Shopping the sale rack

May 6, 2022

As the market plunged to 2022 lows this week, our team took the opportunity to go shopping. We initiated a position in telecom giant T-Mobile (TMUS) for clients in the Flagship strategy while selling our small stake in the battered Netflix (NFLX). We also added to many of our highest conviction ideas, and trimmed a few positions that had become outsized based on the risk/reward profile.

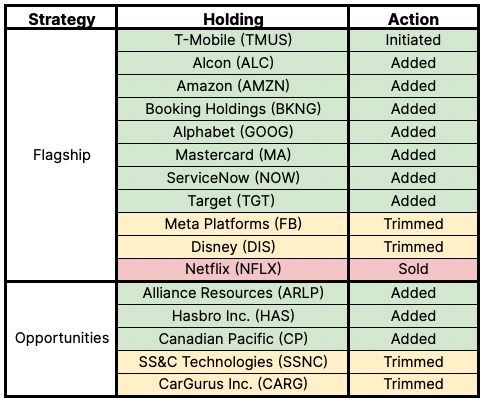

The table below summarizes these moves:

T-Mobile Raising the Bar

We’ve initiated a position in T-Mobile (TMUS) on behalf of Titan Flagship clients. Following its $26B merger between Sprint, T-Mobile has scale, spectrum, coverage, and customer value proposition needed to drive market share even higher, in our opinion. Given the inflationary environment, we continue to source high cash-flow ideas; we’re modeling that free-cash-flow will triple by 2026, allowing the company to return ~$6B of cash to shareholders via share buybacks.

As the first mover on the block, T-mobile’s 5G network reached well over 200M people in 2021 and expects to cover over 300M by 2023 – far surpassing competitors Verizon and AT&T.

Competition has been and continues to be the main risk for the wireless industry, but we believe the depressed valuation compared to peers warranted us building a starter position during this down week. This is a risk we continue to monitor closely, but we’re excited to be invested in T-Mobile on behalf of Flagship clients.

Topping off our top ideas

Alcon (ALC): Johnson & Johnson released standout bullish commentary on its surgical vision and vision care lines of business a la the same space Alcon plays in. The recent pull back in the stock price gave us an opportunity to average down on our initial starter position.

Amazon (AMZN): Amazon’s stock was crushed on earnings – a complete overreaction in our eyes. We took the opportunity to double our stake in this behemoth. We’re hard-pressed to find a company with a deeper moat than Amazon, and sleep easy at night with this as an anchor position in Flagship.

Booking Holdings (BKNG): The leader of the online travel agencies (OTAs), Booking’s overwhelming scale and supply advantage over competitors make this an asymmetric bet on the recovery of travel long-term.

Mastercard (MA): The tables turned in Q1 with pent up cross-border travel demand pushing earnings per share growth to staggering levels, strengthening our conviction that management will be able to navigate hairy macroeconomic and geo-political conditions.

Alphabet (GOOG): Just a small addition to Alphabet, but we felt the need to add to our already outsized position given the stock is still trading below historical averages on a valuation basis. Another quarter of GOOG growing dominance across advertising, mobile and cloud – a few industries that still have a decades long runway in our opinion.

ServiceNow (NOW): A mission critical piece in their customer’s tech stack, ServiceNow reinforced the strength they’re seeing in IT budget spend for their products. We’re bullish on enterprise software right now, and under Bill McDermott’s leadership, this is a horse we’re excited to bet on.

Target (TGT): Another situation where we took the opportunity to size up a starter position in a down market – Target’s sales mix skews more resilient than peers given 45% of its goods sold are non-discretionary like grocery and household essentials.

Alliance Resource Partners (ARLP): Management increased their distribution payout ratio to 40% in the recent quarter, and expect to raise this to historical levels near 100% in the coming quarters. Still sized on the smaller side in Opps, we believe this is an asymmetric risk/reward opportunity that should continue to thrive in an inflationary environment.

Hasbro (HAS): More activists have joined the Hasbro bandwagon, private equity firms are circling their competitors and the stock seems to defy all odds by continuing to show strength in a brutal tape. Our conviction continues to grow here which is reflected in our increased sizing.

Canadian Pacific (CP): Canadian Pacific cooled off after a huge run-up, so we took advantage of recent volatility to add to our position as we believe the company will deliver double-digit growth while generating a mind-blowing amount of cash flow.

Touching up the edges

SS&C Technologies (SSNC): With a bleak outlook for capital markets and the corresponding potential impact on sales growth, it felt prudent to roll back our position a bit in SSNC. Even after this trim, we’re maintaining a full position in SSNC given our confidence in the leadership team’s ability to create value through effective and thoughtful capital allocation.

CarGurus (CARG): With a softening used car environment, we don’t believe CarGurus deserves an outsized position in Opps despite our long-term thesis tracking nicely.

Meta Platforms (FB): TikTok’s potential impact on 2023 ad budgets makes us more cautious on Meta in the short-term, but with attractive 3-year IRRs, we remain holders of FB.

A broken “show me” story

Netflix (NFLX): We elected to sell our ~1% position in Netflix (NFLX) given the hit to management’s credibility and the stock becoming a “show me” story. As consumers, we’ve all seen the increasing streaming wars, and Netflix has been disingenuous with investors (perhaps with themselves as well) regarding the competitive landscape and saturating markets.

Although we believe NFLX will eventually be able to i.) convert free users in mature markets (i.e., password sharing / ad-tiered subs) and ii.) grow international penetration, we find the timing/trajectory difficult to predict due to competitive pressures. As a result, we're modeling lower EBITDA (i.e., competition -> more content spend) and penetration (i.e., success dependent on new initiatives), leading to IRRs of 11%, below our hurdle rate of 15%.

We may be back, but Netflix needs to prove their ability to execute over the coming quarters before we get interested again.

As always, please let us know if you have any questions about this trades. Feel free to email our team at research@titan.com or pose a question on Ask Titan Anything directly in the app.

Onward, Titan investment team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.