Three Things (2/22)

Feb 22, 2023

“We typically turn to the wider world to settle the question of our significance.”

– Alain de Botton, Status Anxiety

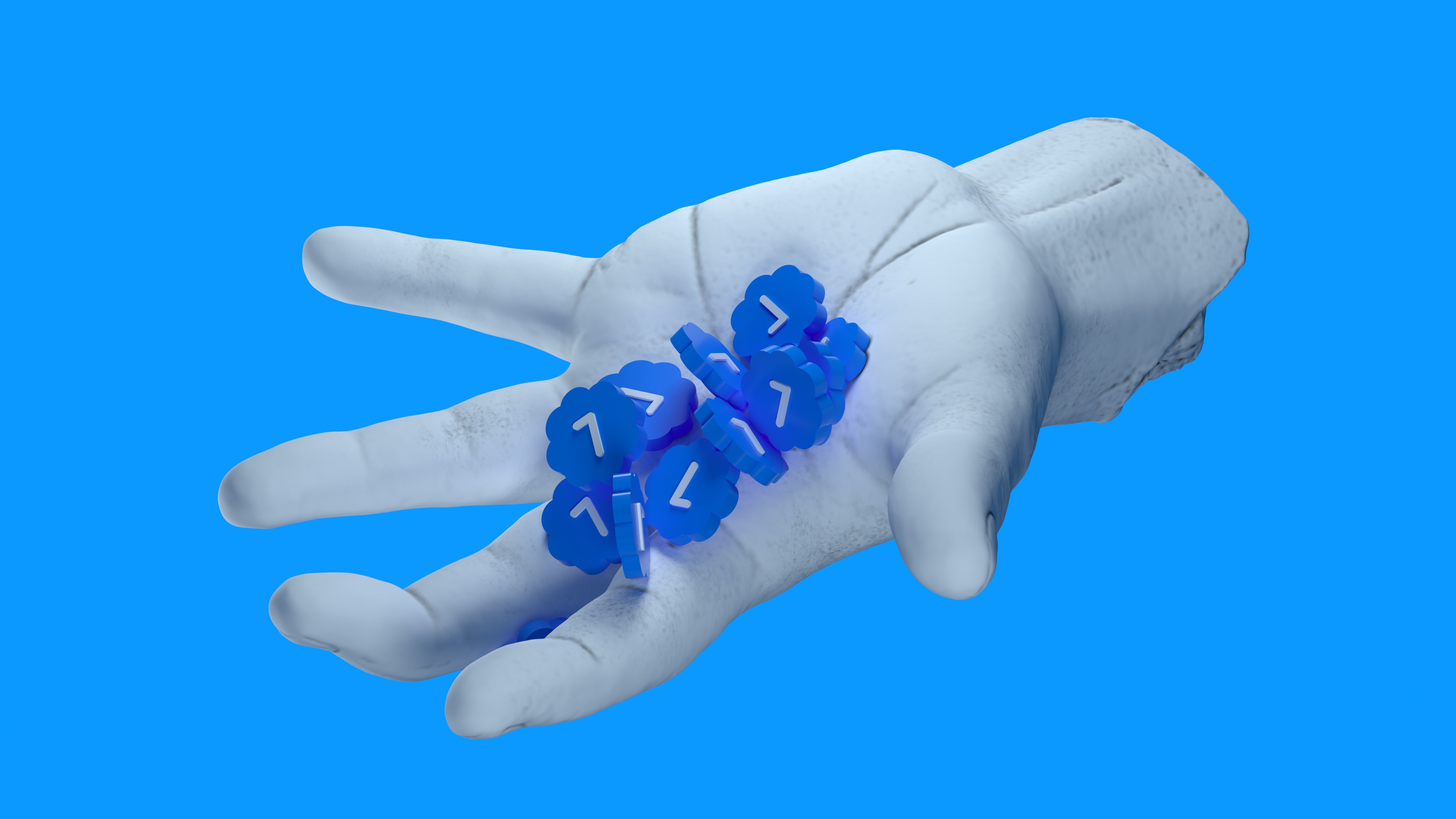

Buying Status on Instagram

If you have an Instagram, you know the coveted blue verification tick has often been affiliated with celebrity status. Meta, taking a page out of Twitter’s book, will enable anyone to have it now for a monthly price of $14.99.

“Indeed, the impact the shiny blue tick—which acts as a benchmark of influence—has on personal branding mustn’t be underestimated. Considering that less than 4% of accounts on Instagram are verified, having the badge appear by your username while searching for accounts or alongside your comment on other people’s photos helps your own stand out among the masses, look notable and build brand awareness. But beware. The symbolic status of Twitter, Facebook and Instagram’s illusive tick will be shattered if it’s available to anyone who can pay for it, leadership experts say.” (Fortune)

Selling Call of Duty?

We’re watching for the results of Microsoft’s standoff against Sony. Microsoft makes Xbox; Sony makes Playstation. Arguably one of the hottest video games of the last two decades has been Call of Duty, made by Activision Blizzard. So, as you might imagine, if Microsoft tries to buy Activision, Sony is going to put up a big fight.

“The closed-door hearing in Brussels will see Xbox chief Phil Spencer and other senior Microsoft executives argue the case for the $68.7 billion deal to proceed, with PlayStation chief Jim Ryan attending to voice Sony’s concerns over the deal…The CMA has offered up possible remedies that include Microsoft being forced to sell off Activision Blizzard’s business associated with Call of Duty.” (The Verge)

Economic Signal: Walmart

In addition to listening to commentary from the Federal Reserve, we track what front-line leaders are saying about the world. Walmart is the largest employer in the US. Here’s what their Chief Financial Officer said:

“We feel good about how the core business is operating, but we’re being cautious with the macroeconomic outlook…There’s a lot of unpredictability around what’s happening, what will be the effect of Fed tightening on the consumer balance sheet, what is the effect of the declining savings rate.” (Bloomberg)

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.