of April, and have benefitted from a flight to quality amidst the turmoil. These companies may not have the same pace of sales growth they once did, but they generate extraordinary amounts of free cash flow.

3/ Let’s not forget about Meta Platforms, too. Zuckerberg’s “Year of Efficiency” has the stock up more than 90% YTD–by far the biggest winner within our portfolios to start 2023. Although the business appears to be firing on all cylinders, we wouldn’t be surprised to see the stock take a healthy pause at these levels to digest such a large move.

4/ Outside of tech, much of the broader energy complex has cooled this year after a historically strong 2022. Oil prices are down close to 20% YTD, and while this helps the inflation situation, it's taken a toll on many energy companies’ stock prices. In our opinion, sentiment is far too bearish, creating a set-up that feels a bit like a coiled spring.

5/ Nothing seems to break the consumer’s will to spend on everything from luxury goods to household essentials. Offshore holding LVMH made new all-time highs during the month, and companies such as Uber and L’Oreal were able to pass along higher prices with ease. All in all, if we were to grade earnings so far, we would give them a solid ‘B+.’

6/ Calls for a recession are old news; it’s quite clear that economic growth is slowing. Many economists are calling for “even odds” of a slight recession or modest growth. We’ll just have to see how it plays out.

7/ In terms of the other asset classes on Titan, Private Credit has really caught our attention as of late. Banks have signaled their plans to lend less, but companies still need capital to fuel operations. Enter: Apollo & Carlyle’s credit teams. Both Apollo and Carlyle’s credit funds have current distribution rates north of 9%¹.

8/ Although the venture capital world feels quieter today, deals are still getting done. ARK recently invested in three new private investments: Anthropic, an AI company founded by the ex VP of Research at OpenAI, Mythical Games, a gaming platform that provides developers and publishers a suite of blockchain tools, and Axiom Space, a space infrastructure developer with goals to own and operate the first commercial space station. It’s refreshing to see entrepreneurs continue to receive the funding they need to build.

9/ Lastly, it was great to see the reception around the launch of Titan Treasury. It's clear that clients are looking for a safer place to park cash while earning a competitive yield. We believe Titan Treasury, yielding up to 4.64%², is just that.

10/ Keep an eye out this month for enhancements to our retirement experience on Titan – from the retirement analyzer report to automated IRA transfers and more. We’re going to be here for the long haul, and we hope you join us.

It’ll be Memorial Day weekend before we know it, and we hope you have a great month. As always, please let us know if you have any questions.

