The Weekly (5/10)

May 15, 2024

Secrecy is the hallmark of the hedge fund industry.

In a world where markets are highly efficient, maintaining a competitive advantage is the number one asset and information is usually the currency.

So when quant power house Jane Street sued two former employees that had jumped ship to rival Millennium, some of the strategies for Wall Street’s best ideas were unveiled to the public. Seeing a glimpse of the inner workings of how and more importantly where these investing giants were allocating capital was a treat for the investment obsessed like us.

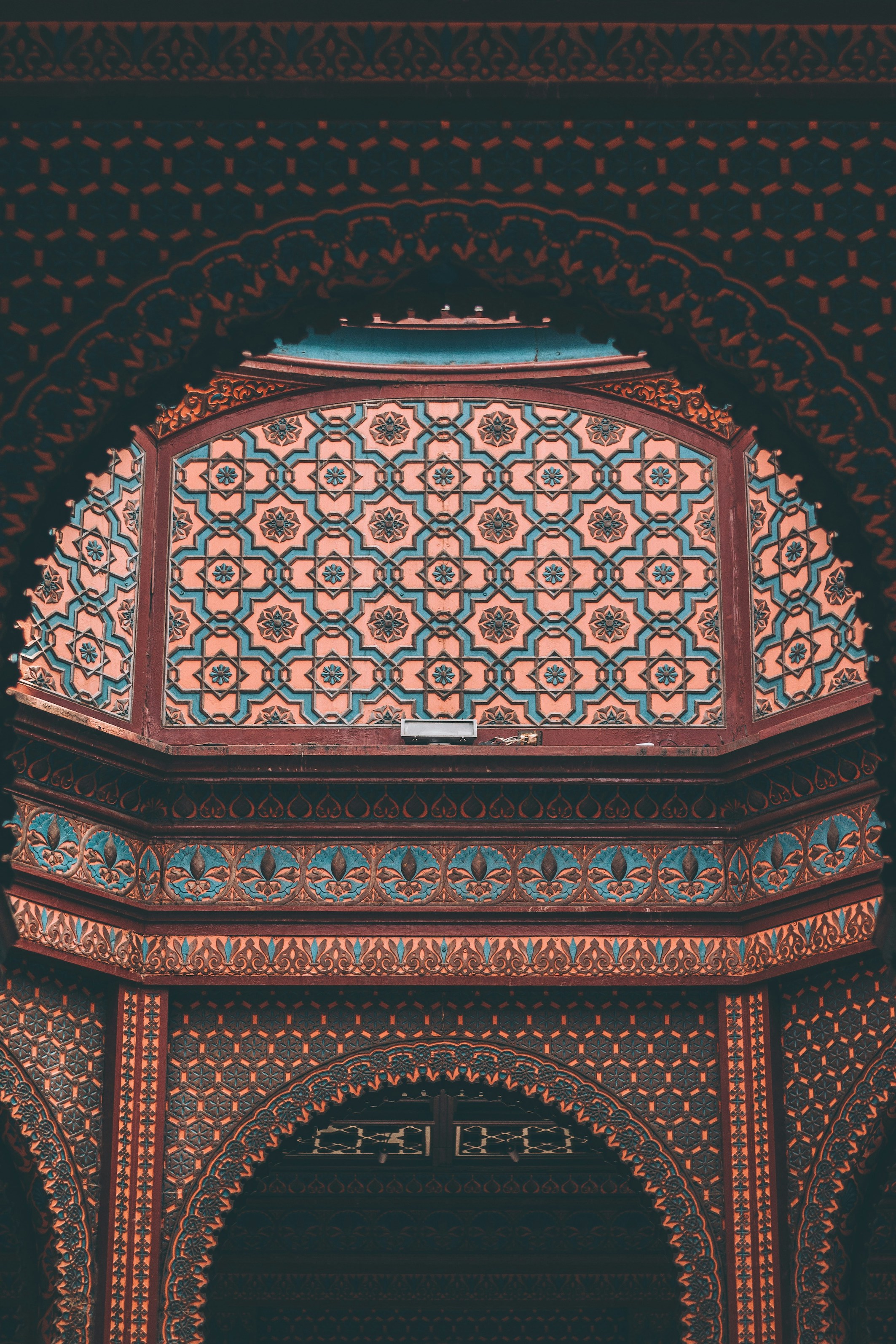

What’s interesting is that documents from the court case revealed that one of Jane Street’s biggest moneymakers isn't some exotic Wall Street derivative or AI thesis, rather the surprisingly unglamorous world of Indian stock options.

We're talking a cool $1 billion in profits last year for Jane Street alone.

This has investors scratching their heads and looking towards the burgeoning market in southeast Asia.

The country accounted for a staggering ~84% of all equity option contracts traded globally last year, up from a measly 15% a decade ago. The National Stock Exchange (NSE) is the epicenter of this frenzy, handling a whopping 93% of the volume.

Why the sudden surge? It likely goes hand-in-hand with India's booming stock market, which recently surpassed Hong Kong to become the world's fourth-largest. The benchmark Nifty 50 is flirting with all-time highs, and the number of retail investors in India has tripled since 2019 thanks to the rise of user-friendly apps.

