Earn 6x more in your retirement account

Aug 14, 2020

.jpg)

How you invest your retirement savings today can mean a difference of hundreds of thousands of dollars.

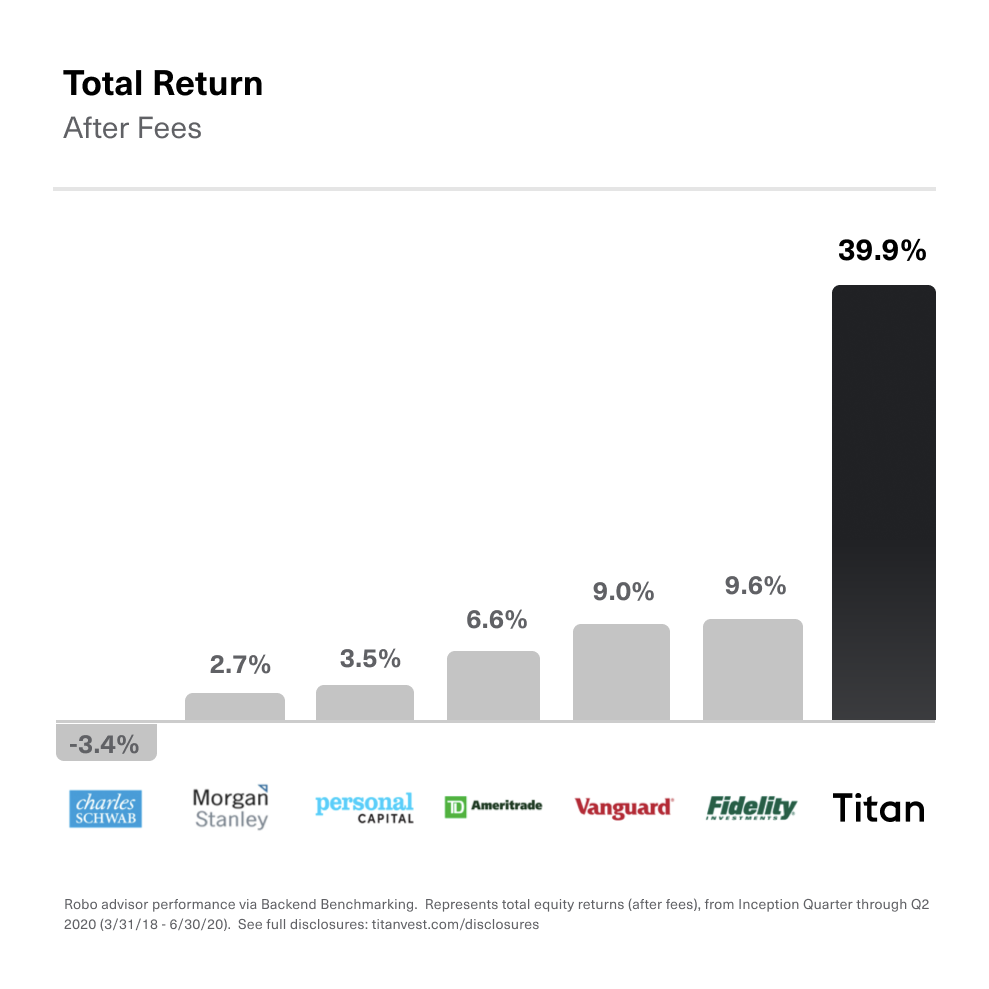

Titan clients have seen their accounts gain +40% after fees since our first quarter of inception in 2018.

That's greater than every other investment advisor covered by Backend Benchmarking over this time period, by nearly 6x on average.

