August in review

Sep 12, 2022

During the first two weeks of August, equities continued to rally off of the mid-June lows. In last month’s recap, we stated that although stocks were moving higher in a hurry, we must remember that we’re still working through a very challenging macroeconomic environment and that volatility would likely persist.

Just as market participants thought they could roll through the end of summer on a high note, Fed Chairman Jerome Powell traveled to Jackson Hole and reminded the world of his plans to rein in inflation.

The market fell more than 3% that day as Powell committed to "use our tools forcefully" and "for some time," acknowledging that it would inflict "some pain."

Despite the many macro challenges, the U.S. economy had an encouraging read on inflation and saw relief in energy prices, while unfortunately, Europeans weren’t so lucky. The ongoing conflict between Russia and Ukraine has led to an energy crisis in Europe that has left many concerned about the pending winter season.

We’re experiencing a once-in-a-generation supply/demand imbalance in energy markets. In late August, our team continued to expand and diversify our energy exposure as we see no end in sight to this dislocation.

Our strategies outpaced their benchmarks in August primarily due to our reduced long exposure (sizable cash reserves) and our tactical overweight to energy, particularly in Opportunities and Offshore. My team’s plans haven’t changed; we will continue to stay diversified across sectors and deploy our cash reserves as we see opportunities to do so.

As mentioned last week, we’re excited to bring expertly-managed Real Estate and Private Credit funds to the Titan platform. These are two alternative asset classes with long track records of consistent income and non-correlated returns across various market cycles.

We’ll have a ton of information to get you up to speed, including a personalized recommendation to enable you to diversify across our new asset classes. It’s a pivotal time for your wealth, and we appreciate the opportunity to be your partner in the journey.

As always, let us know if you have any questions.

Best,

Clay

Co-Founder, Co-CEO, CIO

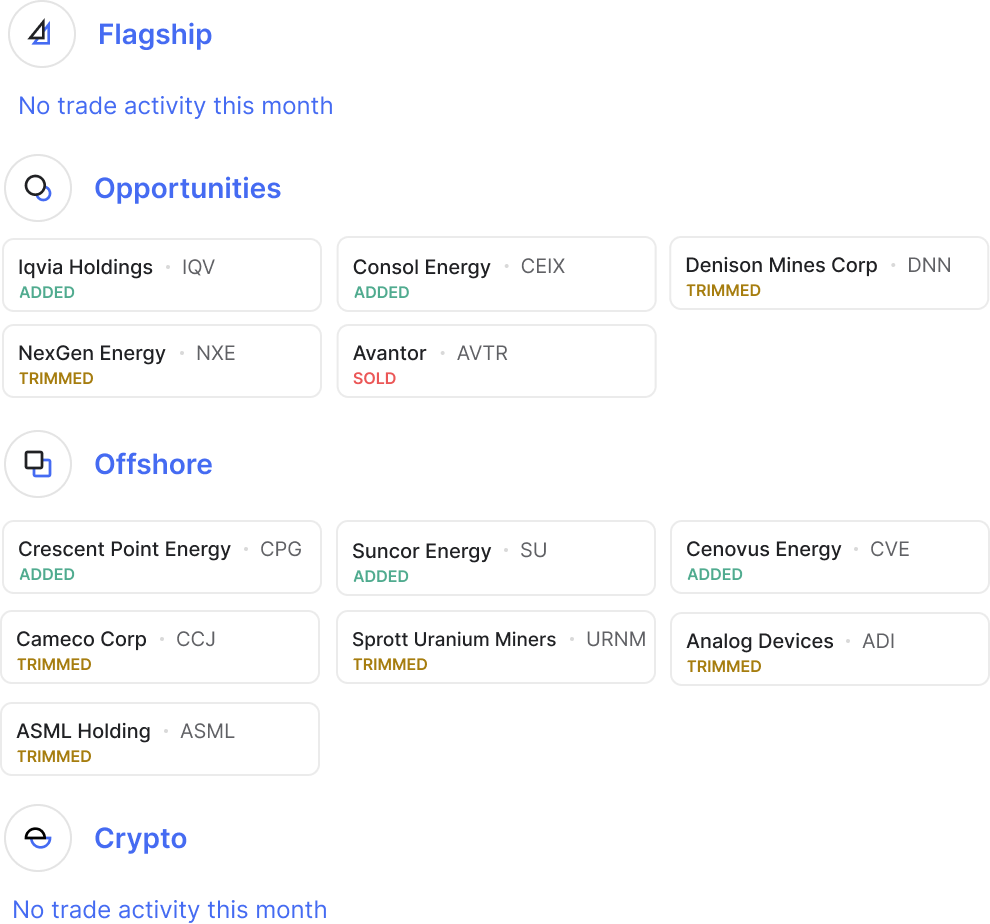

Trade Activity

You can read more about our trading activity from August in the trade update below:

Private investing is coming to the Titan platform

As Clay’s update mentioned above, this week, we’ll be launching alternative asset classes on Titan. We’re starting with Real Estate and Private Credit, two income-focused asset classes that we believe will complement our more growth-oriented equity and crypto strategies nicely.

Professional investors often allocate 40%+ of their capital to alternatives like real estate and credit, whereas individual investors historically have <5% of invested capital in alternative asset classes. The funds we’ll be launching this week are managed by iconic Wall Street firms with 30+ year track records and hundreds of billions under management. We can't wait to share more!

Lean on our team with any questions as you explore these new avenues of diversification. Be sure to update your mobile app, and we’ll send you an email as the funds become available!

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.