Best,

Clay Gardner

Co-CEO and Chief Investment Officer

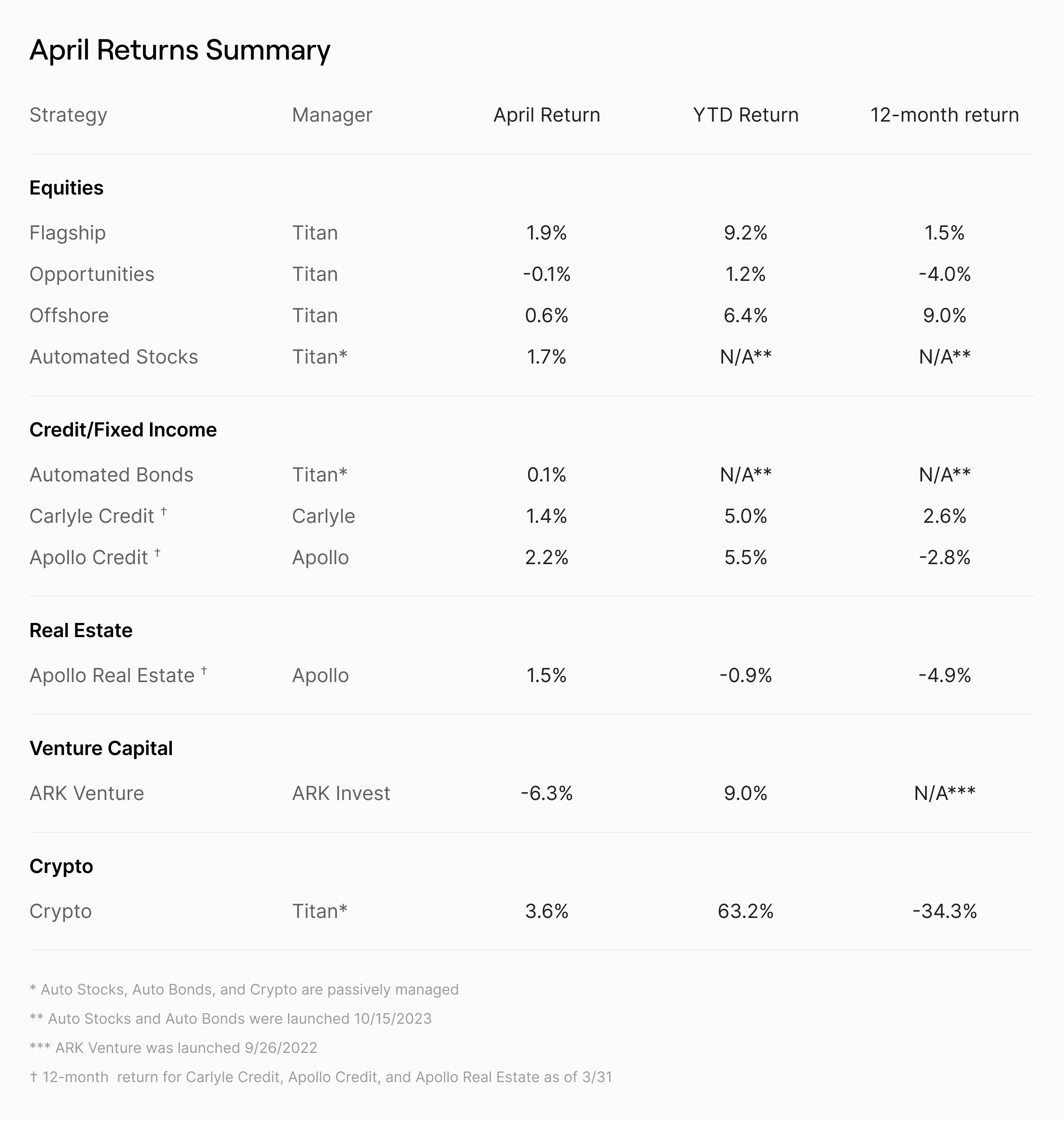

Returns at a glance

In the table below, you can see how each strategy performed in April, year-to-date, and over the last 12-months where applicable.

Disclosures:

1. As of 3/31/2023.

2. As of 5/2/2023. This is the current 7-day SEC yield and is subject to change.

As of writing, AAPL, AMZN, MSFT, META, GOOG, and UBER are holdings in Titan Flagship. LVMH and LRLCY are holdings in Titan Offshore.

Anthropic is a 7.31% holding in the ARK Venture Fund. Mythical Games is a 3.48% holding in the ARK Venture Fund. Axiom Space is a 3.48% holding in the ARK Venture Fund.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck. Contact Titan at support@titan.com. This content is intended for informational purposes only.

Various Registered Investment Company products (“Third Party Funds”) are offered by third-party fund families and investment companies on Titan’s platform as one of many potential investment options available to Titan’s clients, that may or may not be recommended based on an individual client’s investment objectives and risk tolerance. Please review the Third Party Fund’s prospectus in its entirety for a full list of risks associated with investing in the Third Party Fund before making any investment decision. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

You may view the prospectuses for each Third Party Fund mentioned in this content through the hyperlinks below:

Apollo Diversified Credit Fund

Carlyle Tactical Private Credit Fund

All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party. Please visit www.titan.com/legal for important disclosures.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Please visit www.titan.com/legal for important disclosures.

This email is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution, or copying of this message is strictly prohibited. If you have received this message in error, please delete it immediately.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.