ARK Venture Commentary, 5/23/2023

May 23, 2023

Software Abundance: Replit Raises ~$100 Million

Replit, an AI-driven coding platform and software marketplace in ARK Venture Fund’s portfolio, raised ~$100 million at a valuation of more than $1 billion.[1] A16z led the round.

ARK’s Take

By eliminating back-end friction and providing AI coding assistance to developers, Replit is expanding the developer market. 22 million software developers currently work on the Replit platform,[2] a community which formerly contained around 30 million people globally.

Traditional Venture Fund[3] Returns Are Beginning to Reflect Reality

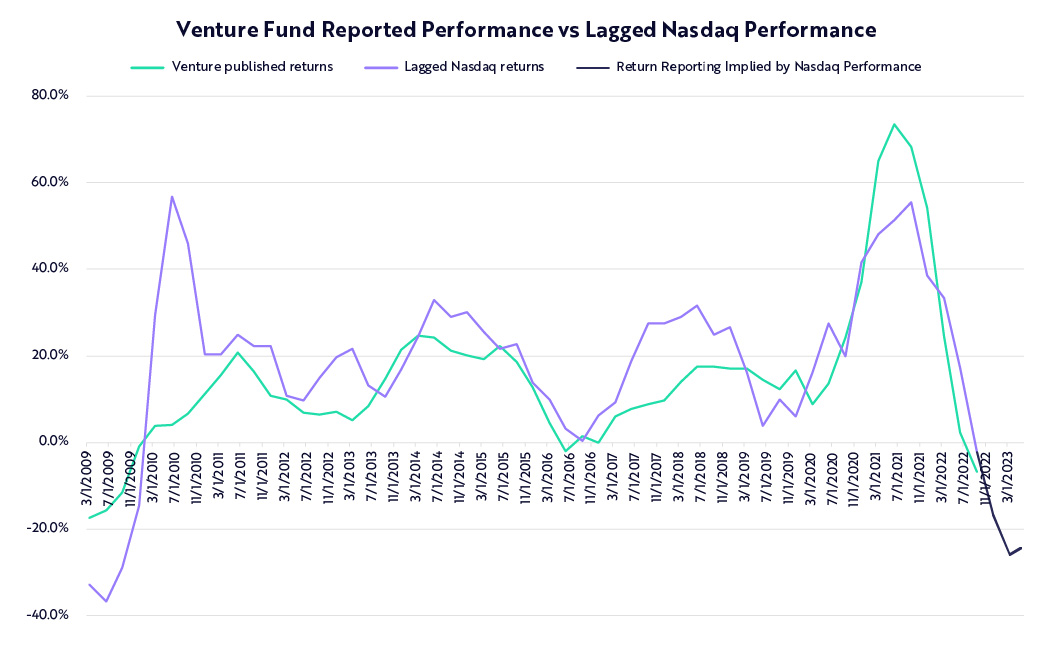

Pitchbook’s 2023 Fund Performance report suggested that venture funds are seeing their worst 1-year rolling performance since 2009:[4] -6.7% 1-year rolling internal rate of return as of third quarter of 2022, with preliminary fourth-quarter reporting suggesting rolling returns of -16%.[5]

ARK’s Take

The situation is likely to look worse over the next few quarters. Venture fund performance reporting tends to recognize write-downs at a 6-month smoothed lag to public market performance, as shown below. This indicates that several investments made during the market's peak in late 2021 have not yet been reflected in the performance data.[6] This is further emphasized by data indicating that additional funding rounds for venture capital are happening at significantly lower valuations compared to previous high points.[7] If its correlation with public markets were to hold, that number likely will deteriorate toward -30% through the first half of this year 2023.

Source: ARK Invest, Capital IQ, Pitchbook Global Fund Performance Report, as of May 2023. Lagged Nasdaq returns are represented by the 3 month trailing average Invesco QQQ Trust Series 1 (QQQ, which tracks the performance of the Nasdaq-100) year over year performance, lagged by 3 months. Past performance is no guarantee of future results. The performance data presented is for illustrative purposes only, does not represent returns of the ARK Venture Fund, and should not be used to form the basis of any investment decision. Nasdaq performance is of the Nasdaq 100 Index, which is unmanaged, does not reflect the deduction of fees or expenses, and is not available for direct investment. Pitchbook Venture Fund data is based on the aggregated Internal Rate of Return (IRR) of 39,059 tracked venture funds.

