Deep dive on Airbnb's IPO filing

Dec 1, 2020

Our top 5 takeaways from Airbnb's 1,500-page IPO filing.

Today, Airbnb announced that it'd be seeking to price its IPO at $44-50 per share, implying a valuation of up to $35 billion at the top end of the range.

As we do with most major IPOs, we took a deep dive into the 1,500 page filing on behalf of our clients in order to assess the attractiveness of the company for our clients' portfolios.

What we found was a company that had the right "bone structure" to potentially make it into the Titan portfolio one day, but also bore some outstanding question marks that would need to be proved out before the risk/reward could become attractive enough to warrant portfolio inclusion.

Many of these outstanding issues were hidden beneath more attention-grabbing and press release-ready headline metrics that tend to be the focus of most financial news coverage, which we find can often misdirect investors.

Below is a summary of our top 5 "less intuitive" takeaways from our deep dive into the IPO filing, each presented as counterpoints to the talking points and hot takes you'll likely hear discussed in the news and amongst friends.

If you enjoyed this piece and would like to see more, please feel free to share with your friends and family.

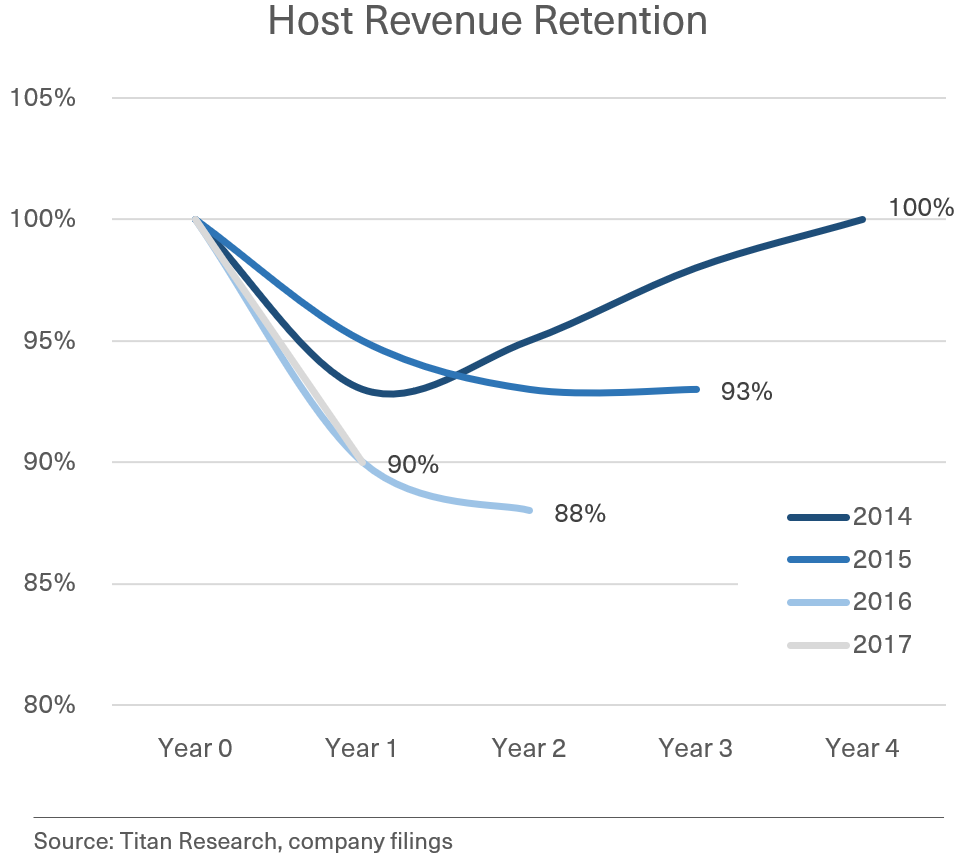

Hot take 1: "Airbnb hosts are incredibly loyal to the platform, and display outstanding retention rates in excess of 90%."

Titan Counterpoint: While the magnitude of Airbnb's host retention is promising, its trendline over successive years is concerning and likely points to intensifying competition for listings.

Growth has unsurprisingly been very strong at Airbnb, but in a world with heavy competition, the ability to retain hard-won users/hosts is the name of the game.

Airbnb's host retention at first glance looks very strong, particularly as it demonstrates the rare "retention smile." This refers when user retention curves don't just flatten out over time, but actually curve back upwards - signaling a product that users just can't get stay away from.

