Trade Update: Moving weight in Titan Crypto

Jan 25, 2022

Over the weekend, our team shifted positions in our Crypto strategy. Clients are now overweight Bitcoin, Ethereum, and Cash, while portfolios still maintain exposure to the altcoins we have the most conviction in long-term. While making these updates, we were also able to harvest losses for clients in some positions, which may help offset taxable gains elsewhere in client portfolios.

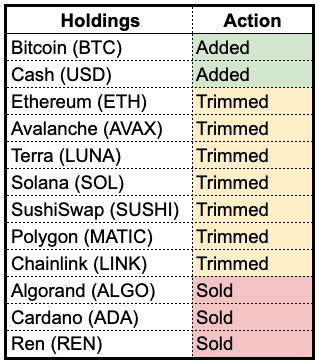

The table below recaps these moves:

With these moves, we believe we’ve accomplished the following for clients:

- Increase exposure to Bitcoin as a “safe haven” Crypto asset;

- Build a strategic cash reserve to deploy in the future;

- Remove exposure to lower-conviction holdings;

- Trim exposure to higher-risk, yet high-conviction, holdings; and

- Harvest losses in some holdings which could help offset taxes elsewhere.

Bitcoin with a side of Fiat

Two weeks ago, we wrote that we believed risks in the crypto market were skewed to the upside. In that note, however, we noted that we were monitoring Bitcoin’s price, flagging $40-$42K as a key support level. Over the weekend, that support level was broken, and in our view, it became time to act.

Almost as soon as Bitcoin fell below $40,000 we saw prices fall to $36,000. At the time, we elected not to sell given the number of massive liquidations we were seeing on-chain and how oversold Bitcoin appeared according to our momentum indicators.

Amid a brief, but smaller than hoped for, relief rally on Saturday, we began making changes in our Crypto strategy. In this rebalance, we elected to overweight Bitcoin, Ethereum and Cash in the strategy for two main reasons:

- The Bitcoin dominance indicator — or Bitcoin’s market cap as a percentage of the total crypto market — remained above the historically significant level of 40%, indicating that investors are treating BTC as a safe haven; and

- Recent volatility has led to many altcoins’ market structure becoming temporarily impaired.

These short term moves are very painful but not overly surprising with a nascent asset class. We remain bullish on crypto over the long-run, but there is a time and place to manage risk, and we believe time is now.

Taking our alts off main

Alongside these increased weights, we elected to exit Cardano (ADA) and significantly reduce our position in Solana (SOL).

In our view, Cardano investors and developers are realizing the structural challenges in creating a fully decentralized solution for batch processing transactions. We believe we are at least 9 months away from a substantial DApp ecosystem being built on Cardano to drive more interest.

With regard to Solana, although we’re seeing a thriving NFT ecosystem come alive, the network has been struggling with incoming traffic, which has led to multiple outages. We believe in the team, but would like to see them develop solutions to deal with network stability before increasing our SOL position.

We’ll continue to remain vigilant and keep you updated on our findings. We always appreciate your trust in our team, but particularly during challenging periods.

Best, Gritt

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.