How tensions at the Ukraine border affect the markets

Feb 20, 2022

Here’s what’s happening

Russian troops have amassed along the Ukraine border over the last several months, raising concerns that an armed conflict could break out in that region of the world.

Comments from U.S. defense officials have spooked markets this month, notably a statement from U.S. security advisor Jake Sullivan who told the White House press corps on Friday, February 11, a full invasion of Ukraine could begin by the end of the Winter Olympics on February 20.

Russian leadership has emphasized that diplomatic solutions remain available.

Titan’s TLDR view:

- Markets have been sensitive to Russia-Ukraine headlines over the last few weeks, with large swings in the price of crude oil a particular pain point for investors. Titan’s only direct exposure to Russia is through Yandex, the country’s internet leader in search, and we recently trimmed this position for clients invested in our Offshore strategy.

What history tells us

While it can feel crass to consider the financial implications of a humanitarian event like armed conflict, these developments have been market movers and our investment team is keeping a close eye on the situation.

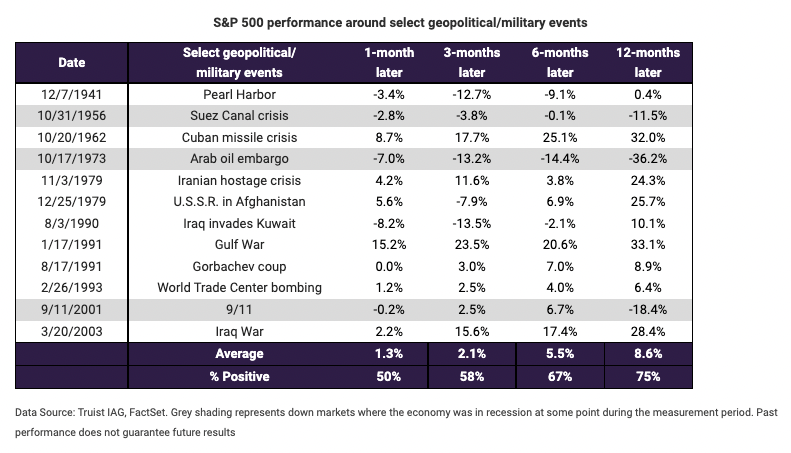

Past performance never guarantees future returns, but market history does tell us about how geopolitical conflicts have been received by investors since World War II.

This data suggests that unless armed conflict takes place during a period in which the U.S. economy is in recession, stocks tend to power higher.

What it means for you:

As we communicated to clients last week, it appears “geopolitical worries” are replacing “inflation fears” as the most likely macro headline that could spook markets in the weeks ahead. That said, a 1% or 2% move in the S&P 500 on any given day is often not enough to warrant portfolio-level changes.

We’re closely monitoring these developments, but outside of trimming our Yandex position have not felt the need to make large portfolio changes in response to this volatility.

Further thoughts from your investment team:

“Given our limited exposure to Russian equities and already defensive portfolio positions with strategic cash at elevated levels, we don’t see the need to make big portfolio changes at this point in time. A risk we’ll be monitoring is whether sustained geopolitical tensions could lead to persistently high oil prices and hotter inflation, which could result in accelerated interest rate hikes.” —Darren Ho & John Bottcher, Titan Investment Analysts

“The Ukraine-Russia saga is dominating news headlines, exacerbating weakness across all risk assets, crypto included. There has been a notable de-leveraging across the crypto derivatives markets this week, as investors de-risk amid global macro headwinds including geopolitical tensions and rising interest rates. Though not a major mover for crypto markets, earlier this week Ukraine’s parliament passed a law to legalize cryptocurrencies. A small piece of positive news in what remains a challenging environment.” —Gritt Trakulhoon, Titan Investment Analyst

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.