Crypto winter gets colder

Nov 10, 2022

Crypto winter gets colder

In the update to clients we published late Tuesday night, we noted that the acquisition of flailing FTX by Binance was conditional on due diligence and that the situation was evolving quickly. Since publishing, Binance completed due diligence and decided against acquiring FTX due to distressed assets. Crypto markets have been under pressure as a result and we have been active in an effort to control risk.

The fallout from the collapse of FTX and Alameda Research has shocked the crypto ecosystem once again. We've seen it several times this year – without the proper guardrails in place, over-leverage and the interconnectedness of the world of crypto can quickly lead to contagion. To be clear, we were never comfortable with the risks of owning FTX’s native token (FTT), nor have we done business with FTX.

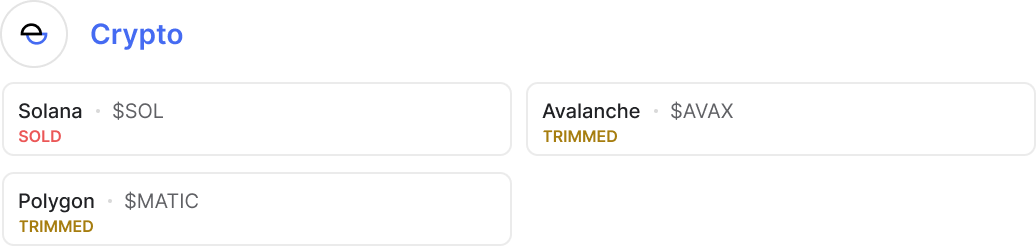

Early Wednesday morning, we elected to sell our stake in Solana ($SOL) and trim our positions in Polygon ($MATIC) and Avalanche ($AVAX).

Let’s dive in.

So long Solana

Our research indicates that roughly 29M $SOL (~$415M), as of the time of writing, will be deactivated from staking at roughly 4:30 AM ET on Thursday morning (11/10/22). Furthermore, Alameda Research’s second-largest holding is Solana. To the extent that it hasn’t already, this position will likely need to be fully liquidated over the coming days – putting intense downward pressure on the crypto asset. Other investors who have staked Solana are recognizing this dynamic are following suit further exacerbating market dynamics.

While we may be involved again at a future date, we believe there is a non-zero chance Solana will collapse in the near term. Fundamentals had softened in recent months, with total value locked (TVL), daily active addresses and transactions, and NFT volumes all declining.

Growing the Solana ecosystem with investment and support has been a top priority for FTX and Alameda Research. Without FTX and Alameda in the picture, we anticipate slower growth for Solana in the medium term, assuming it makes it out of this mess alive.

While making this exit Wednesday morning, we also elected to trim our positions in Polygon ($MATIC) and Avalanche ($AVAX) due to soft technicals. These trims are purely a risk management move, and our thesis continues to track for these tokens.

We’re all hands on deck and will continue to stay nimble in the crypto strategy as needed. As always, we’re here for you. Let us know if you have any questions about this evolving situation.

Onwards,

Titan team

As of this writing, MATIC and AVAX are portfolio holdings of Titan. This security may cease to be portfolio holdings at some point in the future.

Titan Global Capital Management USA LLC ("Titan") is an SEC registered investment adviser. Trade communications are meant for informational purposes only. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or any other product offered by Titan or any third party. Please visitwww.titan.com/legal for important disclosures.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.