An active lack of participation

Oct 22, 2021

The phrase “active management” brings to mind change, movement, a sense that things are always happening.

But we believe active management done well can often look like no action at all.

And some of the most important calls Titan makes as an investment team can result in no visible outcomes. Instead, the research, analysis, and debate that go on behind the scenes might lead us to pause, re-examine, or step away from an opportunity.

In other words, a great deal of what goes into an active management process can appear, from the outside, like just sitting still.

And here we’re inclined to follow the wisdom of Vanguard founder Jack Bogle, who wrote in a 2014 column that investors are best served to follow the aphorism — “Don’t do something. Just stand there!”

If we think about Titan’s investment process as an iceberg, portfolio changes are what can be seen above the water’s surface. Below the surface is where you’ll find most of the team’s work — deep investigations, vigorous debates, and ruthless honesty about how we’re going to make money for our clients.

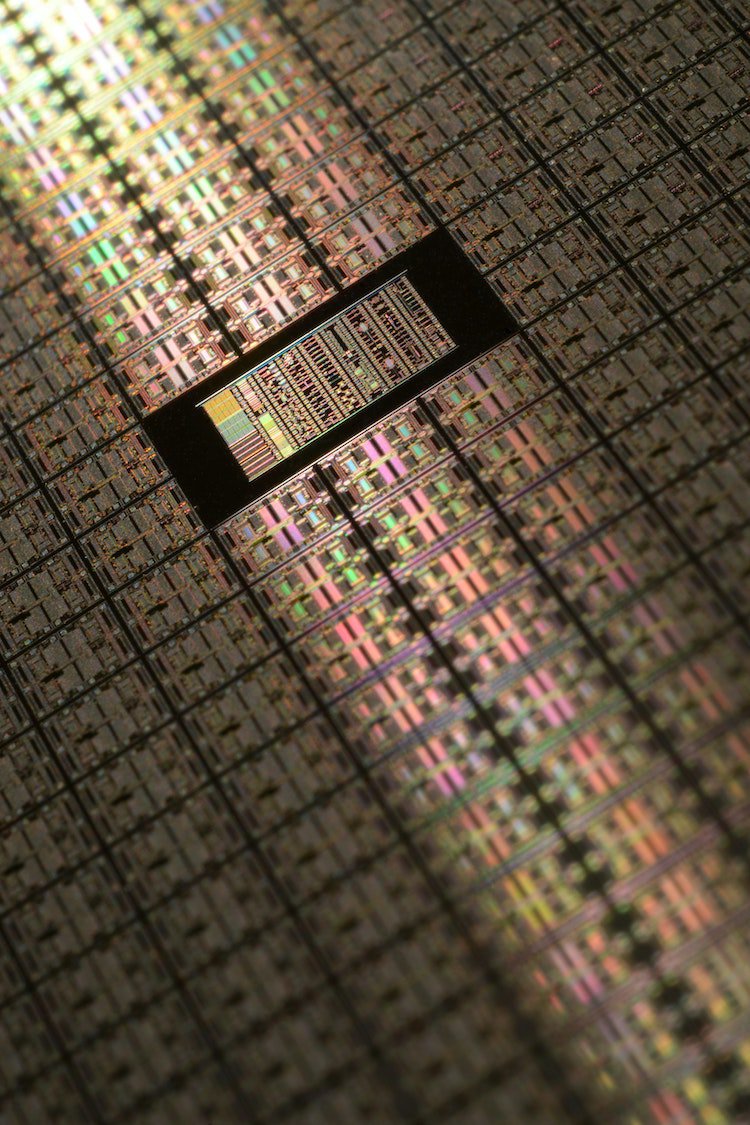

Let’s explore a recent example. Earlier this month, Titan investment analyst Christopher Seifel brought to our investment committee the idea of taking a position in three companies poised to help power what he characterized as a “gold rush” for the semiconductor business.

These are businesses that we believe have durable competitive advantages, secular tailwinds, and great management teams. But the hangup for our team came at the question of valuation.

For these stocks, our valuation work suggested achieving a 15% annual rate of return net of fees was a median outcome rather than a conservative estimate. And our goal at Titan is to attempt to achieve returns that average 15% per year net of fees.

Accordingly, the stocks we buy should not only represent shares in a company that has the three characteristics mentioned above, but should be valued such that we believe a 15% return net of fees is a conservative estimate. This approach may provide us with what investors often refer to as a margin of safety.

In the case of these semiconductor names, things may not need to go perfectly for us to realize 15% annual returns net of fees. But developments that might be classified as “less than ideal” could be more than enough to derail progress towards this outcome, in our view.

For now, we’ve decided to stand by, observe, and wait to see if the state of play shifts. If and when it does, we’ll be ready to act.

But until then, we’re happy to appear like we’re “just standing there.”

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.