More Context, Please

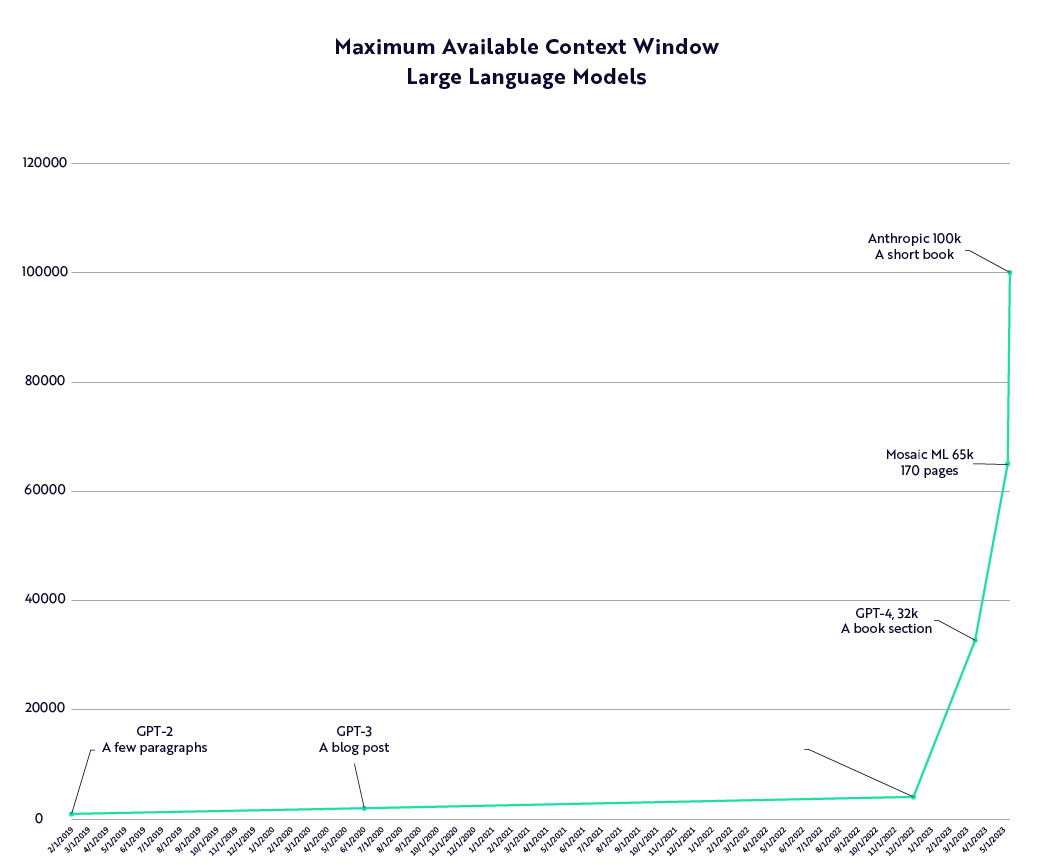

Anthropic, a generative AI company that competes with OpenAI, upgraded its flagship language model’s context window, enabling the AI system to “read” 100,000 tokens (roughly 75k words) at a go.[8] This follows on the heels of MosaicML open-sourcing a model that could take in 65k tokens,[9] and OpenAI’s GPT-4 32k, released in March. [10] Available context windows for AI models have increased 50-fold over 3 years.

Source: ARK Invest, OpenAI, Anthropic, MosaicML, as of May 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. An Application Programming Interface (API) is a set of defined rules that enable different applications to communicate with each other.

ARK’s Take

AI system performance is improving at an astounding rate. Broader context windows allow users to feed more information into an AI model at runtime, which enables the AI model to analyze longer documents or engage in lengthier interactive dialogues and problem-solving sessions. Until this year, the cost of expanding context windows was estimated to scale as a square of context window size. A 100k context window should cost 2,500x more than a 2k context window. Anthropic’s 100k context window costs as much per token as GPT-3’s 2k context window of 3 years ago, suggesting—based on that measure—that AI costs are declining at 90+% per year. Though cost declines are unlikely to continue at that blistering pace—we think 3x per year is a reasonable forecast through 2030—the discontinuous improvement suggests plenty of opportunity for further engineering optimizations amongst AI model providers. Both Anthropic and MosaicML are ARK Venture Fund portfolio companies.

Footnotes:

https://www.reuters.com/technology/cloud-developer-platform-replit-valued-116-bln-after-latest-funding-round-2023-04-25/

In 2019, 30 million software developers were known to be active across the globe. Replit’s 22 million on-platform software developer represent an expansion of that pool. https://www.future-processing.com/blog/how-many-developers-are-there-in-the-world-in-2019/ https://blog.replit.com/replit-developer-day-recap

Traditional venture capital funds in this context are pooled investment vehicles that invest in startups in exchange for ownership in those companies. Venture capital is a type of private equity, which means investments are not made available on a public market. Private funds differ from registered investment companies in that they are offered only to a limited number of financially sophisticated investors rather than to the general public. At its most basic, the two and twenty is basically the standard fee structure for venture capital firms to charge their investors. The 2% is the annual fee that the fund charges investors to manage the fund. And the 20% is the percentage of the upside that the fund managers take.