While we were pleased to see that, what stood out more to us than the level of user retention their concerning downward trendline over each successive year.

Typically, we would expect retention metrics to gradually improve with each successive year as platforms drive improvements to their product that make them more useful and "sticky" to customers. However, hosts that joined Airbnb after 2014 instead appear to be displaying lower overall levels of retention with each successive cohort.

We believe this likely points to intensifying competition for hosts from larger online travel agencies such as Booking and Expedia (owner of VRBO), something supported by anecdotal commentary from the host community.

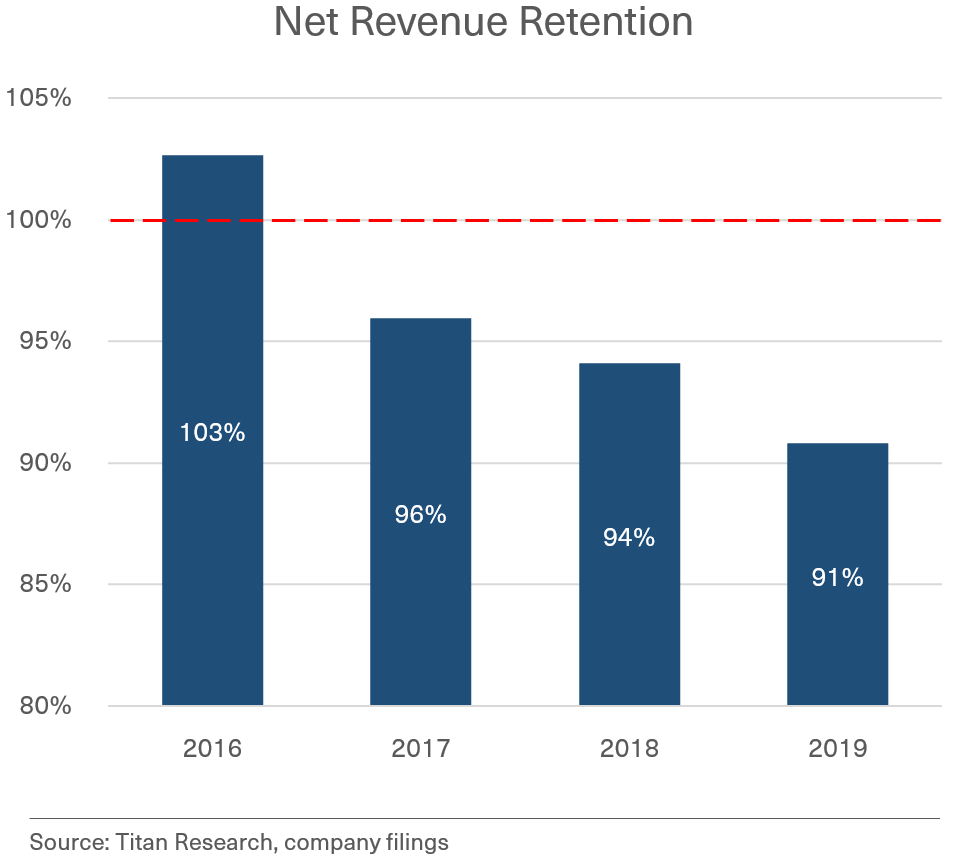

Hot take 2: "Airbnb's customer loyalty is extremely high, with nearly 70% of revenue coming from repeat customers."

Titan Counterpoint: Contrary to intuition, this metric actually implies decreasing year-over-year spend from Airbnb's existing customer base.

A big cornerstone of Airbnb's growth story is its ability to acquire customers cheaply and then retain them through the strength of its brand and user experience.

While we do believe that's in broad strokes true, various metrics in the S-1 also suggest that Airbnb's existing customers have steadily been spending less at Airbnb every year, down from over 100% in 2016 to just over 90% last year.

We would have liked to see this existing customer revenue base to instead increase every year as customers develop trust, get upsold, and ultimately build recurring habits around the platform.

However, because that's not the case, Airbnb's growth algorithm is actually fairly reliant on new customer acquisition for growth, which brings us to our next counterpoint…

Hot take 3: "Airbnb doesn't need to spend to grow given the strength of its brand, in fact 91% of traffic to its website is organic."

