Global dislocation

Oct 14, 2021

Offshore Portfolio Update: Shifting our weight in China and LatAm

A challenging quarter in Titan’s Offshore portfolio has presented us with several compelling opportunities to put additional capital into strong businesses we already own.

TLDR: We’ve consolidated our holdings in China and Brazil, as we believe today’s rocky landscape presents us with a unique opportunity to focus our investments in both countries.

Our view is that China remains investable with recent market volatility creating several compelling entry points for existing holdings. Similarly, in Latin America, investor fears over previously-disclosed regulatory actions have set up a risk-reward opportunity we can’t pass up for our clients.

To capitalize on these market dislocations, we’ve increased our clients’ exposure to PagSeguro (PAGS), Alibaba (BABA), JD.com (JD), and Tencent (TCEHY) while exiting positions in MercadoLibre (MELI) and Pinduoduo (PDD).

Buying the China dip

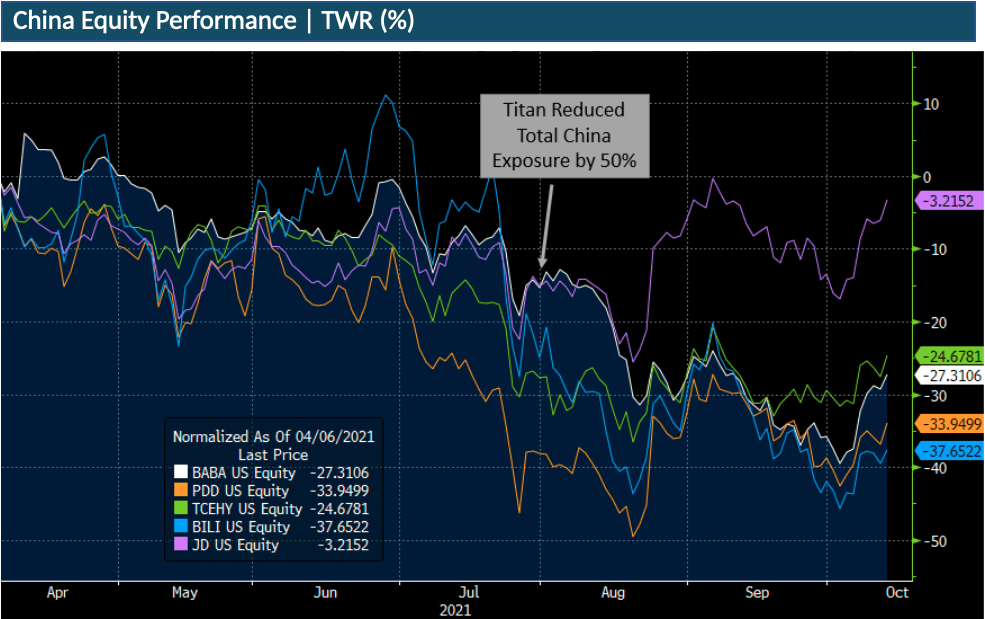

As recently outlined in a memo to clients, Chinese equities have sold off considerably amidst a turbulent regulatory moment. But even against this uncertainty, we believe China continues to offer investors a compelling opportunity, especially with valuations at present levels.

As a result, we’re taking this chance to begin layering in additional capital after previously cutting our exposure. Our China investments have now been consolidated into what we believe are four high-quality names — Alibaba, JD.com, Bilibili, and Tencent — after divesting our stake in Pinduoduo.

The combined exposure of this group is now ~2% higher than before making these updates in the Offshore portfolio and more than half of this new weighting has gone towards Alibaba. In the coming months, we’ll be closely watching China for more clarity around regulatory actions, signs of an improving U.S.-China relationship, and a resumption of foreign IPOs, among other factors, as we look for opportunities to further increase our exposure.

In late July, Titan reduced its exposure to China by about 50% amidst a broader Offshore portfolio shakeup. And while performance in the quarter left us disappointed, these reductions — which included trimming our positions in JD.com, Alibaba, Bilibili, Pinduoduo, and Tencent — ultimately added +2% of net attribution during that quarter vs. if we had made no changes at all.

Source: Bloomberg

Source: Bloomberg

A big bet in Brazil

In Brazil, we’ve taken similar measures and consolidated exposure into our highest conviction position, PagSeguro, a leader in Brazil’s fast-growing payments industry focused on serving small and medium-sized businesses.