https://www.penews.com/articles/vc-fund-returns-experience-worst-slump-since-2009-20230517

https://pitchbook.com/news/reports/2022-global-fund-performance-report-as-of-q3-2022-with-preliminary-q4-2022-data

https://news.crunchbase.com/venture/global-vc-funding-falls-q1-2023/

https://www.reuters.com/technology/fintech-stripe-valued-50-bln-after-65-bln-fundraise-2023-03-15/

https://www.anthropic.com/index/100k-context-windows/

https://www.mosaicml.com/blog/mpt-7b/

https://openai.com/research/gpt-4/

Disclosures

Investors should carefully consider the investment objectives, risks, charges, and expenses of the ARK Venture Fund. Those and other details are provided in the ARK Venture Fund’s prospectus, which may be obtained by visiting www.ark-ventures.com. The prospectus should be read carefully before investing.

To view the top 10 holdings in the ARK Venture Fund, click here. To view the most up to date portfolio, click here.

An investment in the ARK Venture Fund is subject to risks and you can lose money on your investment in the ARK Venture Fund. There can be no assurance that the ARK Venture Fund will achieve its investment objectives. The ARK Venture Fund’s portfolio is more volatile than broad market averages. More detailed information regarding these risks can be found in the ARK Venture Fund’s prospectus.

The Nasdaq 100 Index is designed to track the performance of the 100 largest companies on the Nasdaq exchange.

There is no assurance that the Fund will meet its investment objective. The value of your investment in the Fund, as well as the amount of return you receive on your investment in the Fund, may fluctuate significantly. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. Therefore, you should consider carefully the following risks before investing in the Fund.

Communications Sector Risk. The Fund will be more affected by the performance of the communications sector than a fund with less exposure to such sector. Cyber Security Risk. As the use of Internet technology has become more prevalent in the course of business, funds have become more susceptible to potential operational risks through breaches in cyber security. Disruptive Innovation Risk. Companies that the Adviser believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. Financial Technology Risk. Companies that are developing financial technologies that seek to disrupt or displace established financial institutions generally face competition from much larger and more established firms. Next Generation Internet Companies Risk. The risks described below apply, in particular, to the Fund’s investment in Next Generation Internet Companies. Foreign Securities Risk. The Fund’s investments in foreign securities can be riskier than U.S. securities investments. Investments in the securities of foreign issuers (including investments in ADRs and GDRs) are subject to the risks associated with investing in those foreign markets, such as heightened risks of inflation or nationalization. The prices of foreign securities and the prices of U.S. securities have, at times, moved in opposite directions. In addition, securities of foreign issuers may lose value due to political, economic and geographic events affecting a foreign issuer or market. During periods of social, political or economic instability in a country or region, the value of a foreign security traded on U.S. exchanges could be affected by, among other things, increasing price volatility, illiquidity, or the closure of the primary market on which the security (or the security underlying the ADR or GDR) is traded. You may lose money due to political, economic and geographic events affecting a foreign issuer or market. The Fund normally will not hedge any foreign currency exposure. Future Expected Genomic Business Risk. The Adviser may invest some of the Fund’s assets in Genomics Revolution Companies that do not currently derive a substantial portion of their current revenues from genomic-focused businesses and there is no assurance that any company will do so in the future, which may adversely affect the ability of the Fund to achieve its investment objective. Emerging Market Securities Risk. Investment in securities of emerging market issuers may present risks that are greater than or different from those associated with securities of developed market issuers due to less developed and liquid markets and such factors as increased economic, political, regulatory, or other uncertainties. Cryptocurrency Risk. Cryptocurrencies (also referred to as “virtual currencies” and “digital currencies”) are digital assets designed to act as a medium of exchange. Cryptocurrency is an emerging asset class. There are thousands of cryptocurrencies, the most well-known of which is bitcoin. The Fund may have exposure to cryptocurrencies, such as bitcoin indirectly through an investment in the Bitcoin Investment Trust (“GBTC”), a privately offered, open-end investment vehicle that invests in bitcoin. Health Care Sector Risk. The health care sector may be affected by government regulations and government health care programs, restrictions on government reimbursement for medical expenses, increases or decreases in the cost of medical products and services and product liability claims, among other factors. Leverage Risk. The use of leverage can create risks. Leverage can increase market exposure, increase volatility in the Fund, magnify investment risks, and cause losses to be realized more quickly. New Fund Risk. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board may determine to liquidate the Fund if it determines that liquidation is in the best interest of shareholders. Non-Diversification Risk. The Fund is classified as a “non-diversified” investment company under the 1940 Act. Therefore, the Fund may invest a relatively higher percentage of its assets in a relatively smaller number of issuers or may invest a larger proportion of its assets in a single issuer. As a result, the gains and losses on a single investment may have a greater impact on the Fund’s NAV and may make the Fund more volatile than more diversified funds.

Foreside Fund Services, LLC, distributor.

ARK Investment Management LLC ("ARK Invest") is the investment adviser to the ARK Venture Fund.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.