What’s the investment of choice for these new entrants looking to take more risk? Given that shorting stocks (betting they'll go down) is a pain in India and crypto is under a regulatory microscope, investors, specifically retail investors, are turning to equity-index options.

In its simplest form, you pay a tiny premium for the right to buy a whole basket of stocks (an index) at a certain price by a certain time. Think of it as a lottery ticket for the stock market. If the market zooms past your strike price, you win big. Otherwise, you lose your premium, which is likened to the cost of playing.

Now, for the sophisticated players, this is a goldmine. Jane Street’s high frequency trading platform has been able to massively benefit from India’s low-cost, high-volume market. Using their information advantage they can out hustle a marketplace that’s still relatively inefficient.

It’s not just Jane Street benefitting either. Exchanges are making money on every trade, trading firms are raking in the fees, and the government is even getting its cut in taxes.

It’s not all good news though as retail investors looking to win big make up about 35% of option trades in India. Market regulators estimate that 90% of those traders lose money on derivatives so it appears that Jane Street’s profits could be coming at the expense of the every day investor.

But with institutional profits soaring, others are swarming.

Citadel, IMC, and others are beginning to build out their efforts in India. As markets become more crowded, they become more efficient. And as they become more efficient, the profits get squeezed towards zero.

Which brings us back to the ethos of information advantages in the investing industry.

The importance of secrecy we suppose is for good reason. The cat’s out of the bag and so are Jane Street’s incredible profits – like most market anomalies, this one will likely be competed away.

Markets are efficient and this is yet another example of that thesis proving true.

Have a great weekend,

– Your Titan team

Advisory services are offered by Titan Global Capital Management USA LLC (“Titan”), an SEC registered investment adviser. Titan’s affiliate, Titan Global Technologies LLC (“TGT”), is a registered broker-dealer and member of FINRA/SIPC. Newsletters provided by Titan reflect the opinions of only the authors who are associated persons of Titan and do not reflect the views of Titan, or any of its subsidiaries or affiliates. They are meant for educational and informational purposes only, are not intended to serve as a recommendation to buy or sell any security and are not an offer to buy or sell a security. They are also not research reports and are not intended to serve as the basis for any investment decision. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. Any third-party information provided therein does not reflect the views of Titan or any of its subsidiaries or affiliates. All investments involve risk, and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and clients may lose money, including their original investment and principal. Any rewards or free trials offered through Titan's client referral program are subject to full program terms & conditions.

Titan newsletters are curated digests of business news stories delivered daily. Titan newsletters’ goals are to make business and financial news accessible to all. The Titan newsletter team has editorial independence. Authority over all news decisions that appear in Titan newsletters, including what news we cover, our tone, and any accompanying media, lies with the Titan news team. Titan newsletter editors conduct daily research through a variety of primary (e.g., press releases, financial reports, public statements, economic data, social media accounts, interviews, etc.), and secondary sources (e.g., Fortune, The Wall Street Journal, The New York Times, Bloomberg, CNBC, TechCrunch, Jalopnik, Business Insider, Fox Business, etc.). The editors then determine the stories to be featured, covering a mix of headline news as well as less reported, yet relevant stories. Titan can’t cover everything, but the Titan newsletters aim to deliver a well-rounded serving of news. Titan newsletters make every attempt to report the facts fairly and accurately and provide “Takeaways” based on our understanding of the trends, our business experiences, and our personal opinions. We deliver the crucial information and our unique perspective so you can assess the news critically. Titan newsletters may contain forward-looking statements, which reflect the author’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. We do not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Smart Cash is offered by Titan as one of its RIA product offerings. Titan's Smart Cash strives for tax optimization; after-tax yields are estimates, and actual outcomes may vary. Yields are subject to market conditions, will fluctuate, and are not a guarantee or forecast of future earnings. While Titan can provide general tax information and guidance, any information provided should not be taken as tax advice as Titan is not a tax professional. Consult a tax professional for personalized tax advice. View Smart Cash risks and disclosures at titan.com/smart-cash-disclosures.

Various Registered Investment Company products (or “Third Party Funds”) are offered by third-party fund families and investment companies on the platform as one of many potential investment options available to Titan’s clients, that may or may not be recommended based on an individual client’s investment objectives and risk tolerance. Certain Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. The Third Party Funds that are available on the platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund. Please review the Third Party Fund’s prospectus, available on www.titan.com, in its entirety for a full list of risks associated with investing in the interval fund before making any investment decision.

Investments with exposure to crypto assets are only suitable for investors who are willing to bear the risk of loss and experience sharp drawdowns, as they still carry inherent risk associated with cryptocurrencies. You are solely responsible for evaluating the merits and risks associated with the use of any information, materials, content, user content, or third party content provided before making any decisions based on such content.

If there are substantive errors when published, corrections will appear in the following day’s material or within a business day of discovery of the error. When Titan or the author of a newsletter owns stock in a company mentioned, we’ll disclose it at the bottom of our newsletter.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.