Titan ranked #1 advisor for returns in Q1 2020

May 5, 2020

.jpg)

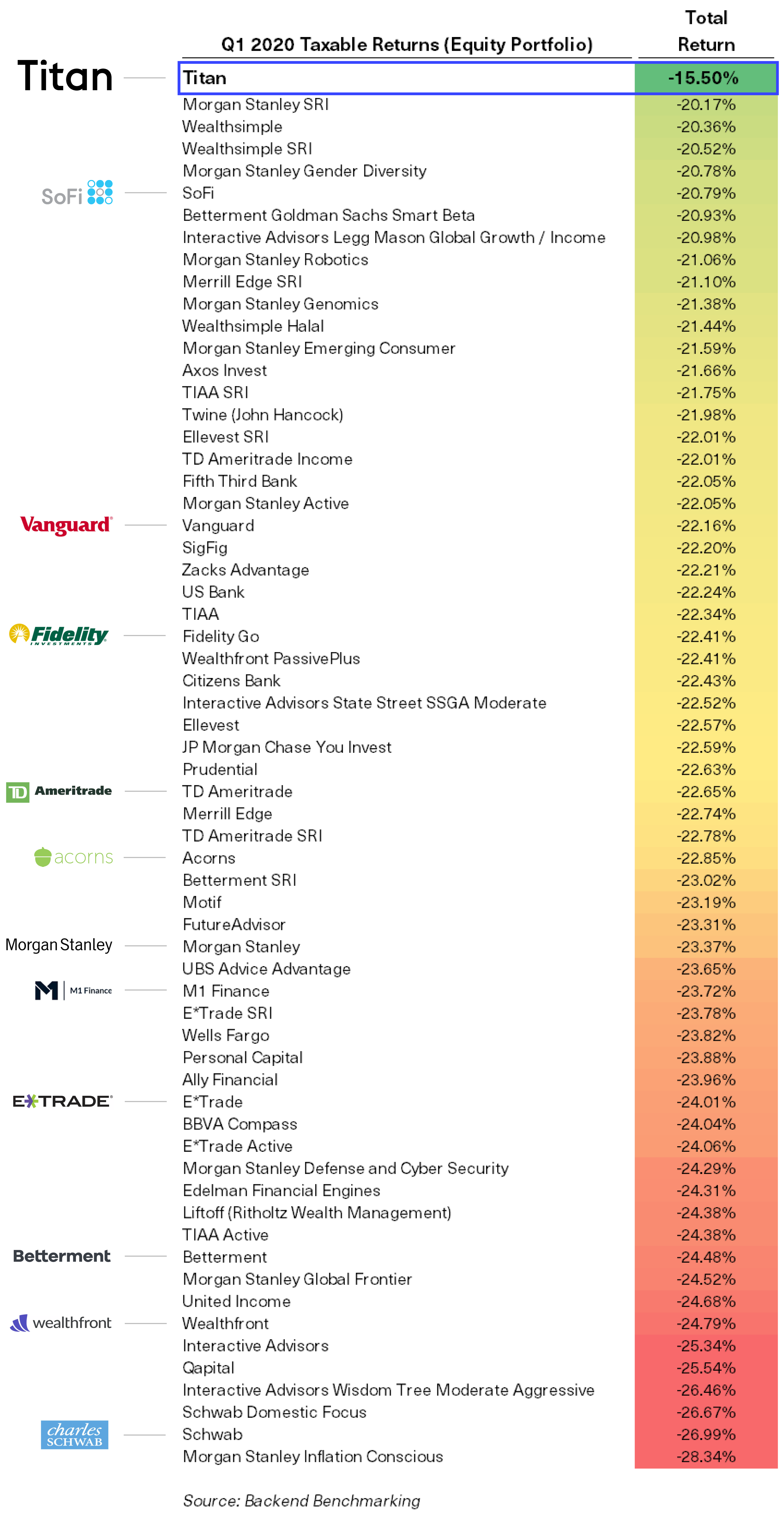

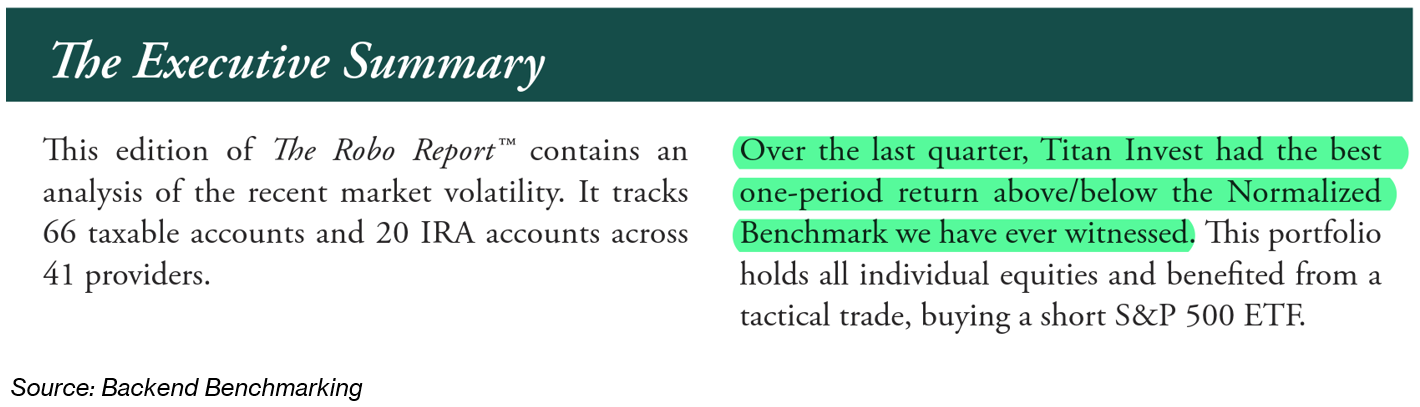

We're pleased to announce that Titan was ranked #1 out of 60+ robo advisors for both equity returns and excess returns in Q1 2020, according to The Robo Report.

Titan outperformed all other investment managers in the study, including Fidelity, Vanguard, Wealthfront, Betterment, and M1 Finance (all on an after-fees basis).

This represented Titan's 2nd consecutive quarter of ranking #1 in excess returns vs. normalized benchmarks.

As mentioned in the report, Titan was the only robo advisor to beat the S&P 500's return in Q1 2020, thanks in part to the downside hedge we activated for clients in early March.

Below are some highlights from The Robo Report and our overall rankings. For the full report, please click the "Download Report" link above.

