The Weekly (9/8)

Sep 8, 2023

Earlier this week, we bought shares of Nvidia (NVDA) in Flagship. On the surface, this may have come as a surprise.

“Didn’t we miss the boat already given the stock’s 200%+* rally this year?!”

As I described in my video from our recent Investment Committee meeting* – investing is an expectations game. If our expectations for a company’s future earnings far exceed the market’s consensus expectations, a stock can be an attractive buy – even if the stock price has already rallied significantly.

Let me explain using Nvidia as an example (I’ll use hypothetical numbers and events here for compliance purposes, but the general idea still holds…).

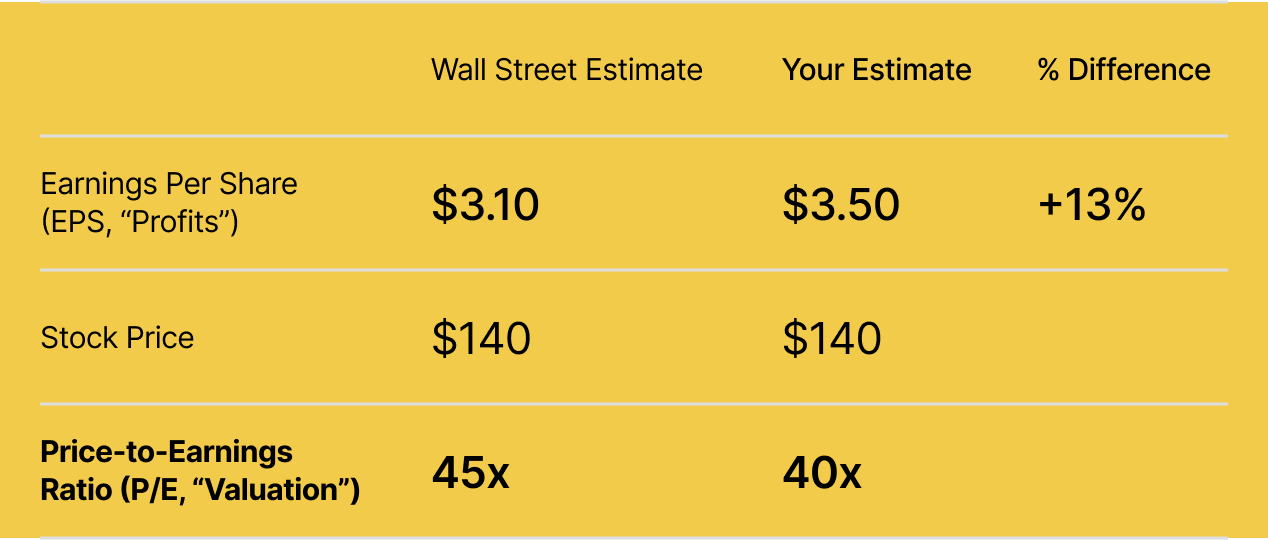

Suppose back on January 1st you looked up the price of Nvidia’s stock ($140) and then checked out Wall Street’s estimates for the company’s profits in 2024.

You decide the company’s valuation (40x forward P/E ratio on your estimates, 45x on Wall Street’s) is a bit too rich for your appetite – based on NVDA’s historical valuation range, its peers’ valuation multiples, etc. So you decide *not* to buy the stock.

Fast forward to late August 2023 and you see the company’s stock having risen 200%+ YTD. You think to yourself “dang, I guess I missed the boat – the stock seems even more expensive now.” But then Nvidia reports Q2 earnings…

The results are a smash hit. Nvidia delivers an absolute blowout quarter, far exceeding Wall Street’s estimates and blowing yours out of the water completely. The AI boom is real and here. The stock price is now $450.

