Looking back at 2021, looking ahead to 2022

Jan 12, 2022

Titan has two main objectives: attempt to grow your capital at a high rate of return over a long period of time and to help make you the smartest investor you’ve ever been.

If you’ve heard us say it once, you’ve heard us say it many times: we’re in this for the long run. We don’t lose sleep over a month, quarter or year of underperformance because we’ve seen it before, but this should never be confused with an acceptance of underperformance over any period of time.

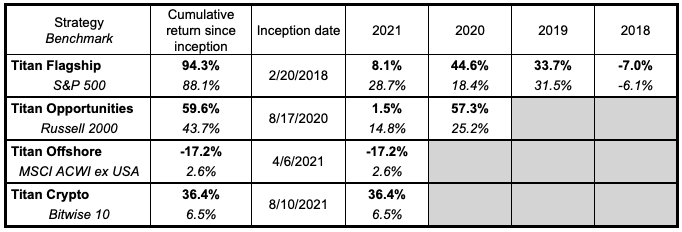

In 2021, we underperformed the benchmarks in 3 of our 4 portfolios. Our 2021 returns, as well as returns since inception (after fees) in each strategy, are as follows:

Since launching each portfolio, we have outperformed the benchmark in 3 of 4 portfolios on an after-fees basis, but again, we’re in this for the long run.

Quality 🤝 Growth

As long-term investors, there will (unfortunately) inevitably be years where we underperform our benchmarks. Any investor who tells you this can be avoided should be viewed with extreme skepticism.

At Titan, we consider ourselves “quality growth investors.” Our goal is to grow our clients’ capital at a high rate of return over a long period of time by investing in what we believe to be high-quality compounders.

Let’s take a minute to dissect what “quality growth investor” means.

As bottom-up fundamental investors at Titan, we define quality companies as businesses that are highly profitable or have a clear path to becoming so, in our view. Our investment team attempts to be able to conservatively underwrite a 15%+ annualized return over a 3+ year period for us to consider building a position. We’d rather be a little late to a great party, than the first ones to a lame party.

We define growth companies as businesses we believe may reinvest their current profits to fuel future growth. A metric my team lives and dies by is Return on Invested Capital, or ROIC. Over time, a company that generates a mid-to-high teens ROIC generally finds its market cap growing at a similar rate. If it sounds simple, that’s because we believe this concept is.

In the short term, however, Mr. Market may not always value fundamentals over technicals, sentiment, macro factors, or other flavor-of-the-moment market dynamics.

Back to the future

By March 2020, global equities had dropped roughly 30% from their prior highs.

Stocks appeared extremely oversold to us at the time. We believed 30% of all future corporate profits had not been wiped out by the impacts of the pandemic. We believed the sell-off was overdone and advised our clients to remain invested. We’re thankful that ~99% of our clients remained invested through the market’s lows.

Eventually, the market caught its breath. An unprecedented amount of stimulus was pumped into the economy by Congress and the Federal Reserve, the next financial crisis appeared unlikely to materialize, and soon stocks caught a bid. But not just the high quality growth names that we believe populate Titan’s strategies — every stock seemed to be in rally mode.

In 2020, our Flagship and Opportunities strategies outperformed their benchmarks, net of fees, by double-digits. As 2021 began, a strong move higher for growth assets took hold and our portfolios reflected this move. However, our year was about to get significantly more challenging.

Transitory proves transitory

A recovery in the U.S. economy fueled by economic stimulus, Covid vaccinations, and a surge in hiring, among other factors, created an explosion of demand for goods, services, and risk assets. The “meme stock” rallies of the winter and summer of 2021, a record year for IPO markets, and a new wave of crypto enthusiasm created a loud and chaotic environment for long-term investors.

In the background of these financial market distractions, the economic recovery was surfacing a risk that investors had not faced in a generation: inflation. Initially expected by many policymakers and economists to be a “transitory,” or short-lived, phenomenon in markets, rising prices for consumers and businesses have stuck around.

Inflation can have many impacts on the investing landscape, but the most significant impact from the persistent rise in prices we’ve seen over the last several quarters has been a major shift in Fed policy and resulted in rising interest rates.

When 2021 began, many investors believed we may not see the Fed raise interest rates until 2023. As we write this letter in early January 2022, markets are now pricing in as many as four interest rate increases in 2022. These expectations for rising interest rates pressured long-duration assets, or anything investors are buying today in hopes of realizing profits tomorrow. And many of the fastest-growing names in our strategies fell into this camp.

In response to this shifting environment, we’ve increased our portfolios’ exposure to healthcare and industrial companies while reducing our exposure to tech stocks. We believe companies like Thermo Fisher, Avantor, and Safran exhibit the characteristics of businesses we hope to own in our portfolios — durable competitive advantages, growing secular industry backdrops, best-in-class leadership teams, and attractive valuations. We also raised cash in each of our equity strategies, reduced exposure to some high-growth software names, and added to some existing portfolio holdings we believed had been unfairly punished amid this market regime change.

Could we have done some things differently in 2021? Yes, but hindsight is 2020 (no pun intended). Looking back, we may have overstayed our welcome in a handful of stocks whose valuations surpassed what may have been justified by their fundamentals. But for many other names, we continue to believe in the long-term earnings potential and may gladly stomach near-term underperformance in an effort to realize gains over the long run.

Our investment philosophy is centered on owning a select number of stocks that we believe can outperform highly diversified indices over time. Being concentrated does not come without volatility. Is it painful while volatility happens? You bet. Is it expected? You bet. But we believe long-term investors have the ability to stomach volatility in the short term in order to outperform over the long run.

After an active second half of the year, we believe our decisions may help mitigate downside risk and reduce portfolio volatility in the short term, while also providing our strategies with additional “dry powder” that can be used to seize opportunities during the current market dislocation.

If we can be invested in companies trading at what we believe to be attractive valuations that are growing earnings organically upwards of 15% or 20%+ per year, we believe we can weather any storm while outperforming our benchmarks over a 3-5 year investment horizon.

On the horizon

Looking ahead to 2022, we expect the recent bout of market volatility may persist amid a number of uncertainties. But we believe volatility can also lead to the moments of greatest opportunity, especially to those investors with a long time horizon.

How many rate hikes can we expect? Will inflation prove transitory? If so, when? If not, how high can it go? Will there be another Covid variant? Will it slow economic growth? Midterm elections? China? The list of macro questions goes on…

Nobody can answer these questions with certainty. And if someone says they can, we don’t believe this person is being honest with you.

We believe reining in our risk exposures to certain sectors and factors enables us to prepare for, but not predict, these unknowns.

And with these risk and portfolio management frameworks in place, our team is able to focus on what it does best: find long-term quality compounders with idiosyncratic upside.

We believe we are well-positioned across our four strategies today, and as opportunities arise we may start to gradually leg back into higher quality growth investments that have fallen sharply — sometimes up to 40% or 50% — in recent months using the cash positions we've built in each portfolio.

Impossible without you

Over the last four years, we have built a community of over 50,000 investors that have trusted us with some portion of their hard-earned capital, and we don’t take this responsibility lightly.

I started this letter with our two objectives: grow your capital at a high rate of return over a long period of time and to make you the smartest investor you’ve ever been. Core to us achieving these objectives is earning the trust and patience of our clients who enable our process to play out.

We’re thankful to have an avenue to speak directly to our investors and plan to keep this line of communication open as we navigate these choppy waters.

As always, thank you for the trust you’ve put in our team, and we’re optimistic about a strong 2022.

Best, Clay

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.