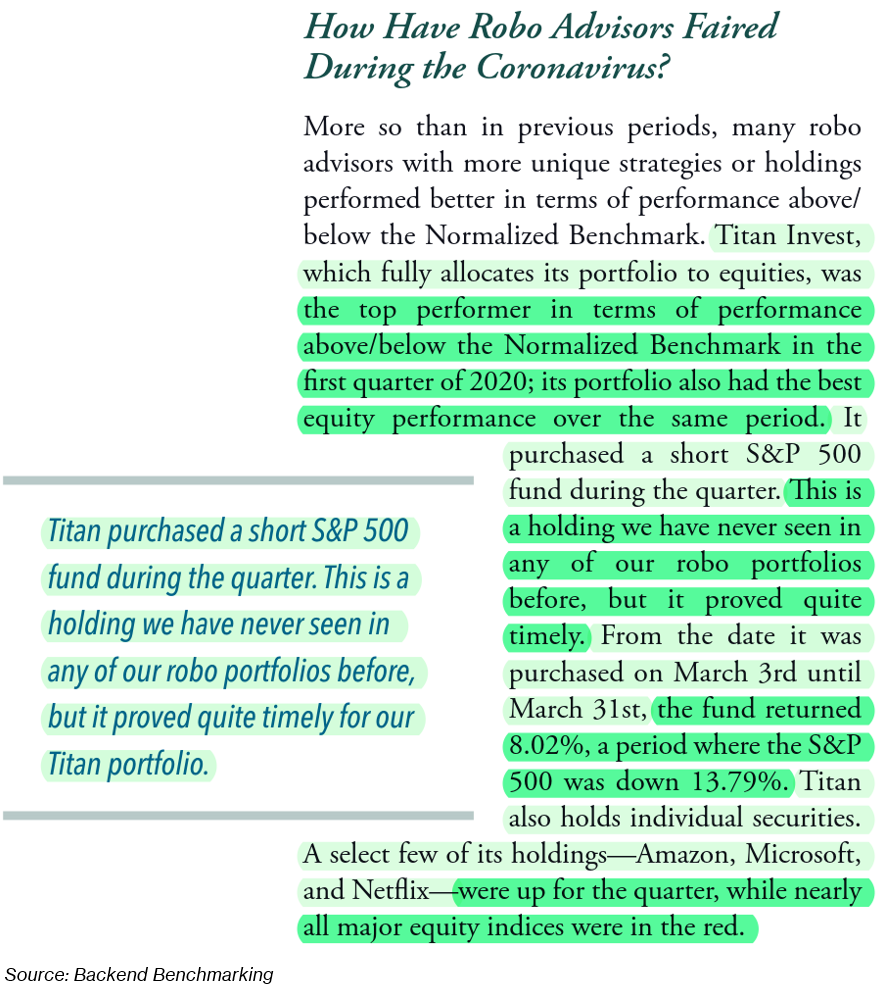

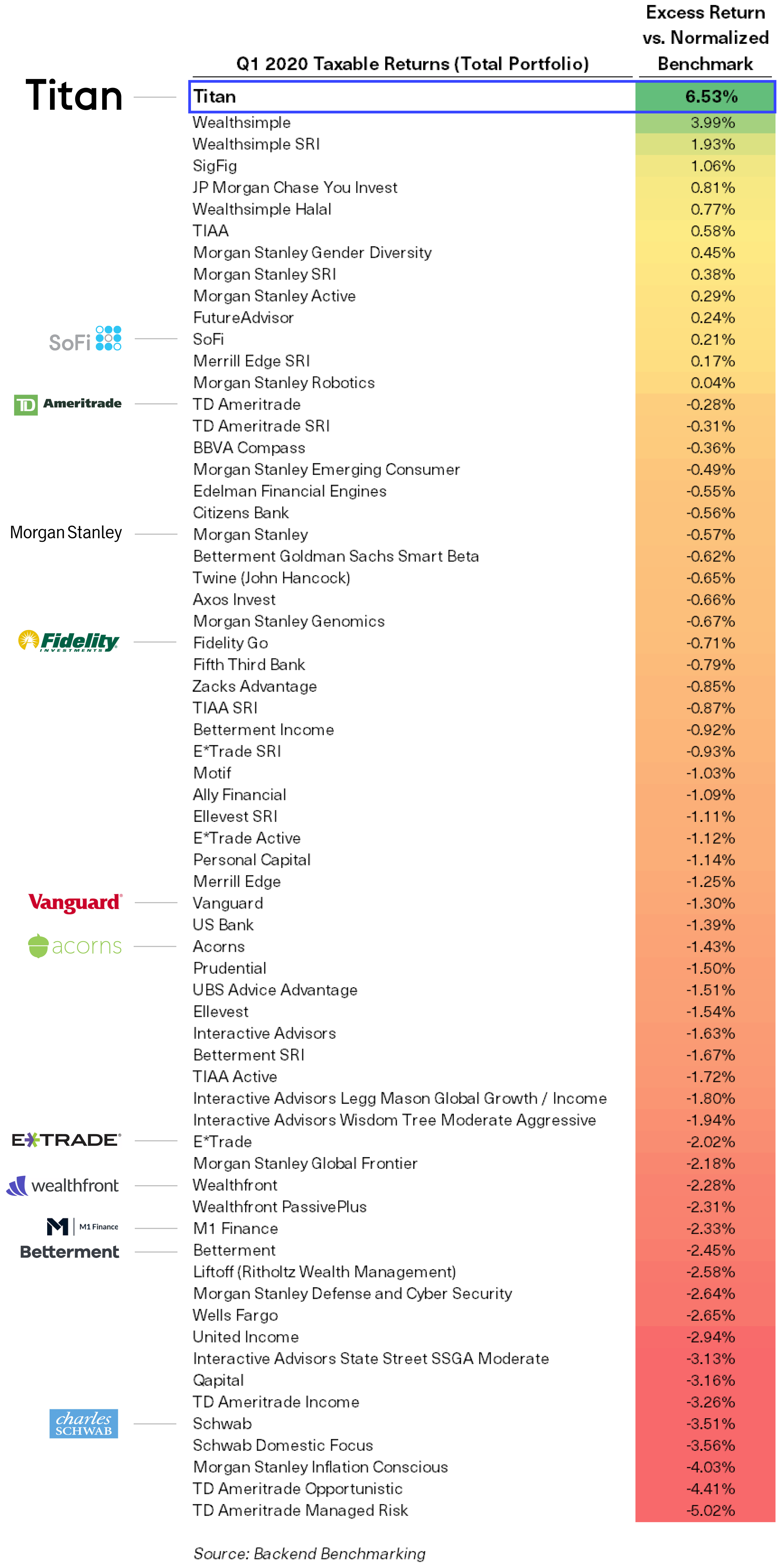

Overview

Ranking by Excess Returns

Ranking by Equity Returns

Executive Summary

These results suggest that Titan is delivering higher absolute *and* relative returns versus every other investment advisor covered.

The Robo Report

The Robo Report is published each quarter. It measures portfolio performance sourced from real accounts tracked by Backend Benchmarking, a third-party financial portfolio analytics platform. They started tracking Titan in 3Q 2019.

The Robo Report shows Titan's net returns (after fees) for an Aggressive client in Q1 2020. See page 22 of The Robo Report for more details.

Other Notes

- Some of the above advisors' portfolios had more equity than fixed income. Titan, for example, is 100% equity; other advisors are 60% equity / 40% fixed income. The percentage allocated to equities in a portfolio is one of the largest drivers of returns; generally, higher equity allocations drive higher returns than fixed income over time, but equity is also higher risk. Because of this, comparing portfolios that have a different level of equity allocation can be misleading.

- Backend Benchmarking's Robo Report does a great job of normalizing returns for these allocation differences. The table above shows each advisor's "Excess Return vs. Normalized Benchmark" which attempts to normalize their varying equity vs. fixed income allocations. The result is a more apples-to-apples comparison of returns than just looking at their nominal portfolio returns, in our view.

- Backend Benchmarking's illustrative Titan account represents an account with an Aggressive risk profile; clients with Moderate and Conservative risk profiles would have experienced lower returns. See website for full disclosures.

- In the Ranking portion of the report, Backend Benchmarking limits the advisors to those that had a minimum of 2.25 years performance history within the account they track. This is why Titan among many other robo advisors are not covered in the Robo Ranking section of the report yet. We look forward to being covered in the Robo Ranking in the future.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.