Why we're bullish on Stellar

Aug 26, 2021

Titan Crypto: Spotlights

In the world of crypto, it's valuable to understand what you own and why you own it. That's why we're sharing our theses on each coin in Titan Crypto.

Today, we're taking a look at Stellar (XLM), the premier payment network for global institutions, enterprises, and retail.

Stellar has benefitted from the positive tailwinds across the crypto landscape since we launched, but we see a long runway ahead with our long-term price target of $1.50 (upside potential of ~330%).

Let's dive in.

Stellar (XLM): Integrating with global financial institutions to solve cross border payments

Thesis: Stellar will serve as a major solution to the remittances and cross-border payments space, offering near-instant, low-cost transactions between any pair of currencies and tokenized real assets. Stellar carries a 5.5% weighting in our portfolio.

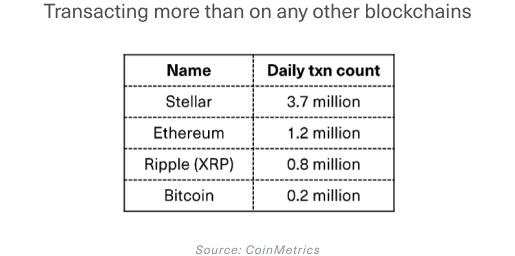

Stellar has solidified its position within the blockchain payments space, differentiating itself from other blockchains with its unique, payments-focused value propositions

The platform allows users to issue new assets such as stocks, currencies, and cryptoassets, and exchange them for other assets via built-in asset exchange features. Stellar’s native token, XLM, serves as the “bridge” currency between other assets to facilitate and create liquidity.

- Fast and efficient transactions: (<5 sec finality) and fees of (0.000002 USD per tx)

- Asset issuance: Anyone can tokenize assets and transfer or trade them over the Stellar network quickly and cheaply. The creator can apply rules or restrictions to fit their requirements such as setting monetary policy, controlling who can hold the token (through KYCs), clawing back assets from other accounts or lost keys. These features are critical to allow regulated assets to be issued on the Stellar network, such as central bank digital currencies (CBDCs) and digital debt securities

- Anchors fiat on/off ramp: “Anchors” are trusted institutions around the world that provide easy on/off ramps for users. They accept deposits of fiat currencies such as USD, CNY, EUR via existing rails, and send a user the equivalent digital tokens to be used in the network. Users can exchange USD -> EUR, for example, and redeem those tokens for the real-world assets they represent at destination

- Cross-asset payments: Identify and automatically convert currencies along the most optimal conversion paths to execute the best exchange rates for users

- Protocol-native decentralized exchange (DEX): Users can buy, sell or trade their assets directly from their wallets

- Safety over liveness: Unlike most public blockchains that prioritize liveness (system is never halted; disagreement on consensus leads to multiple fork versions instead), Stellar prioritizes safety (system rather halt than fork; confirmed transactions cannot be later rolled back). This payment-focused design choice means that Stellar can guarantee its users the security and near-instant finality of their transactions, unlike other blockchains such as Bitcoin which typically requires 5+ blocks (30 mins +) before transactions can be deemed finalized

- Turing-complete smart contracts (in development): This will allow Stellar to support wide-ranging use cases such as DeFi

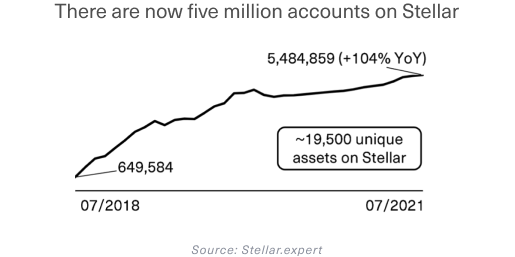

We're seeing growing network activity and adoption

Unlike other crypto projects, Stellar is trying to integrate with, rather than replace, the existing global financial systems

Based on our research, Stellar has been one of the best and most active crypto projects when it comes to partnerships and building out their global reach:

- Ukraine’s government: Chosen to be the platform for the country’s central bank digital currency (CBDC) earlier this year

- IBM: Global partnership to implement blockchain banking via its IBM World Wire project

- Circle: Became the third official chain for USDC, the world’s leading digital dollar stablecoin

- Deloitte: Infrastructure provider for Deloitte Digital Bank

- Stripe: Sole early investor in Stellar

- Franklin Templeton: Plans to tokenize a new fund on Stellar

- Coinbase: Users can earn 4% cashback in XLM on its credit card

- Vonovia (largest German real estate group): Issued $24M digital bond

- Various regulators: World Economic Forum, IMF, OCC, and more

In summary, we believe Stellar is a solid long-term bet that warrants an allocation. Stellar has strong fundamentals and wide user adoption, and is relatively undervalued in our eyes. While its tokenomics still need time to improve, we're bullish that Stellar will continue to gain mainstream adoption as the go-to payments and regulated asset creation platform.

For the rest of our memo on XLM and more, see our launch materials.

Why invest in crypto now?

Growth Runway

- We believe the next big tech paradigm shift will be driven by crypto and blockchain technologies. The crypto space is experiencing an extraordinary level of software development and innovation, and has immense growth potential over the coming decade.

It's Still Early

- There are many signs suggesting that those who invest in crypto today are still “getting in” near the beginning. There is still a great deal of skepticism and disillusionment from the public at large: typical of any technology that is very early in its life cycle. Existing infrastructure is still too complicated and confusing for mainstream adoption. Even regulators are still debating on how to regulate the space.

Diversification

- Crypto is generally uncorrelated to the behavior of other asset classes, and could serve as a strategic allocation in portfolios. Extensive research has shown that a small allocation of cryptos would have consistently and significantly increased both the cumulative and risk-adjusted returns of a portfolio.

As always, let us know if you have any questions.

Onwards, The Titan Investment Team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.