Passing on Airbnb and DoorDash (for now)

Dec 17, 2020

Despite IPO markets being on fire, we have passed on Airbnb and DoorDash (for now).

Why? Because these IPOs have had unique trading dynamics that we believe do not warrant your capital being invested (yet). Below are our top takeaways.

If you enjoyed this piece, feel free to share with friends and family.

1. Day one "pops" rarely mean anything for the typical investor.

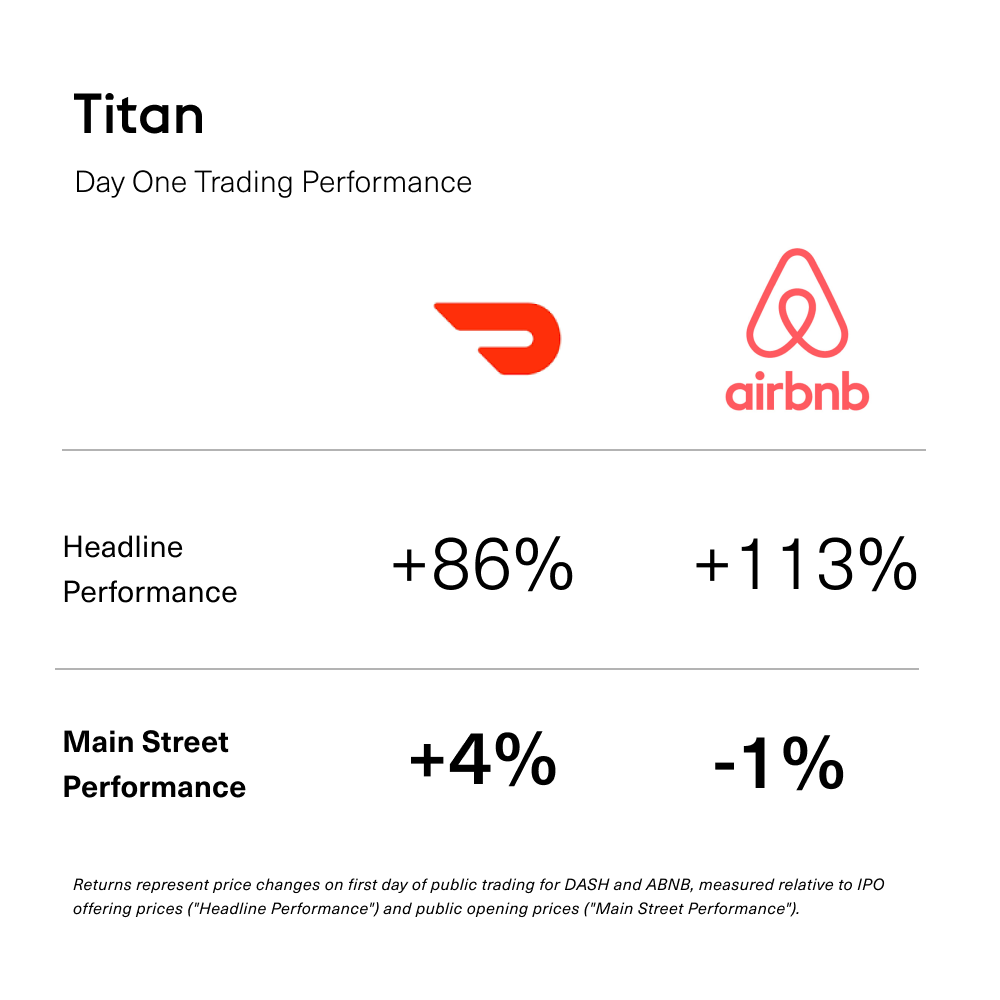

The financial media often wrongly makes high-profile IPOs seem like an easy way to make a quick buck. For example, DoorDash and Airbnb are both widely quoted to have risen +86% and +113% respectively on their first day of trading.

But these day-one returns are for the offering price and only apply to people who had exclusive access to pre-IPO shares (e.g., insiders, hedge funds).

Because the first public trades of IPOs are often meaningfully above these offering prices, true day-one returns for everyone else are often much more muted than what headlines suggest.

On this metric, DoorDash and Airbnb actually returned a typical +4% and -1% on their first trading day - not a terrible outcome, but far from a free lunch.

2. Unique supply/demand imbalances around IPOs often drive share prices to deviate materially from fundamentals.

Part of what causes the first trades of an IPO to get booked materially above the official offering price is: supply of shares < investors' demand for them.

As investment banks drum up excitement around their IPO clients like Airbnb, they also carefully price shares to build in a little undersupply that should boost the stock prices during the first day of trading.

For those who get exclusive access, this often results in a quick one-day win, as prices promptly surge at the onset of trading.

But as the first trading day's hype fades, prices tend to drift back towards more normalized levels. For example, DoorDash and Airbnb are both now down -16% and -14% respectively since their fiery debuts last week.

3. Lockup periods prop up share prices temporarily, but result in downward price pressure in the future.

Most IPOs tend to come with lock-up provisions. These clauses prohibit insiders like employees and private investors from selling shares for 3-6 months following the IPO.

This is intended to prevent a flood of people trying to sell from negatively impacting the initial trading dynamics of the company - but ultimately, that piper needs to be paid.

Inevitably, new public stocks begin facing downward price pressure as the lockup period expires and employees start to sell stock.

This dynamic is one that actually may benefit main street investors, as the technical impact of a wave of new share supply can cause stocks to trade below where their fundamentals dictate. That means a buying opportunity.

TLDR: We're staying patient and picky with Airbnb and DoorDash vs. getting caught up in the IPO hype.

We continue to monitor the IPO and post-IPO market on your behalf, and will follow up should any attractive new opportunities come across our radar.

As always, if you have any questions, don't hesitate to reach out.

Best, Titan Investment Team

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.