Titan Counterpoint: Contrary to what the above might suggest, Airbnb's marketing spend has actually been growing in near-identical lockstep with revenue from new customers.

While we believe Airbnb's brand is a remarkably strong customer acquisition tool, the data interestingly suggests a divergent story, with implied revenue from new customers incidentally growing in a near 1-to-1 ratio alongside sales & marketing spend.

While not all of this sales & marketing spend is necessarily directly allocated towards new customer acquisition, the relationship is notable and it's unclear how much Airbnb's ability to acquire new customers would be hampered should it pull back this spend.

Given the importance we highlighted above of new user acquisition to Airbnb's growth model, we believe understanding the true economics of its customer acquisition engine is key to understanding its long-term prospects.

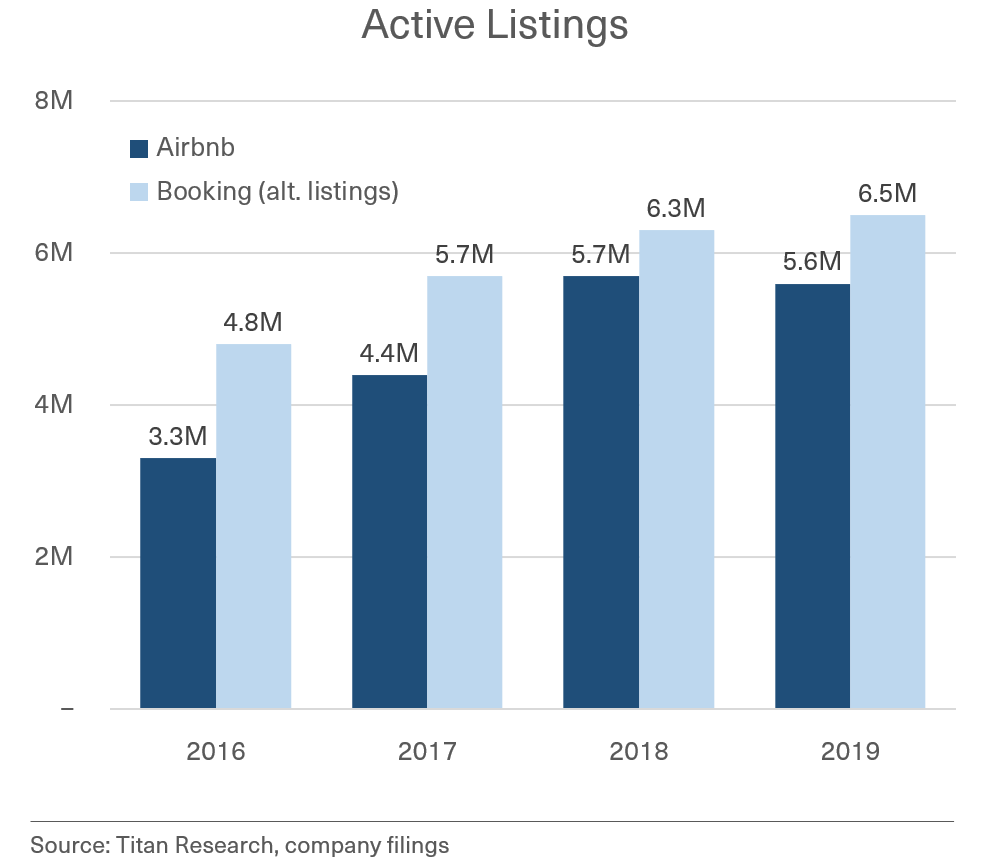

Hot take 4: "Airbnb has a wide lead in the alternative listings space, with more than 50% of its listings exclusive to the platform."

Titan Counterpoint: Based on number of active listings, Booking has actually had a fairly consistent (albeit narrowing) lead over Airbnb in the alternative accommodations space.

While we believe Airbnb has a strong lead over its competitors in terms of alternative accommodation bookings, in terms of pure listings supply, the platform may not be as far ahead as suggested by its >50% exclusive listings metric.

Airbnb still has a ~3x lead over VRBO in terms of listing count (understandably so, since VRBO only offers "whole house" rentals), but relative to Booking it's actually a slight laggard.

We believe this is important as Booking's looming, largely still-untapped listing supply could represent a headwind to Airbnb's growth and pricing should it be activated in force.