Compared to others, Titan's performance has been:

- >4x that of Fidelity & Vanguard

- >6x that of TD Ameritrade

- >11x that of Personal Capital

- >14x that of Morgan Stanley

- >78x that of Schwab & Betterment

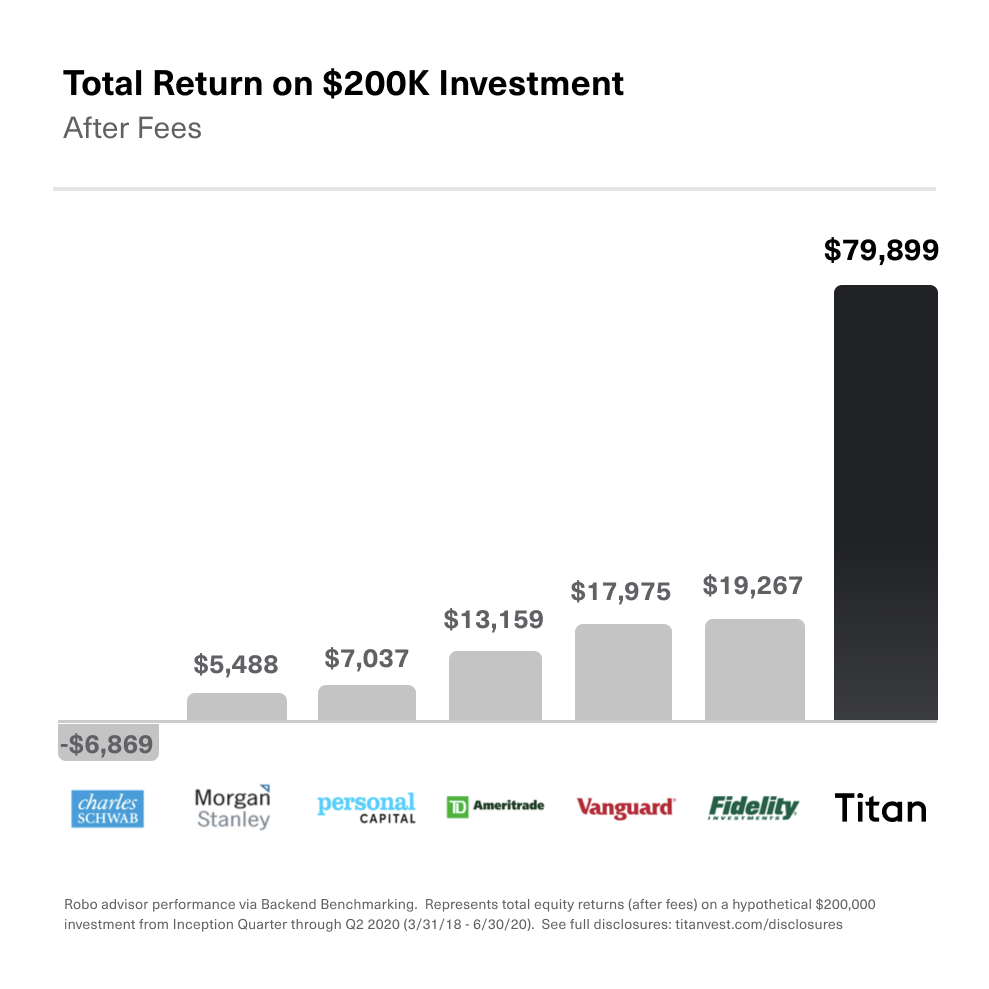

What this means is that over the last 2.25 years, $200K invested in Titan would have earned an additional ~$68,478 after fees than what it would have if invested in the average robo advisor.

Given the typical multi-decade time horizon that most retirement accounts take, this type of outperformance can make a world of difference.

Have an old 401(k) lying around?

Fortunately, transferring your retirement account over to Titan today is a simple as a few taps in the app.

If you're like most folks, you probably...

- Have an old 401(k) from a past employer

- Have a few IRA accounts

- Have seen those accounts decline meaningfully this year as a result of the COVID-19 crisis

- Are unknowingly paying high hidden fees (which can often total to more than 2%) on top of the subpar performance

Titan retirement clients are different:

- Thousands have rolled over 401(k), 403(b), and IRA accounts into Titan IRAs with just the tap of a button

- They have grown their wealth +13-17% after fees this year through all the market volatility

- They pay a simple 1% annual fee, or even as little as 0% (yes, zero) after making a few referrals

When it comes to your retirement savings, you deserve the best possible long-term returns. That is precisely what Titan is built to deliver via its high-quality, actively-managed portfolios of the world's best companies.

