How we're investing through inflation

May 13, 2021

Inflation: why it matters

One of the most important macroeconomic variables we’ve been tracking here at Titan is inflation. In this note, we'll outline how we think about it and how we're managing your portfolio around it.

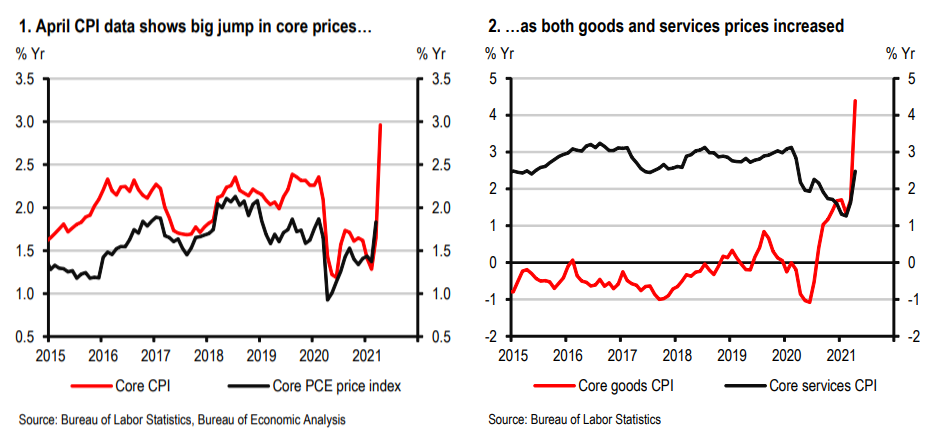

As we discussed in our Q1 letter, early this year we had begun seeing signs of increasing inflation pressures due to supply bottlenecks in areas ranging from shipping costs to semiconductors.

Our view has been that the recent inflationary bump would prove more transitory than expected, as we believe massive secularly deflationary pressures (many of which stem from technological innovation) would on net outweigh the near-term supply shortage-driven boost in commodity good prices (e.g., staples, semis, commodities).

However, since then, we’ve seen data that suggests inflation is moving higher/faster than we expected. From consumer price index (CPI) data to commodities (i.e. copper, lumber, etc.), prices seem to be soaring everywhere.

While the jury is still out on whether these inflationary dynamics will prove transitory vs. structural (we remain in the transitory camp), we are proactively managing the portfolios in an attempt to mitigate risk in the event that these trends continue.

How inflation is impacting stocks

The recent market rotation away from tech / growth and towards more cyclical sectors that underperformed in 2020 (such as energy and financials) became much more apparent during Q1 as investors became focused on higher interest rate dynamics.

These increased inflationary concerns have impacted growth stocks particularly meaningfully as it translates into higher discount rates for long-term cash flows.

High-quality companies are not immune to this: we've seen multiple world class software/cloud names in our Opportunities strategy get hit by inflation fears.

Why? Because these types of companies tend to reinvest excess cash flow into internal growth opportunities, a meaningful portion of their cash flow – and hence their stock price valuation – is "long duration" and thus more sensitive to interest rate movements.

As a result, inflationary trends have weighed on recent performance of our strategies despite the broad-based strength in fundamentals seen in Q1 results.

What we are doing about it

First, our investment team is currently re-underwriting all three of our equity portfolios after Q1 results, analyzing how their long-term earnings trajectories have evolved (or not) following Q1 earnings.

Second, we're diving deep on fundamentals and technicals. We're decomposing the inflationary components of our stocks' P&Ls and factor exposures to understand the go-forward risks for our holdings amidst a potentially sustained inflationary market environment.

Finally, we are prioritizing speed and focus for your capital. We recently brought on two new investment analysts, John and Justin, who bring a wealth of secular and cyclical investing experience to the team. We're thrilled to have them join the team and expand our coverage universe and research capabilities - expect to hear more from them going forward.

Stepping back, we are working hard to position the strategies for what we believe to be some of the leading risk/reward prospects regardless of the direction of any macroeconomic shifts. Stay tuned for more updates from the team in the coming weeks.

Our outlook for markets

At a high level, our global outlook remains positive.

First, widening vaccination efforts should promote lower COVID-19 infection rates after peaking in early Q1.

Second, healthy consumer balance sheets, bolstered by nearly $1.7 trillion in excess savings, should fuel robust consumption growth throughout the year along with a meaningful recovery in the services sector.

Further supporting this positive outlook, US policy makers proved successful in turbocharging the economy with the passing of the $1.9 trillion fiscal stimulus package in March, equal to ~8.5% of GDP.

From a timing perspective, this boost comes on the heels of the $900 billion stimulus already passed in December and amidst an accelerating domestic recovery already underway from expanding vaccination efforts.

As a result, we believe both the US and global economies remain well positioned to fire on all cylinders throughout 2021 and well into 2022. For context, US 2021 GDP growth estimates have been revised upward to +6.5% -- levels the country hasn’t seen in more than 20+ years.

That said, inflation is real and increased investor focus on that narrative is hitting growth stocks right now. The jury is still out on whether these inflationary dynamics will prove transitory or structural (we remain in the transitory camp), but we are working hard to make Titan portfolios anti-fragile in either scenario.

Look out for additional updates from us in the coming weeks. Meanwhile, we believe long-term investors would do well to add capital on this selloff. Speaking personally, I've been adding opportunistically to my Titan account on the recent weakness.

Clay Gardner Chief Investment Officer

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.