As for why that hasn't already occurred, we believe that may come down to simple economics, which leads to our final counterpoint…

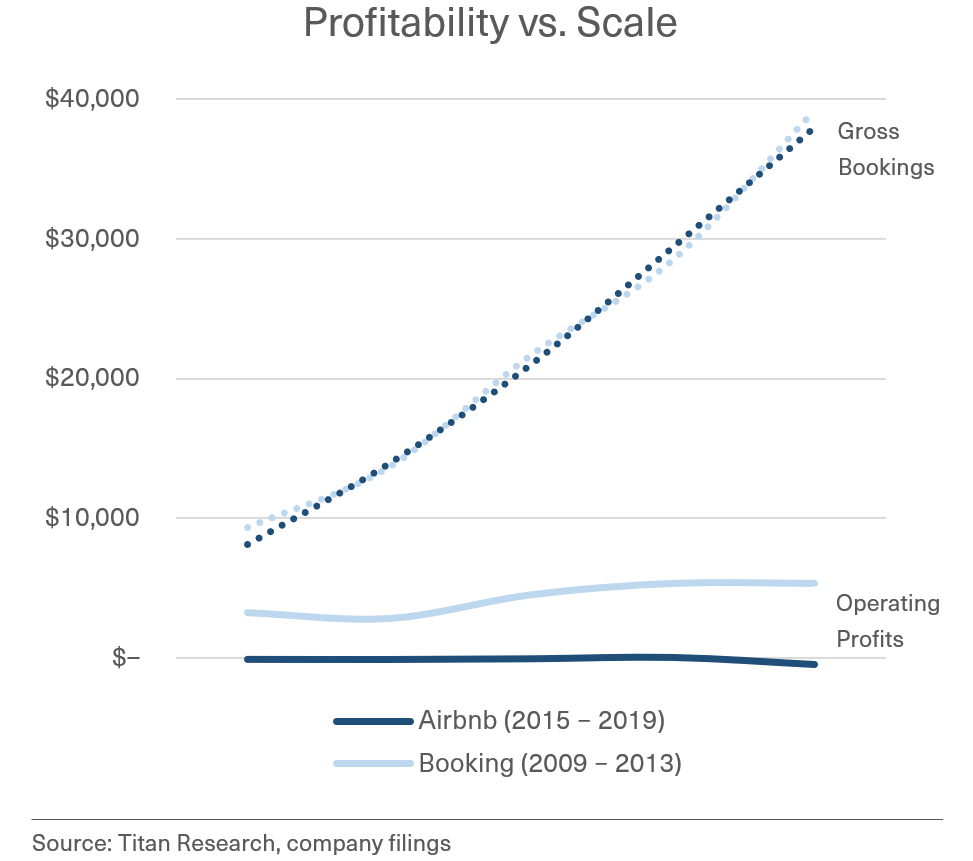

Hot take 5: "While Airbnb is unprofitable today, as it scales its financial profile should grow to rival those of leading online travel agencies."

Titan Counterpoint: A potentially structural gap in gross margins vs. traditional online travel agencies (OTAs) may prevent Airbnb's economics from ever approaching those of Booking and Expedia.

A common refrain we've heard is how while Airbnb is unprofitable today, as it scales it should demonstrate profitability that approaches today's OTA giants.

However, as you can see above, if you compare Airbnb's trajectory over the last 5 years to Booking's over 2009-2013, the two almost match up exactly in terms of gross bookings volume (or in other words, scale).

Despite that, over these respective time periods, Booking raked in over $21 billion in profits, while Airbnb recorded an aggregate net loss of over $820 million.

This suggests that there may be a potentially structural difference in operating leverage between Airbnb and OTAs like Booking.

While it's possible Airbnb may be able to narrow this gap as it grows and matures, investors should understand that some of this may be the result of structural business model differences (for instance, listing individual houses will likely always be more customer service-heavy than listing hotels that have their own customer service teams).

Stepping back

Overall, we see Airbnb as a high-quality business with an impressive organic growth engine driven by a powerful brand that has not only reached both noun and verb status.

But like for many other high-profile IPOs, the investment narrative for Airbnb is more complex than it may seem on the surface.

We'll continue to keep close tabs on Airbnb for you as the company progresses through the offering process and eventually starts trading publicly.

As we continue to monitor the company for your portfolio, we'll be sure to let you know if the risk/reward shifts materially.

For our latest thoughts, be sure to check back in here on the app. And as always, if you have any questions, don't hesitate to reach out.