Titan Trade Update: Expanding our energy exposure

Apr 28, 2022

Amid the market dislocation, we’ve forged ahead with the deployment of some of our cash reserves into both new and existing positions, with a focus on energy.

In our Opportunities strategy, we’ve initiated a position in Alliance Resource Partners (ARLP), increased our positions in Denison Mines (DNN), NexGen Energy (NXE), and Raytheon Technologies (RTX). We trimmed IQVIA (IQV), Avantor (AVTR), and exited Hayward Holdings (HAYW) to partially fund these positions while also drawing down a portion of our cash reserves.

In the Offshore strategy, we increased exposure to our uranium investments, Sprott Uranium Miners (URNM) and Cameco Corp (CCJ), while drawing down our cash reserves.

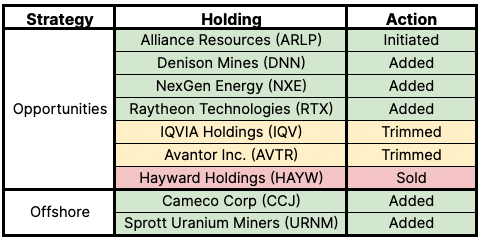

The table below summarizes these moves:

Diversifying our bets on energy

We’ve initiated a position in Alliance Resource Partners (ARLP), a diversified natural resource company with several mineral interests located in the Illinois Basin and Appalachia. At Titan, we generally look for companies that reinvest their current profits to fuel future growth and admittedly that is not ARLP – the company pays investors a 6% dividend yield today with plans to go much higher. As a reminder, all dividends paid by Titan companies are automatically reinvested across holdings within a given portfolio.

Amid the current global energy crisis spurred by Russia’s war in Ukraine, commodity prices have soared in recent months. ARLP has capitalized on this favorable pricing environment and secured several longer-term contracts at prices we haven’t seen in nearly a decade.

Based on our research, these newly signed contracts should enable ARLP to increase its free-cash-flow by more than 100% over the next 12-24 months. This could lead to the company increasing its distribution payout ratio back to historical levels, which would result in shareholders receiving dividends equal to 100% of the company’s cash flows. That would translate to a $4/share dividend, or a ~25% dividend yield at today’s prices.

We believe ARLP offers a highly asymmetric risk/reward proposition for Titan clients, and we have strong conviction that ARLP's share price could double in the next 24-36 months leading to annualized returns in excess of 30%, net of fees.

More nuclear, more A&D

Our investments in the uranium miners (Denison Mines, NexGen Energy, Cameco Corp, Sprott Uranium Mining) got off to a hot start in 2022 and saw early gains. Over the last 30 days, these names have declined along with the broader market, though we believe our thesis has gained momentum in the interim. As a result, we’re taking this opportunity to increase our positions in all four companies.

We also took the opportunity to size up our position in leading aerospace and defense company Raytheon Technologies. After initiating this position in early February, we’ve increased the position a few times as our thesis continues to gain traction. We have a price target of $140/share by the end of 2024, and continue to value the stability and robust free-cash-flow RTX provides in the Opportunities strategy.

Goodbye to Hayward

After first initiating a position in Hayward Holdings (HAYW), our thesis has tracked just as planned. We modeled a 6% growth rate in 2022, they provided guidance at 11-14%, we modeled 29% EBITDA next year, they guided to 30% for FY 2022.

So why has the stock sold off ~30% since we first invested?

It’s never easy to rationalize drivers of multiple compression, but we believe the reasons here are i) companies with a lack of liquidity typically don’t attract new investors in bear markets; ii) a need to build rapport as a public company; and iii) selling pressure from private equity owners, notably CCMP and Alberta, likely to free up cash ahead of a potentially weaker macro environment.

We’re working through a full post-mortem here, and despite the strong underlying fundamentals, we determined the opportunity cost of maintaining this position was high and elected to sell our stake in HAYW.

Trimming Healthcare

Lastly, we took this opportunity to trim a few healthcare holdings, Avantor (AVTR) and IQVIA (IQV), to partially fund the new investment into ARLP and the increased investments in DNN, RTX and NXE. Given the volatility still in the market, we continue to maintain a sizable cash reserve, which we believe will allow us to deploy capital into new holdings that we think are trading at steep discounts.

As always, let us know if you have any questions on these moves. We’re back on offense.

Onward,

Titan Investment Team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.