Google: A Compelling Risk/Reward?

Jun 3, 2019

Alphabet (GOOG) fell -6% on Monday on the news that the U.S. Department of Justice (DOJ) is preparing an investigation of Google.

DOJ Investigation##

There is no case against Google yet; there isn't even an investigation. However, it's worth understanding why the DOJ is potentially going after Google, and how the stock is valued on a risk/reward basis here.

We love this thought from Stratechery's Ben Thompson:

"Tech companies gain market power, at least in the beginning, by offering a superior solution. They leverage that advantage into market dominance through network effects. And only then, when they have picked all of the low-hanging fruit in their market, do tech companies start to leverage their size into adjacent markets, which is what triggers antitrust scrutiny."

Why DOJ Is Concerned##

The DOJ is primarily concerned with Google's search business and its Android operating system business:

- Both of these segments have tremendous market share (well over 50% depending on how you cut their "addressable markets" in different geographic regions).

- The DOJ is digging into whether such high market share is preventing adequate competition and thus hurting consumers' best interests.

It's too early to tell if an investigation will actually happen, and if it does, what the result could be. But we think the valuation is already baking in a lot of this risk.

GOOG at its Lowest Valuation in Years##

Here's a chart of GOOG's stock recently:

Source: Sentieo

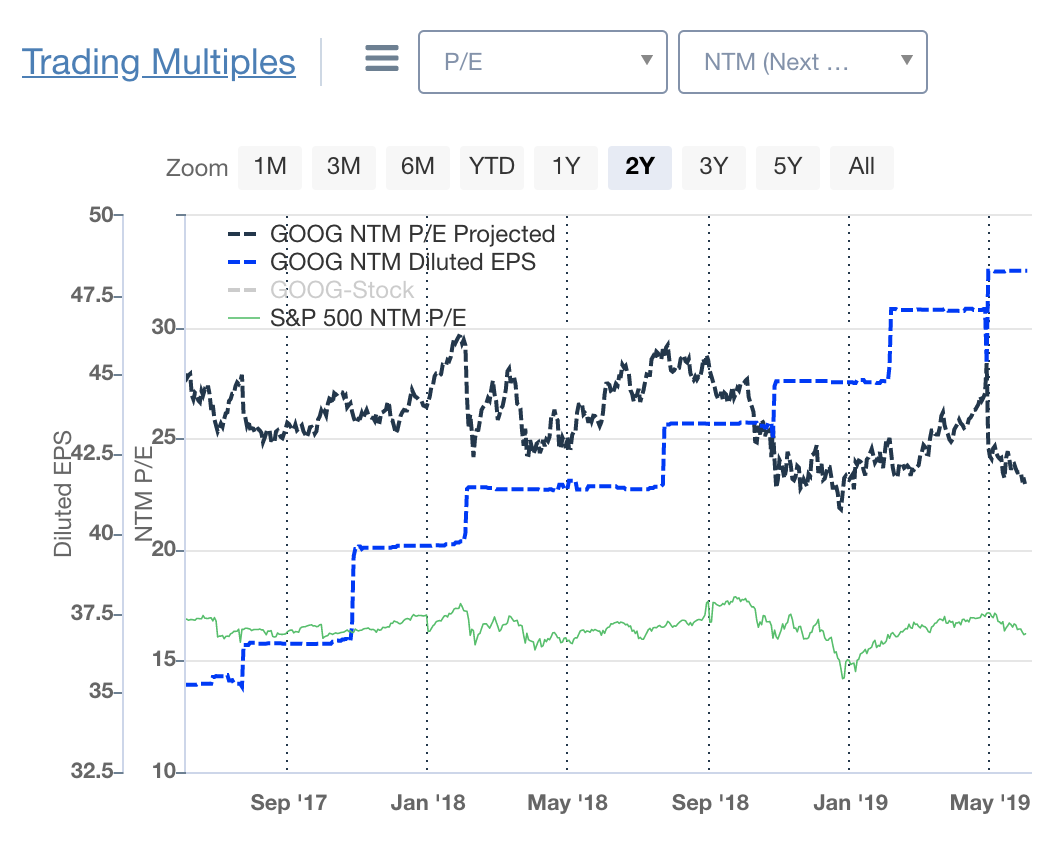

Its valuation has fallen to the lowest level in 2 years, despite revenue and earnings continuing to grow +15-20% annually (more than 2x faster than the S&P 500):

Source: Sentieo

You're now being offered GOOG stock at less than 12x 2019 P/E compared to the S&P 500 at ~16x 2019 P/E (!). We're hearing a number of sharp long-term investors calling the stock a "no-brainer" at these levels.

Alphabet has three businesses inside the company (YouTube, Google Cloud Platform, and Waymo) which are potentially worth a lot more than is reflected in the stock price given the secular trends + growth rates + leading technology position of each relative to the contribution profit that each is making to Alphabet P&L today.

It's not clear how any of these businesses would come under DOJ antitrust review either (versus Android). We doubt any of them will anytime soon.

Stepping Back##

- We think it's hard to find any other company with so many large valuable technology platforms that are scaling in massive global industries.

- While each of these businesses certainly benefit from being part of Alphabet, they should each eventually be able to stand on their own as separate entities--or at a minimum, could be broken out a la AWS to highlight the value and growth.

- YouTube is particularly interesting here because there is almost nothing to get in the way of its continued growth over the next 10 years in terms of hours viewed/better monetization around the world -- as long as Google can manage the regulatory concerns of being a global user-generated content platform.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.