Titan Trade Update: Adding cash across the board

Feb 25, 2022

We’ve made a number of changes across all three equity strategies in an effort to reduce risk ahead of the March Fed meeting.

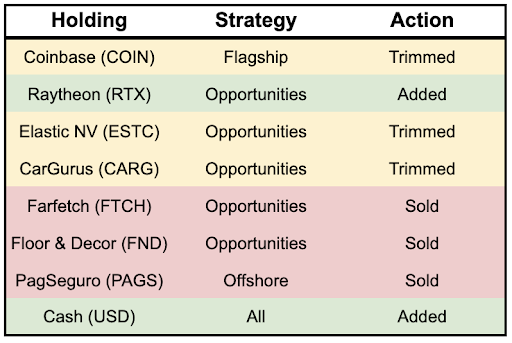

In the Flagship strategy, we trimmed Coinbase (COIN) and added to our cash reserve. In the Opportunities strategy, we added to Raytheon (RTX) and our cash reserve, trimmed Elastic NV (ESTC), CarGurus (CARG), Denison Mines (DNN), and sold Floor & Decor (FND) and Farfetch (FTCH). In our Offshore strategy, we sold PagSeguro (PAGS) and added to our cash reserve.

The table below summarizes these moves:

Volatility persists

On Thursday morning, February 24, the world woke up to the news that Russia had invaded Ukraine, sending markets on the move. By day’s end, the Nasdaq had swung more than 6% from trough to peak, a reminder of how volatile this current market environment remains.

As our team continues to position our portfolios for a higher rate environment and what we expect to be a choppy period for equities, we’ve continued to trim holdings we believe trade at elevated valuations while adding to our cash holdings. With this latest rebalance, we exited three positions and trimmed four others.

As recently communicated to clients, hedges have been fully activated across all three equity strategies since January, and each strategy is now holding more than 15% cash.

By shoring up more cash now, we believe we may be able to redeploy capital into more attractive situations in the future as the environment settles down.

Playing defense

Raytheon Technologies (RTX): With a portion of the proceeds from our portfolio moves, we added to our recently initiated position in RTX. With free-cash-flow growing more than 20% year-over-year and ~50% of revenues coming from their stable, high-margin defense business, RTX should act as a steady anchor throughout this volatile period. We currently are forecasting an 18% annualized return, net of fees, through the end of 2024.

We added additional cash to our reserves in all three equity strategies in an effort to further reduce our net exposure in anticipation of deploying this capital into stocks that offer superior risk/reward in the future.

A touch of risk management

Elastic NV (ESTC): We elected to trim our position in Elastic, a fast-growing software name we believe remains vulnerable to the stock pressures facing businesses with similar qualities as interest rates continue to rise. Even with this reduction, we maintain nearly a full position in ESTC for clients in our Opportunities strategy and continue to be bullish on their business long-term.

CarGurus (CARG): Before trimming our position, CARG had been a steady positive performer for the portfolio, growing to nearly 9% position weighting within the Opportunities strategy. CARG’s auction business (CarOffer) continues to grow at a staggering rate, subscription business continues to chug along, and we remain happy investors of CARG. Due to the increasing size of the position on an absolute level, we believe trimming our position is the prudent risk management decision at this time.

Coinbase (COIN): As mentioned in a recent trade update, we believe it's prudent to trim our COIN position further due the volatility associated with owning high EV / Sales (aka expensive) and high beta (aka volatile) stocks. Coinbase certainly falls in that camp, but we continue to be bullish long term.

Denison Mines (DNN): This was a very small trim (<0.5%) to keep the position under our target weight within the portfolio. We continue to be very bullish on the shift to nuclear, particularly in light of the recent conflict in eastern Europe.

So long, for now

Floor and Decor (FND): We’ve sold the remainder of our FND position in the Opportunities strategy after investing in the company back in August 2020. Our research indicates that some of the recent headwinds surrounding supply chain bottlenecks, increasing costs, and lower DIY spend seen in recent months could remain longer than initially expected. Our research/diligence efforts also indicate that strong DIY spend seen in prior periods could begin tapering/normalizing faster than current expectations with recent data points showing elevated demand spurred from government stimulus and Covid-era consumer habits has slowed with economic reopening. While we remain very confident in the company’s ability to perform well over the medium/-long-term on the back of strong +15-20% unit expansion/year, we believe the risks for the company/stock have meaningfully increased relative to our initial expectations and could pressure the stock during the upcoming quarters. We’re keen to re-underwrite the thesis again in the future.

PagSeguro (PAGS): We’ve sold the remainder of our PAGS position in the Offshore strategy. As much as it pains us to sell the stock at these levels, from a risk-management perspective, the negative attribution to date — i.e. the losses that would have otherwise not been realized had PAGS been taken out of the strategy — in the portfolio is unacceptable. Although our investment thesis in the company remains intact given the strong/improving underlying fundamentals and rapid growth at the company’s crown jewel PagBank division, we meaningfully underestimated the impact/magnitude of Brazil’s macroeconomic influence (staggering unemployment, increasing inflation, and rising rates) on the stock’s performance. Make no mistake, we are not/will never be satisfied with any negative investment outcome for our clients and have conducted a full post-mortem / incorporated these learnings into our investment process going forward.

Farfetch (FTCH): We were torn between keeping a small position or exiting the holding completely but ultimately decided to sell our position in FTCH for Opportunities clients. A challenging e-commerce environment coupled with volatility in the name created a situation we believe was most prudently addressed by exiting the position. We’re working through a post-mortem here and will share our takeaways.

As always, let us know if you have any questions about these moves, and thank you for your trust during times of uncertainty.

Onwards, Titan Team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.