Disney Announces Disney+ at $6.99 per Month

Apr 12, 2019

Disney is up +10% on Friday morning after it announced it will launch its streaming video platform & Netflix competitor, Disney+, in November at $6.99/month.

We tuned into the Investor Day to give you some quick insights.

Takeaways##

- Disney+ is a Netflix competitor, and it will launch in November at $6.99 per month, which is sharply lower than Netflix's $8-14 average despite a very strong content library including Star Wars and Marvel Studios

- We were positively surprised by Disney+'s low price as well as its strong subscriber targets (60-90M by end of 2024)

- We think Disney will give Netflix a run for its money given the lower price, broader content which lowers customer acquisition costs, bundle potential with ESPN+, Hulu to lower churn, and company's balance sheet and cash flows

- That said, we're still positive on Netflix and think DIS/NFLX can coexist profitably

Bottom line: We are very excited about Disney+ and its prospects for the stock. The shift to a more recurring-revenue business model bodes well for Disney long term.

What will Disney+ look like?##

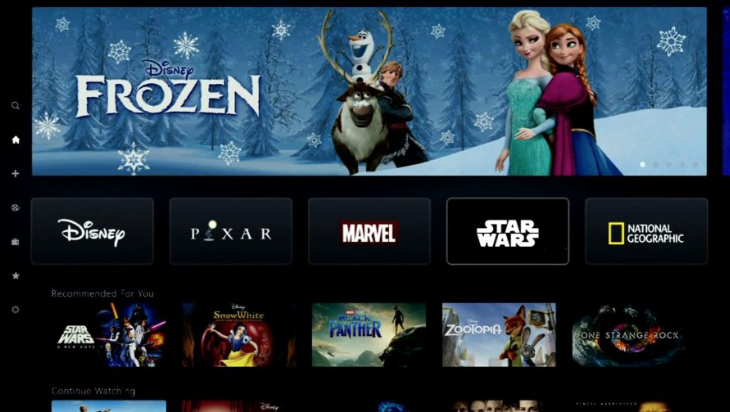

The interface looks a lot like the interface for Apple TV or Netflix (think of a grid of brands and content).

The Disney+ homepage is obviously for navigation, but it's about showing consumers everything it owns, and reminding them that Disney is the only place to get it all.

This is a core part of our investment thesis that Disney will leverage its video library to drive sales of its toys, theme park tickets, and more.

When content will Disney+ include?##

All the hits. Here's a sample:

- Adult: Star Wars, Marvel, Bohemian Rhapsody

- Kids: Toy Story, Frozen, Finding Nemo

- Classics: The Sound of Music, Titanic, Lion King, The Simpsons

When will Disney+ launch?##

November 12, 2019. Don't get too anxious though; we think the stock could reflect the growth and value creation that Disney+ will bring much earlier than Q4, as we explain below.

How much will Disney+ cost?##

$6.99 per month. That's about half of what Netflix charges for its standard HD plan.

We're very optimistic about the value provided to consumers at the $6.99 price point. Recent survey data from Morgan Stanley indicated healthy levels of interest for Disney+ at an $8/month price point.

What will I get in my Disney+ subscription?##

You can subscribe to Disney+ itself, or buy a bundle of all the Disney streaming services - Disney+, ESPN, and Hulu - at a discounted price. It's kind of like cable TV, but smaller and on multiple platforms and all under Disney's corporate umbrella.

But even better than cable, Disney+ will be ad-free -- no commercials. And all of its content will be available to download and view offline That's a feature Netflix only added in the last couple of years (and it still doesn't apply to everything on its service).

Disney+ will be a content powerhouse, with all the bells and whistles that Netflix provides, at almost half the price.

What's next for Disney's stock?##

We think the Disney+ service is well positioned to have an extremely strong launch that surpasses consensus subscriber expectations.

The Investor Day unveiling of Disney+ should shift the investor focus to the upcoming positive catalyst path.

As Disney becomes a more recurring, subscription-driven business - starting with Disney+ later this year - its valuation should grow from a consumer-esque one today (~16x P/E) to a higher, more Netflix-like valuation in years to come.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.