Trade Update: Investing South of the Equator

May 10, 2023

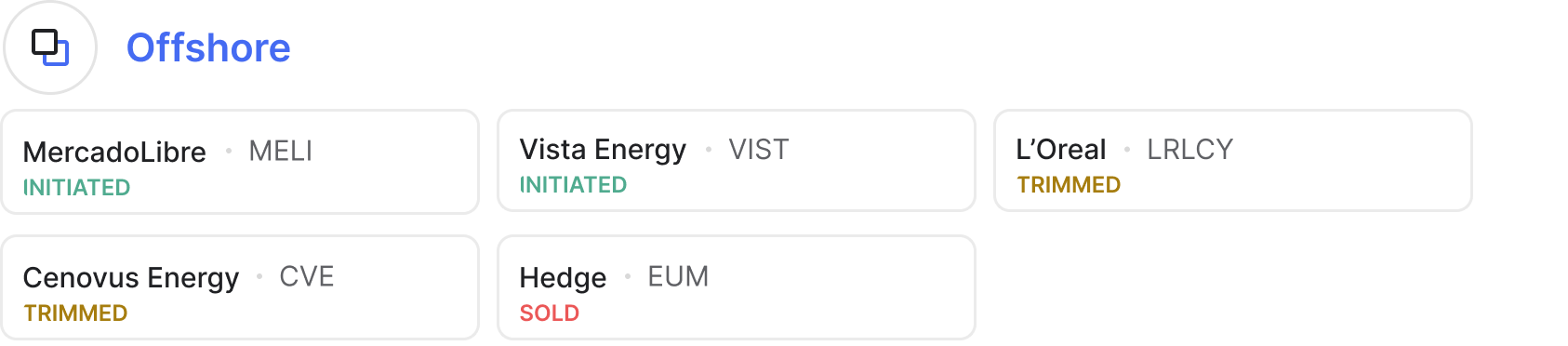

On Tuesday, we initiated positions in MercadoLibre (MELI) and Vista Energy (VIST) for clients in our Offshore strategy. We also trimmed our positions in Cenovus Energy (CVE) and L’Oreal (LRLCY), while rolling back our hedge for all clients.

The table below details these moves. Let’s dive in.

A Return to Latin America

Over the last several quarters, Latin America has been in the “too hard bucket” due to a strong U.S. dollar, ongoing geopolitical instability, and general macro uncertainty across the region. However, after nearly 18 months without investing in Latin America, we now believe that the very uncertainties that once deterred us have ultimately created intriguing new investment opportunities.

MercadoLibre (MELI), known as the Amazon of LatAm, is a full-stack e-commerce and fintech platform serving more than 100 million customers across 18 countries in Central and South America. While the Commerce business continues to show resilience (+31% USD year-over-year revenue growth in Q1 2023), MELI’s Fintech businesses (Mobile Wallet, Credit, Financing, Payment processing) are also attractive growth stories (+40% USD year-over-year revenue growth in Q1 2023) that have caught our eye.

The sheer scale that the marketplace has reached really unlocks the high-margin potential of the payments businesses. We believe that MercadoLibre has hit an inflection point due to economies of scale, giving it the opportunity to monetize highly profitable growth levers (credit cards, advertising, payments, etc.) for years to come. We’re excited to be invested in MercadoLibre once again.

Vista Energy (VIST) is one of the leading energy companies in Argentina with meaningful ownership of the largest shale oil and gas development outside of the U.S. Our thesis is two fold: Argentina’s macro normalizing ahead of the October presidential election and Vista’s operational excellence.

With the presidential election coming this fall, we expect a continued normalization in Argentina’s political and macro environment, which we believe will further unlock infrastructure spend and development of Vaca Muerta, Vista’s most valuable asset. Management has also improved operational processes and reduced costs by more than 45% since 2018–a trend we expect to continue lifting margins. These drivers coupled with the fact that the stock is trading at a ~50% discount to peers, creates a compelling risk/reward setup for clients.

Trimming around the edges

L’Oreal (LRLCY) has been one of Offshore’s strongest performers to start the year, and we’re happy to take some chips off the table with the stock up more than 50% from the recent lows. The consumer has held up well thus far, but with cracks forming as we near the second half of the year, trimming the position feels prudent.

Cenovus Energy (CVE) hasn’t played out as expected thus far due to operational issues and pricing pressure. As mentioned above, we’ve diversified our energy exposure with the addition of Vista and funded that investment with a portion of our Cenovus investment. All that being said, we still believe in the long-term story for Cenovus and remain invested in the Canadian energy company.

Rolling back the hedge

After activating our maximum hedges in January of 2022, our signposts have led us to roll these back for clients. As a reminder, these hedges are activated when our analysis leads us to conclude the high probability path for markets in the near-term is to the downside. This analysis was correct; the hedge not only reduced volatility, but generated a 19% return since initiation.

Important note: This is not us calling the bottom. We lean heavily on technical analysis to determine our hedge timing/trades, and with the international index nearing its 200 day moving average, we’ve concluded that international markets have a high probability to sustain this move higher. Conservative clients will continue to have ~10% of their portfolio invested in the hedging vehicle (EUM), and moderate clients will have ~5% invested in the hedge.

As always, let us know if you have any questions about the recent trades; we’re happy to assist.

- Your Titan team

Disclosures:

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Please refer to Titan's Program Brochure for important additional information. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Contact Titan at support@titan.com.

Trade communications are meant for informational purposes only. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. There is always the potential of losing money. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. The rate of return on investments can vary widely over time, especially for long term investments. Past performance is no guarantee of future results.

There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party.

The content provided in this email is for informational purposes only and is not investment or financial advice, tax or legal advice, an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Please visit www.titan.com/legal for important disclosures.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.