Titan Trade Update: We’ve invested in ServiceNow and Target

Apr 19, 2022

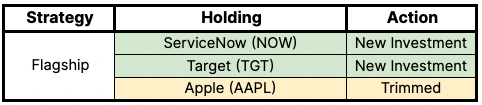

After an investment committee meeting early Monday morning, our team has decided to initiate positions in shares of ServiceNow (NOW) and Target (TGT) for clients in our Flagship strategy. Our team also elected to trim our position in Apple (AAPL).

The table below summarizes these moves:

It was never goodbye forever with ServiceNow

As the sell-off in software names took hold in late 2021, even high-quality SaaS names like ServiceNow came under significant selling pressure. Amid this market rotation, we elected to exit our position in NOW for clients in the Flagship portfolio, eventually selling out of the name on December 8th, 2021 when the stock was trading at ~$660.

This week, our team was able to initiate a new position in NOW for Flagship clients at an average price of ~$511/share across Titan client accounts.

ServiceNow is a quasi-monopoly and is the only SaaS platform that offers the full suite of back-to-front office workflow tools. In plain English, NOW is a one-stop shop for an IT department’s needs. In our view, platform is often an overused term when talking about technology businesses, but we think it’s an appropriate way to describe NOW’s offering.

Enterprise software contracts are long-term in nature and notoriously hairy to get out of, and we believe that even during a potentially slower IT budget environment, NOW contracts will be last to go given their deep integration across their customers’ business.

Clients can read our NOW thesis in the app within the Flagship portfolio, and we’re excited to get involved in SaaS again in Flagship.

On Target

Our team has initiated a position in Target (TGT) for clients in Titan’s Flagship strategy as a starter position. In the months ahead, we’ll be tracking for a series of signposts that will indicate if and when our team sizes up this position within the strategy.

In a crowded U.S. retail landscape, TGT may seem like another big box retailer. But in the last several years, the company has been successful in leveraging its unique omni-channel model to facilitate a digital transformation with full integration of its physical stores and distribution network, effectively repositioning its brand amidst a brutally competitive landscape.

After outsourcing its e-commerce operations to Amazon for nearly a decade in the early 2000s, TGT prioritized investing heavily in its own online and omni-channel infrastructure as evidenced by online sales now comprising over 20% of total sales at TGT, up from just 6% in 2018. TGT has become an industry leader in initiatives like same-day fulfillment and what’s known as BOPIS, or buy online, pick up in store.

Signposts we’ll be tracking for the TGT position include i) Same-store-sales (SSS) and market share gains, ii) digital/e-commerce growth, iii) omni-channel leadership / same-day services and, iv) margins. Should we see improving data points across these four areas, it’s likely we will be adding to this position for Flagship clients.

Slicing Apple

As we were initiating positions in NOW and TGT, we also trimmed our position in Apple (AAPL) for Flagship clients. Apple has held up remarkably well throughout this correction, and the valuation is rich in our eyes. Our research out of China indicates that demand is slowing, and we believe this dynamic could extend further into the U.S. With these factors in mind, we felt it was prudent to roll back our position slightly.

Onward, Titan Team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.