ASML soars on surging demand

Apr 22, 2021

On Wednesday, Offshore portfolio holding ASML rose +6% after reporting blowout earnings on the back of soaring semiconductor demand.

The semicap supplier topped revenue and earnings estimates by +8% and +25% respectively as heightened customer demand for productivity improvements pulled forward meaningful software upgrade revenues into the quarter.

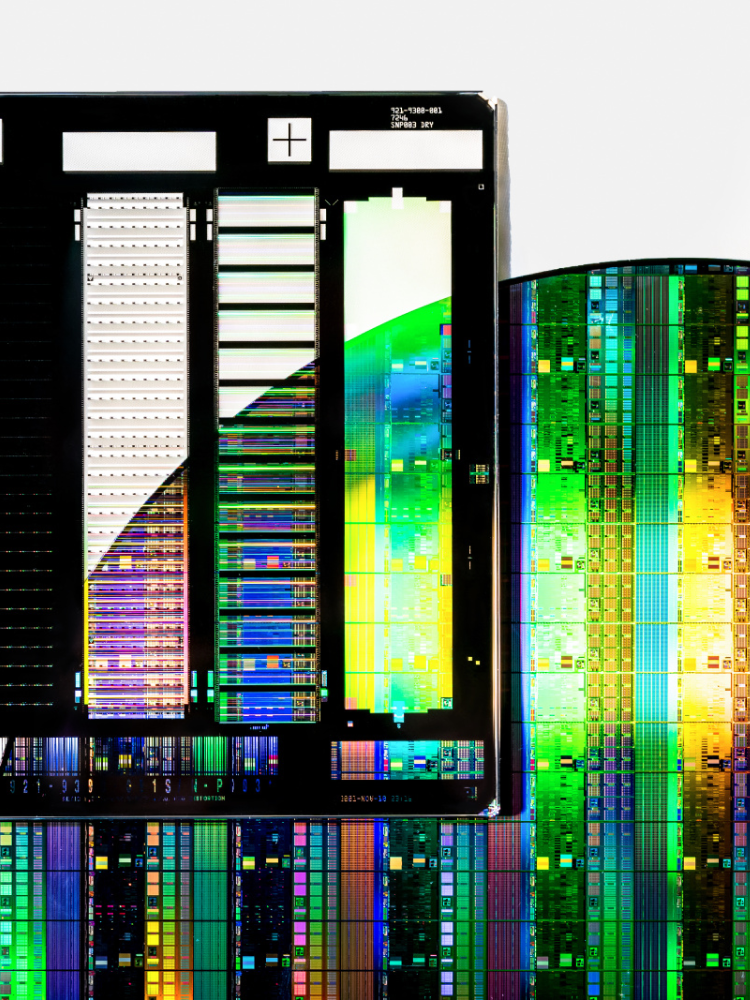

As a reminder, ASML is a mission-critical developer of leading-edge semiconductor equipment - in particular, the advanced lithography systems that enable chip manufacturers like Intel to "print" circuit designs onto silicon.

In our opinion, ASML is arguably the single most important technology business in the world, having a monopoly on the critical next-gen technology that enables global computing power to get orders of magnitude better and cheaper every couple of years (in other words, Moore's Law).

Demand for ASML's system solutions surged in Q1 as the world grapples with a global chip shortage that prompted ASML to dramatically hike its fiscal year outlook, with logic and memory revenue growth targets increased to +30% and +50% respectively (up from +10% and +20% just three months ago).

What's most impressive is that ASML's dominance in lithography is not driven by network effects, economies of scale, or your other more typical competitive advantages, but rather just a raw technological edge that has been slowly accumulated over decades of hard, bleeding-edge research & development.

The next-gen solutions ASML has pioneered (mainly, extreme ultraviolet or "EUV" lithography) took decades and tens of billions of dollars to develop as the fundamental problems they seek to solve require feats that push the limits of physics itself - achievements that can be thought of as akin to developing a flashlight that can accurately strike a penny on the moon.

To enable these types of outcomes to be achieved, ASML developed incredibly advanced and complex systems that can weigh up to 200 tons per unit and that each individually require a custom supply chain of up to 20 trucks and 3 cargo jets just to transport.

This is a technological and process advantage that's not going away any time soon, and one that we expect ASML will meaningfully benefit from over the next several years as it occupies the position as the de facto "arms dealer" sitting at the crossroads of two major and accelerating drivers of semiconductor capex (the competitive race between Intel/Samsung and TSMC for foundry parity, and the geopolitical race between US and China for technological/semiconductor independence).

Stepping back, we were pleased to see ASML's strength in Q1 and are optimistic on its ability to achieve its materially boosted outlook for the remainder of 2021, but remain ever-focused on the long-term.

As the world's need for leading edge computing power accelerates on the back of artificial intelligence, 5G, and autonomous driving-fueled demand, ASML should see accelerating secular growth in demand for its next-gen, mission critical lithography technology.

At the same time, its economic profile should meaningfully improve as nascent but growing subscription-like service revenues increasingly dominate its overall financial profile, boosting both margins and cash flow stability.

We believe the convergence of these two trends will have an extremely powerful effect and should drive ASML to outperform for years to come as it continues to act as the quiet but critical enabler behind the world's most important technological and economic advancements.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.