Titan Offshore Trade Update: We’ve bought TSM, added to SE, sold out of BILI, and trimmed ASML

Nov 24, 2021

For Titan’s Offshore portfolio, we’ve sold Bilibili (BILI) and trimmed ASML (ASML). We’ve used the proceeds to purchase Taiwan Semiconductor Manufacturing Company (TSM) and to increase our position in Sea Limited (SE).

We believe this offers Titan Offshore clients:

- Exposure to what we consider a first-class semiconductor business amid a massive investment cycle; and

- Reduced exposure to Chinese social media companies.

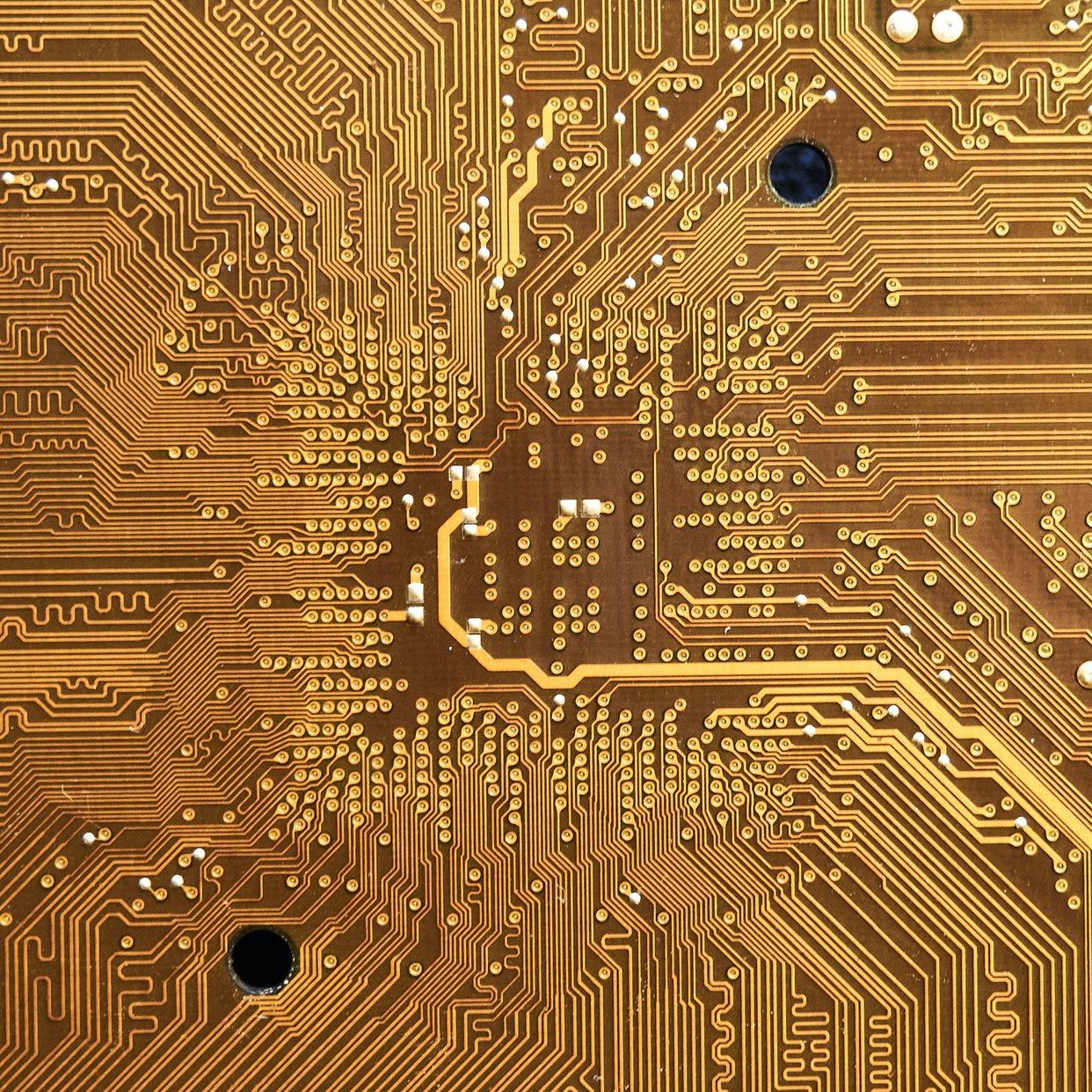

Placing chips on TSM

TSM is a leading semiconductor foundry, manufacturing the chips that power technology at the bleeding edge of innovation.

TSM’s chips power technologies that range from smartphones and tablets to electric vehicles and server farms. We often talk about wanting to own the “picks and shovels” of growing industries, and we believe TSM may be one the clearest examples of this dynamic among any business in the world.

TSM has consistently compounded its economic value through semiconductor investment cycles, and our work indicates the company may be able to sustain this growth over the next decade.

In the near-term, we believe TSM may be able to raise prices and improve margins; in our view, TSM is currently offering a discount relative to its foundry competitors.

Capital expenditures also form the basis of future growth for TSM, and we believe the company’s current budget of $100 billion may not be sufficient in this environment. Raising this outlook may be a catalyst for the stock.

Bye bye, BILI

BILI can be thought of as “China’s YouTube”: a streaming video and media platform with a Gen-Z user base operating in China’s dynamic social media landscape.

Since we first purchased BILI on April 6, 2021, regulatory scrutiny from Chinese regulators has increased. For example, minors are now limited to one hour of online gaming per day on weekend and holiday evenings, a ruling that may impact BILI’s gaming segment.

Although we believe BILI may be able to average annual returns in the high-teens through 2023, net of fees, we don’t believe this offers a compelling risk/reward given the regulatory risks associated with BILI.

In October, we divested our stake in Pinduoduo (PDD). By exiting BILI, we have further trimmed our clients’ direct China exposure, limiting it to holdings in what we believe are three excellent businesses: Alibaba (BABA), JD.com (JD), and Tencent (TCEHY).

We believe these three names offer a more compelling risk/reward for Offshore clients, while providing the portfolio exposure to a potential China turnaround story as regulatory clarity emerges.

Taking advantage of a SE change

We’re increasing our exposure to SE, an emerging leader in e-commerce, gaming, and payments in Southeast Asia.

Following the company’s most recent quarterly report, we believe SE shares have been unfairly punished despite solid fundamentals, falling more than 20% since the market close on October 20, 2021.

We believe this recent decline in SE has improved the risk/reward for the stock and presents an opportunity to increase our position.

We believe SE continues to execute well on its growth initiatives, particularly in e-commerce via its Shopee franchise, which may be its largest value driver in the coming years.

Slimming ASML

ASML is a leading producer of photolithography equipment, used in the production of semiconductors. Our new Offshore holding TSM is one of ASML’s largest customers.

Since being added to the Offshore portfolio at inception on April 6, 2021, ASML has been one of the best performing names in the strategy, rising 28% over that period.

Given this run-up in the stock and limited potential upside to earnings estimates over the next 6-9 months, we believe the risk/reward for ASML shares has become less compelling.

Even with this trim, our exposure to the stock remains above that of the Offshore strategy’s benchmark, the MSCI World ex-USA Index.

In our view, an active overweight to ASML remains warranted given the multi-year semiconductor investment cycle we believe is underway.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.