Private Credit the Titan way

Oct 17, 2022

Titan Research represents some of our thinking on the markets, stocks, and investing. Check out the app for more.

When building out our Private Credit offering, we had three main goals to ensure clients had a premier Private Credit investing experience:

Partner with a firm with a robust track record investing in Private Credit,

Provide a highly diversified, actively managed private credit product,

Offer quarterly liquidity with low minimums.

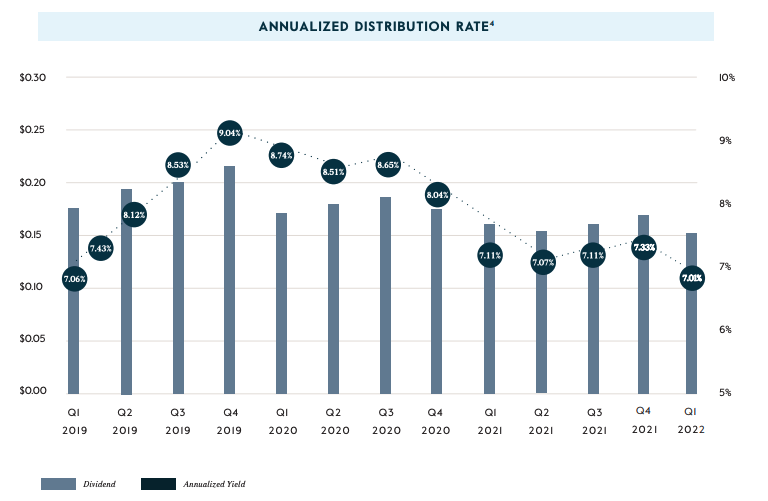

Partner: The Carlyle Group, founded in 1987, has been managing private capital for some of the world’s largest institutions including endowments, state retirement plans, sovereign wealth funds, and more. Carlyle has over 200 credit professionals in 18 countries, and CTAC has generated a 7%+ annualized distribution rate since its inception as of 9/30/2022.

Diversification and active management: The team at Carlyle takes an active approach when managing CTAC and tactically shifts allocation to different credit strategies based on the current market environment. Carlyle has exposure to six private credit types:

Direct Lending: Senior loans to small and medium-sized companies.

Opportunistic Credit: Opportunities that arise due to market dislocation that often target higher returns.

Liquid Credit: More traditional bonds and treasuries that are common in the classic stock/bond portfolio.

Real Assets Credit: Investments across aviation, infrastructure like bridges or cell towers, and other real assets.

Special Situations: Debt investments in operationally sound but financially distressed companies.

Structured Credit: Highly structured debt financings.

Quarterly liquidity and lower minimums: Many closed-end funds have long lockup periods of 5-10+ years, and for some people, life happens and you just need a bit of liquidity. We’re happy to be able to provide liquidity on a quarterly basis. We're delighted that Carlyle is able to provide a liquidity offering on a quarterly basis. Also, our minimum is $2,500 vs. many institutional Real Estate funds that have six-figure minimums.

Carlyle Tactical Private Credit Fund (“Fund”) is a Registered Investment Company product offered by Carlyle Global Credit Investment Management and made available on Titan’s platform as one of many potential investment options available to Titan clients, that may or may not be recommended based on an individual client’s investment objectives and risk tolerance. Please review the following summary of risk factors, as well as the prospectus, for a full list of risks associated with investing in the Fund before making any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not ensure a profit or protect against loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Titan is not registered. Please visit www.carlyle.com/fund for important additional disclosures.