If you haven't already, consider rolling over your retirement account to Titan today. Your retirement is counting on it.

Rollovers with Titan are quick and easy

Just email rollovers@titanvest.com with a statement for the account you wish to roll over.

Our Rollover Concierge will handle the entire process from there. Your retirement funds can be invested in a Titan IRA in a matter of days.

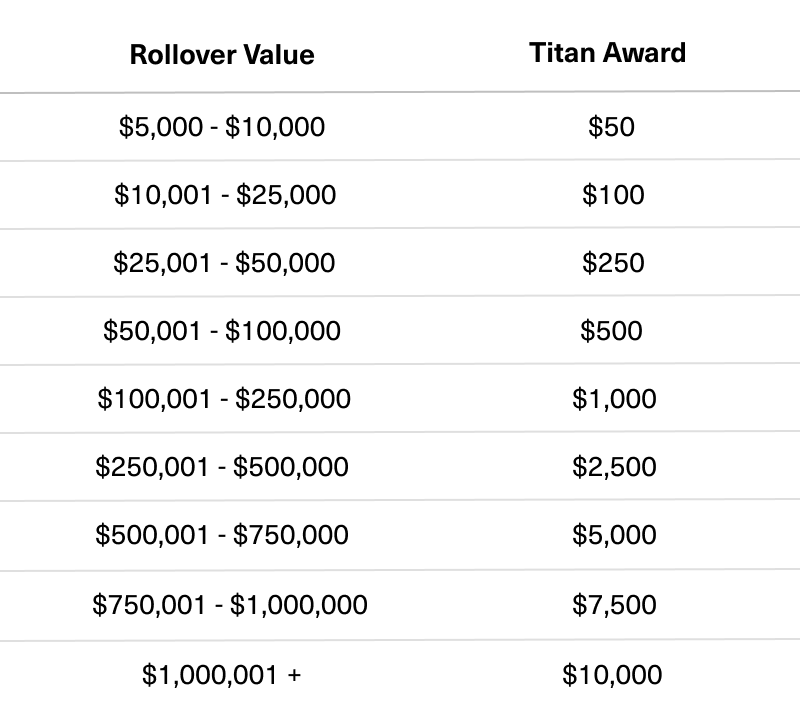

Plus, we're giving you up to $10,000 in rewards when you roll over retirement accounts to Titan. More details here.

FAQ

What types of accounts can I roll over? We accept IRA transfers (Traditional, Roth, SEP, SIMPLE), 401(k) and 403(b) rollovers, and even non-taxable account transfers of $10,000+.

Can I roll over part of my funds instead of the entire account? For IRAs, yes. For 401(k) and 403(b) plans, it depends on your plan provider's policy. Ask them if they allow "partial rollovers." If they do, then you can inform them of the specific amount you would like liquidated and rolled over to Titan.

What is the investment strategy for Titan IRAs? Your IRA will be invested in the same Flagship strategy as our Individual accounts. However, you can designate a different risk profile for your IRA vs. your Individual account, which would dictate a different hedge level.

What are the fees for Titan IRAs? The annual fee for IRAs is a simple 1% of assets, the same as Individual accounts.

Will my referral credits apply to a Titan IRA? Yes! Your referral credits will apply to all your Titan assets (Individual and IRA accounts).

Will a rollover result in any taxes or penalties? No, direct rollovers of 401(k), 403(b), and IRA accounts do not incur any taxes or penalties.

Will I be charged any fees to roll over my IRA, 401(k), or 403(b)? No, we do not charge any fees for incoming rollovers. However, your retirement account provider may charge an outgoing fee. Check with them if you're unsure.

Do I need to sell any investments in my retirement account(s) before rolling over? No, we can usually handle this for you. As a reminder, selling your investments is not a taxable event because you are selling shares in a tax-advantaged account.

Other questions? Email rollovers@titanvest.com and a member of our Rollover Concierge team will be happy to assist you.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.