The Weekly (1/5)

Jan 5, 2024

State of freight

The Suez Canal is back in the news.

In what had been described as a ‘return to supply chain normality’ for most of 2023, global trade is being threatened once again. This time, it’s not the Ever Given blocking the waterway, rather rebels from Yemen prohibiting safe passage and threatening the status quo of global trade.

A now dangerous trip through the Red Sea to the canal has caused Danish shipping giant Maersk to pause all transit through the Red Sea until further notice.

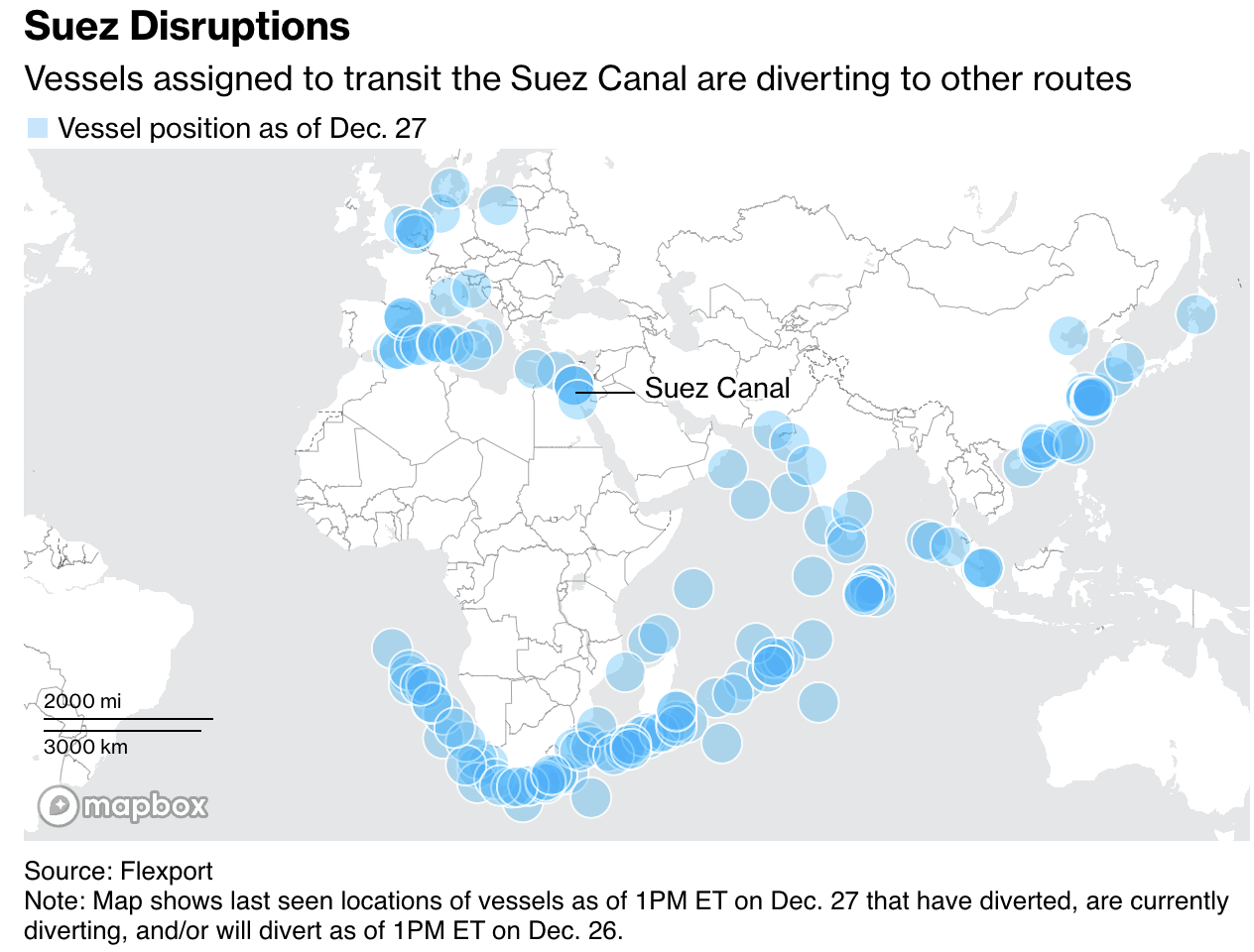

Ships setting sail from Asia to Europe are as a result being diverted to the Cape of Good Hope, a journey around the tip of Africa that is ~25% longer (and thus, 25% more expensive). This new form of “slow steaming” results in about 14 extra days of travel time and 3,000 more nautical miles.

It makes us wonder. What are the potential downstream impacts from the disruption?

Given that demand for maritime shipping is inelastic, unless a product has razor thin margins, companies will ship their products regardless of the price of freight.

The resulting trips around the southern tip of Africa are essentially cutting shipping capacity by 25%. If there isn’t enough capacity for all the goods that need to ship, it’s easy to envision a world where the companies with the highest margins who care the least about the price of freight (back to the point on inelasticity) will likely bid up the price of containers to ensure their goods get loaded.

The prevailing circumstances have led container liners to apply emergency peak season surcharges and the impacts are just getting started.

That’s all fine and dandy for the biggest folks at the party but the costs for smaller scale operations will eventually have to be offloaded somewhere. The most likely destination? The consumer.

Retailers on earnings calls have specifically cited lower ocean freight prices as a driving factor in lower prices in 2023, but could a spike in maritime shipping reignite pricing pressures?

If these pricing pressures continue to compound over an extended period, could inflation creep back once again? And if rising costs cause inflation to increase, does it force the Fed’s hand and disrupt plans to cut interest rates?

Of course, this is likely overly dramatic and seriously over simplified, but it serves to prove a point: the global economy is massive, yet it’s intensely interconnected.

Ryan Petersen, CEO of Flexport mentioned, “supply chains are not [some] abstract phenomena removed from the human experience, they are very much run by and subject to all our flaws.” One disruption many miles away can have hundreds of downstream impacts and billions of dollars in repercussions.

Are we comfortable with that status quo?

The initial effects of the disruption in the Red Sea will be most acutely felt on the margin. If the closure extends long enough, it will then extend to markets and consumers most directly impacted like Europe and Asia. But if it goes on for months? Who knows the true potential.

‘Supply chains’ were a buzzword during Covid but did it need to be that way? There appears to be incredible potential to innovate and we wonder who might seize the opportunity next.

Have a great weekend,

- Your Titan Team

Disclosures:

As of writing, Flexport is a 0.66% position in the ARK Venture Fund.