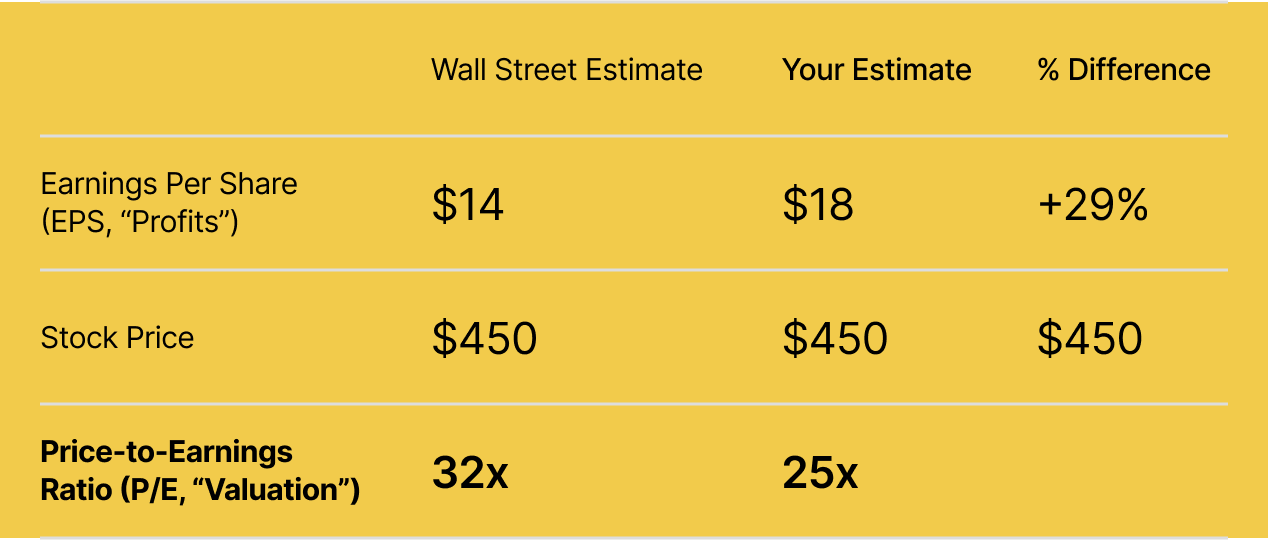

Both you and Wall Street analysts go back to the drawing board and increase your estimated future outlooks. With 2024 almost here, you’re now looking at 2025. Your table looks like this:

NVDA stock is actually better value than it was at the start of the year! Despite the stock being up more than 3x since Jan 1st, its valuation is materially lower (25x forward P/E vs. 40x) because your earnings estimates have gone up >5x ($18 vs. $3.50). And not only that – your forward earnings estimates are now actually almost 30% higher than Wall Street’s (vs. only 13% higher at the start of the year).

Simply put: despite the stock price having more than tripled, you didn’t “miss the boat” – in fact, the boat got even faster and stronger…AND the ticket prices to hop aboard got cheaper.

So you make the call to invest.

Will Nvidia’s stock pan out to be a home run investment from here? Of course “only time will tell,” but based on our actions we think it’s a good bet. We know sometimes we’ll swing and miss, and that ultimately slugging percentage is what matters most, but we think NVIDIA is a smart swing at these levels.

Ending where we started: investing is an expectations game. It’s easy to think “I missed the boat on XYZ stock” based purely on its recent performance. But that’s falling prey to anchoring bias. To ascertain value (and aim for outsized returns), you need to understand your forward expectations vs. Wall Street’s. If there’s a mismatch, things get interesting.

“I don't need an analyst to tell me when a low PE stock is cheap. Everyone knows that. I need an analyst to tell me when a high PE stock is cheap.” (Stephen Mandel, founder of hedge fund Lone Pine Capital)

Have a great weekend.

— Clay & the Titan Team

P.S. If you’re curious, below is the real-life chart of NVDA’s stock price vs. Wall Street’s expectations for its 2025 EPS (courtesy of Bloomberg). Spoiler alert: our investment team’s expectations are *much higher” than Wall Street’s $16.

*Recorded on Aug 31st, before NVDA was a holding stock in Flagship.

*NVDA year-to-date price change as of 9/7/2023

All figures in the hypothetical charts above are fictional and for illustrative purposes only. They do not reflect real earnings, stock prices, or actual price-to-earning ratios.

As of writing, NVDA is a holding in Titan Flagship.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.