Titan Trade Update: Initiating three new investments

Mar 11, 2022

Amidst the ongoing volatility, it was an active week for Titan’s portfolios.

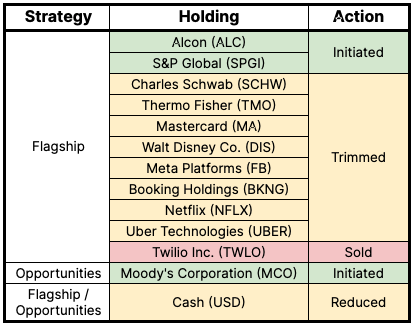

On Wednesday, we sold out of our position in Twilio (TWLO) for Flagship clients while trimming our stakes in several other portfolio holdings into extreme market strength.

On Thursday, we initiated two positions in Flagship and one in our Opportunities strategy during a material market pullback, drawing down some of our strategic cash reserves for the first time this year.

The table below summarizes these moves:

Tapping the cash reserve for first time this year

In our Flagship strategy, we’ve initiated positions in Alcon (ALC) and S&P Global (SPGI). In our Opportunities strategy, we’ve initiated a position in Moody’s Corporation (MCO). All three positions were funded using a portion of our cash reserves, marking the first time we’ve drawn down cash this year.

Over the last several months, we’ve been reducing our positions in high valuation (aka expensive) names and high beta (aka volatile) stocks while building a sizable strategic cash reserves.

It’s important to reiterate that all else equal, we would always prefer to be fully invested; in the coming months, we hope to return our portfolios to this condition.

After a challenging start to the year in equity markets , we’re cautiously optimistic about current market conditions. We see a world where high valuation names have a bit more pain ahead, but believe the time is right to initiate positions in quality companies that we believe are on sale.

We expect to maintain a sizable cash reserve in each strategy given the continued volatility around inflation and the war in Ukraine. And while markets will likely never signal an “all clear” to investors, we’ll continue to opportunistically pick our spots to deploy this capital as conditions evolve.

Adding a few more compounders to the mix

We believe S&P Global (SPGI) and Moody’s Corporation (MCO) are two companies that almost fit a textbook definition of what we mean when we talk about wanting to own compounders. In our eyes, SPGI and MCO are both high-quality businesses with dominant market share, durable competitive advantages, and significant pricing power as toll collectors in the global debt capital markets ecosystem.

Our investment thesis for both S&P Global and Moody’s is based on four main drivers:

Dominant leaders in a duopolistic industry with strong pricing power advantages: SPGI and MCO control 80%+ market share in the debt ratings market.

Superior data analytics platforms: SPGI’s and MCO’s analytics divisions have proven to be scalable, asset-light business models with visible recurring revenue streams and stable margins.

Well positioned to capitalize on the explosive growth of ESG investing: We expect the shift to ESG-focused portfolios to continue for decades into the future, and we’ve underwritten 35-45% compounded annual growth in both companies’ ESG business lines.

Capital-light businesses with an unmatched capital allocation track record: Both SPGI and MCO generate substantial free-cash-flow given their “asset light” business models, meaning their balance sheets are largely free of depreciating assets that require regular and substantial maintenance and investment. The return on invested capital (ROIC’s) for both businesses are at the high-end of Titan holdings, with our working suggesting a 25-35% ROIC for both businesses.

Clear eyes with Alcon

In our Flagship strategy, we initiated a position in the global leader in the eye-care market, Alcon (ALC).

What's bad for our eyes is good for Alcon's bottom line. The eye-care market is a secular growth story driven by a myopia epidemic resulting from far too much screen time, an aging population, and rising income levels driving more demand for eye care. We believe these trends create attractive markets with defensive characteristics, which should continue to grow even in the event of an economic slowdown.

Alcon has always been hyper-focused on physicians because they are the "gate-keepers" to the eye-care market, and consumer decisions are heavily influenced by their doctors’ recommendations. Physicians care more about effectiveness, customer comfort, and new products than price and Alcon's long-standing relationships with physicians are hard for competitors to replicate. Additionally, roughly 70% of the company’s sales are recurring, which always provides another layer of comfort.

We're excited to add additional healthcare exposure to our Flagship strategy, and we believe this secular growth story can compound client capital at 15% annually over the next 3 years.

Cutting ties with Twilio

Twilio has been an incredibly frustrating holding over the last 6 months, and after a swift fall from recent highs, the stock is nearing its pre-COVID levels. We had materially trimmed our position ahead of their last earnings report, and this week sold our final stake in the name.

We struggle to see what gets this stock moving higher in the near/medium term given the stagflationary macro environment, continued near-term margin headwinds, and an apparent air pocket down to pre-COVID valuation lows even after the brutal drawdown over the past 3-6 months.

With a lack of company specific catalysts for Twilio in the near-term, we frankly believe there are better risk-adjusted opportunities (e.g. SPGI, ALC) for clients in Flagship. We were able to harvest losses for many clients which should help offset taxable gains elsewhere in client portfolios.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.