Titan Trade Update: Shoring up cash in Offshore

Feb 8, 2022

We’ve trimmed several existing holdings for clients in our Offshore strategy to replenish our strategic cash reserve.

We are cognizant that international markets have been challenging, and Titan’s Offshore portfolio has not been immune. We continue to have conviction in select international equities over the long run that meet our rigorous investment checklist (long growth runways, durable competitive advantages, excellent unit economics, attractive valuations). However, we believe current conditions warrant a further de-risking within the portfolio, with a stronger dollar, higher interest rates, elevated energy prices, and an idiosyncratic global recovery from the pandemic challenging equity valuations outside the U.S. more harshly than state-side peers.

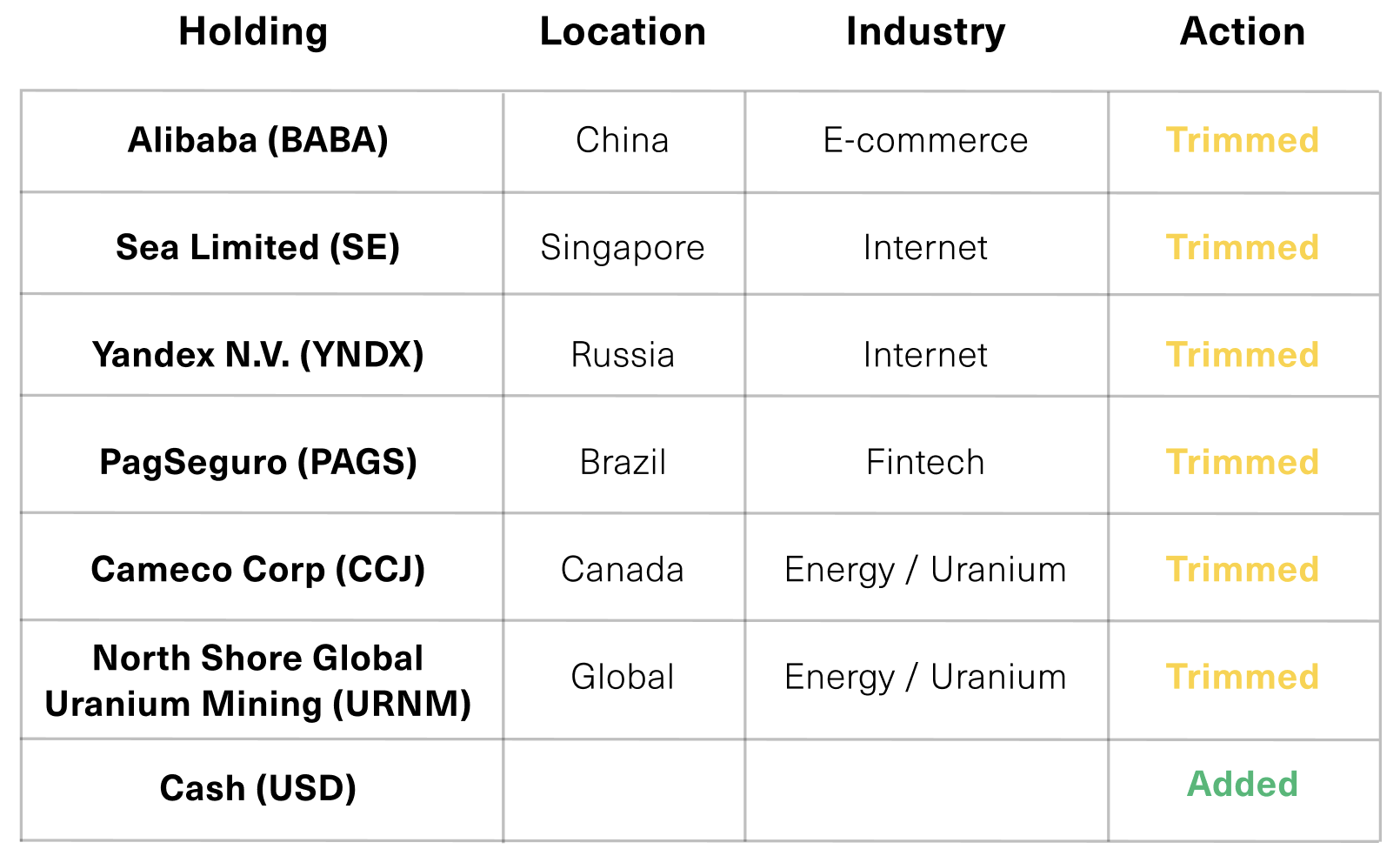

The table below summarizes our portfolio adjustments:

We believe these moves accomplish two key things for our clients:

We believe these moves accomplish two key things for our clients:

- Adding to our cash reserve to deploy in the future; and

- Reducing exposure to low free-cash-flow holdings.

Another broad slice to the globe

Uranium holdings (URNM/CCJ): We believe demand for uranium amid global interest in nuclear power as a source of renewable energy may be in its early days. In other words, the core tenets of our uranium thesis remain intact. However, these holdings have grown to be some of the largest in the portfolio, and we believe it is prudent to reduce the portfolio’s exposure to this theme.

Alibaba (BABA): As we enter 2022, we believe that we are likely past the peak of regulatory intensity in China and have a broadly sanguine view on Chinese equities given present valuations. However, we are selectively trimming our position in Alibaba as near-term estimates still seem too high as competition in e-commerce is unlikely to abate, in our view.

Sea Limited (SE): Our work suggests the company may be seeing a deceleration in the growth of its gaming and ecommerce businesses, and in this investment climate investors have judged any signs of slowing growth harshly. We believe the company can be a dominant force across all 3 of its categories — gaming, ecommerce, and payments — over the long-run, but believe a smaller position within the portfolio is warranted at this time.

Yandex N.V. (YNDX): As we noted in our update on Friday, geopolitical tensions are worsening in eastern Europe. As a result, we’ve reduced our exposure in this Russian internet conglomerate as we wait for more clarity on the situation.

PagSeguro (PAGS): PAGS has faced considerable macroeconomics headwinds in Brazil as interest rates rise and economic growth slows, putting shares under meaningful pressure over the last several months. While we continue to believe in the company long-term, we believe the macro narrative will continue to drive price action in the near term. When macro stories trump business fundamentals, it is difficult to maintain conviction in a position that warrants a large weighting and believe trimming our holdings in PAGS at this time offers our Offshore strategy a more balanced risk profile.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.