Trade Update: Rolling back the hedge

May 19, 2023

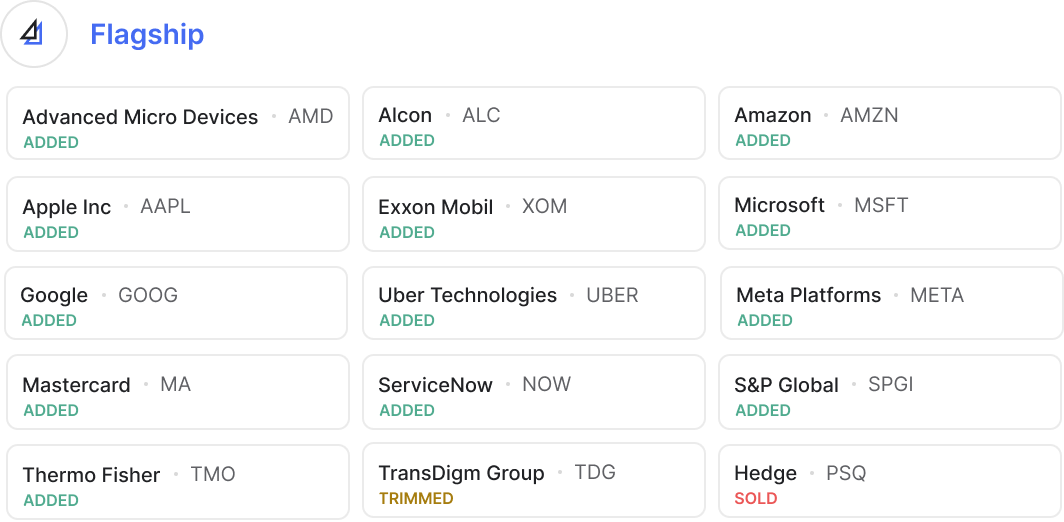

After confirming all of our signposts, we made the decision to exit Flagship’s Hedge (PSQ) on Friday morning. We also trimmed our position in TransDigm (TDG) and added to several Flagship holdings as detailed in the table below.

Let’s dive in.

Rolling back the hedge

We activated our maximum hedges in January of 2022 and after the recent market rally, we have elected to exit the position. We lean heavily on technical analysis to determine our hedge timing/trades and as the Nasdaq broke through its 200 day moving average (amongst other technical indicators we follow), we’ve concluded that large-cap U.S. equity markets have a high probability to sustain this move higher. After generating positive returns for clients since we initiated them, our hedges not only reduced volatility but insulated clients from downside pressures.

We annotated this in our Offshore update and feel compelled to raise this point again: This is not us calling the bottom. Conservative clients will continue to have ~10% of their portfolio invested in the hedging vehicle (PSQ), and moderate clients will have ~5% invested in the hedge.

Right sizing across the board

TransDigm (TDG) has been one of Flagship’s strongest performers (+31% YTD) and after hitting new all-time-highs, we took the opportunity to trim the position slightly. Our thesis around recovery in aerospace remains fully intact but after organically growing to nearly 9% of Flagship’s invested capital, a trim seems prudent.

Apple (AAPL) has proven to be one of the most resilient businesses in the world despite continued economic uncertainty and supply chain troubles. With their installed base reaching new heights and the highly anticipated launch of their VR headset approaching, we elected to take the proceeds from TransDigm and add to our position in Apple here.

In an effort to increase net exposure, we used the proceeds from our Hedge (PSQ) to add ~30 basis points to an additional 13 positions in Flagship (annotated in the chart above). This move allows us to ‘top off’ several of our highest conviction names while increasing net exposure by 7.3% for Flagship overall. We believe this move will allow us to capture more upside in an effort to drive long-term growth.

As always, let us know if you have any questions about the recent trades; we’re happy to assist.

–Your Titan Team

As of writing, AMD, ALC, AMZN, AAPL, XOM, MSFT, GOOG, UBER, META, MA, NOW, SPGI, TMO, and TDG are holdings in Titan's Flagship strategy.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Contact Titan at support@titan.com.

Trade communications are meant for informational purposes only. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. There is always the potential of losing money. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. The rate of return on investments can vary widely over time, especially for long term investments. Past performance is no guarantee of future results.

There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Please visit www.titan.com/legal for important disclosures.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.