PagSeguro’s stock has recently come under pressure following two isolated events. And the scale of this move is not to be understated: since these headlines crossed on October 7, shares of PagSeguro lost 20% through Wednesday 10/13.

Regulatory headlines suggested the Central Bank of Brazil (BCB) would potentially cap prepaid and debit card interchange fees, a BCB focus point that investors have been aware of since at least 2018. Additionally, an unrelated research report speculated about potential headwinds facing PagSeguro given a challenging Brazilian macroeconomic environment.

A review of these developments by our investment analysts, however, did not reveal a change to our core investment thesis in PagSeguro. Our current model suggests PagSeguro could be worth $69 per share by YE 2023, or roughly double today’s current prices in the mid-$30s. And we believe this risk-reward setup is one we should seize on behalf of clients.

We believe PagSeguro remains well-positioned to capitalize on the secular trends underscoring the growth of Latin America’s payments ecosystem. The company’s PagBank business also remains undervalued, and PagSeguro may be able to deliver revenue and earnings growth in excess of 30% over the next five years.

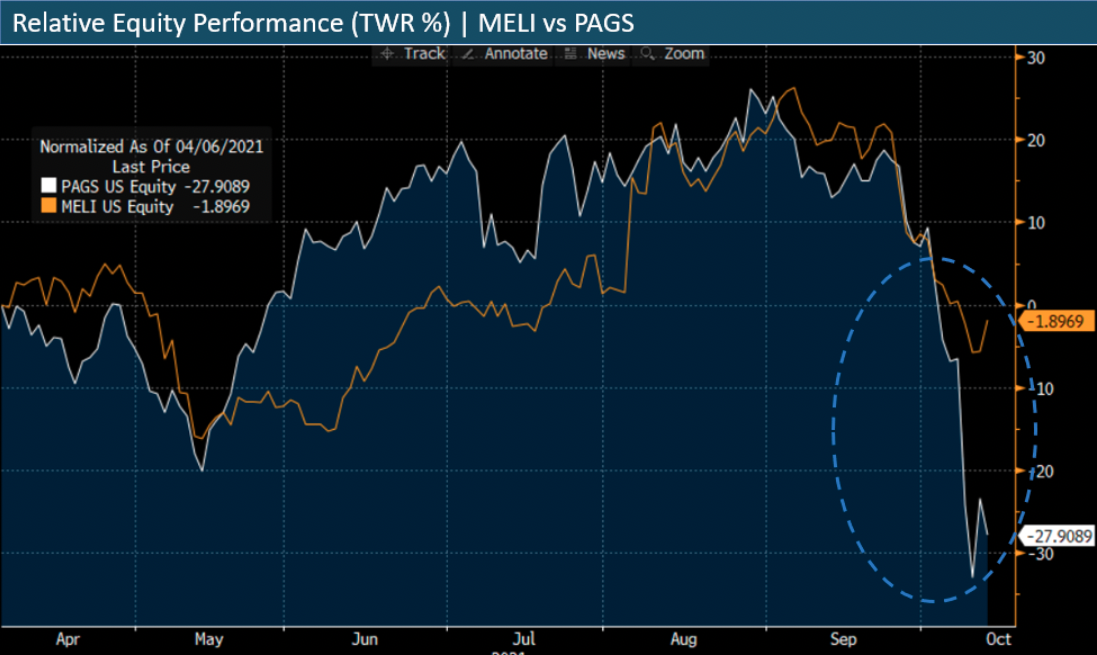

The recent sell-off in PagSeguro has dislocated the stock from shares of Brazilian peer MercadoLibre, a shift after the two companies had traded in-line with each other for the better part of six months. Since early April, MercadoLibre shares are down less than 2%; PagSeguro shares are down close to 30% over that same period.

Source: Bloomberg

Source: Bloomberg

Given our conviction in the outlook for PagSeguro and the discount the market now offers relative to its peer group, we believe this is a unique opportunity to use proceeds from the sale of MercadoLibre to increase our exposure to PagSeguro.

As ever, thank you for the opportunity to manage your capital. If you have any questions about these trades or any other aspect of investing with Titan, you can respond directly to this email and a member of our team will be in touch.

Best, John, Darren, and the investment team at Titan

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.