Titan Trade Update: Exiting China, adding to Raytheon

Mar 16, 2022

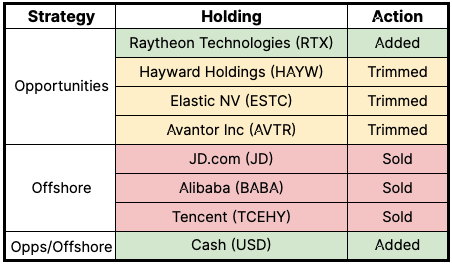

The headwinds in China have been persistent, and earlier this week we elected to sell our small remaining stakes in all Chinese holdings including JD.com (JD), Alibaba (BABA) and Tencent Holdings (TCEHY) to further bolster our cash reserves in the Offshore strategy. In addition to eliminating our exposure to China in Offshore, we continued to position the Opportunities portfolio more defensively by further reducing growth exposure and reinvesting some of the proceeds into Raytheon (RTX).

A not-so perfect storm

In the words of Warren Buffett, “I don’t try to jump over seven foot hurdles, I look for one foot hurdles I can step over” and Tencent, Alibaba and JD.com have evolved into seven foot hurdles. We believe there are better risk-adjusted opportunities abroad (i.e. one foot hurdles), and we sold our remaining stakes in these businesses earlier this week. We could rattle off half a dozen macro-driven headwinds we're seeing in China, and we don’t expect the market to value fundamentals for the foreseeable future.

China is experiencing their worst covid outbreak since early 2020, forcing tens of millions of residents back into lockdown, particularly in China’s tech hub, Shenzhen. Although China’s “Covid Zero” policy hasn’t led to major economic disruption thus far, further lockdowns will put further stress on global supply chains as well as dampen growth expectations for the world’s largest economy.

As mentioned in Three Things on Monday, the U.S. passed a law requiring Chinese companies to allow our regulators to access financials back in late 2020. In their first sign that they aren’t bluffing, the U.S. Securities and Exchange Commission (SEC) identified five Chinese companies that will be delisted from US exchanges if they don’t provide access to audited documents by 2024-2025. Although we don’t own and have never owned any of these companies, the entire Chinese market sold off steeply early in the week on this announcement.

The investment business is one of the most humbling businesses in the world, and it was incredibly frustrating to see China equities bounce higher today after Chinese officials said they would introduce market-friendly policies and keep the capital markets running smoothly. We believe these moves were largely investors covering their short positions vs. new capital being deployed into these companies as sentiment in China has arguably never been worse. Regardless, it’s brutal to see stocks you owned just days earlier soar on a headline.

With the proceeds of these sales, we have added to our cash reserve and plan to deploy this cash into high-quality companies that are more akin to a one foot hurdle.

Leaning on the defense

Although the peace talks with Russia and Ukraine seem to be tracking towards a ceasefire, the situation remains fluid with bounds of uncertainty. We’ve added to our position in Raytheon Technologies (RTX), an aerospace and defense leader with durable free-cash-flow, and reduced our stakes in several volatile holdings in Elastic NV (ESTC), Hayward Holdings (HAYW), and Avantor Inc (AVTR). We’ve also added some proceeds to our cash reserve.

We believe that all three equity portfolios are well positioned to weather the storm with the hedges fully activated and sizable cash positions of 20%+. With the markets in a deep correction, we expect fundamentals to begin to drive narratives after this market wide re-rating, sooner rather than later. We’ll be ready.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.