Facebook Earnings Analysis: Q1 2020 results show ad spend stabilizing

Apr 30, 2020

On Wednesday after hours, Facebook surged +9% after reporting strong user growth and a healthy beat on topline revenue, which grew +18% year-over-year (down from +25% last quarter).

Coming into the quarter, many analysts had been concerned about Facebook's exposure to advertising spending.

However, despite the broader slowdown in ad spend, Facebook still was able to grow average revenue per user (ARPU) in Q1, which rose +8% year-over-year to $8.52 globally.

This of course represented a significant deceleration from the +16% ARPU growth Facebook saw the prior quarter, but is still impressive for a company as strongly levered to ad budgets as Facebook.

Strong user growth takes investor focus

More notable to us was the massive surge Facebook reported in active users and user engagement across all geographic regions.

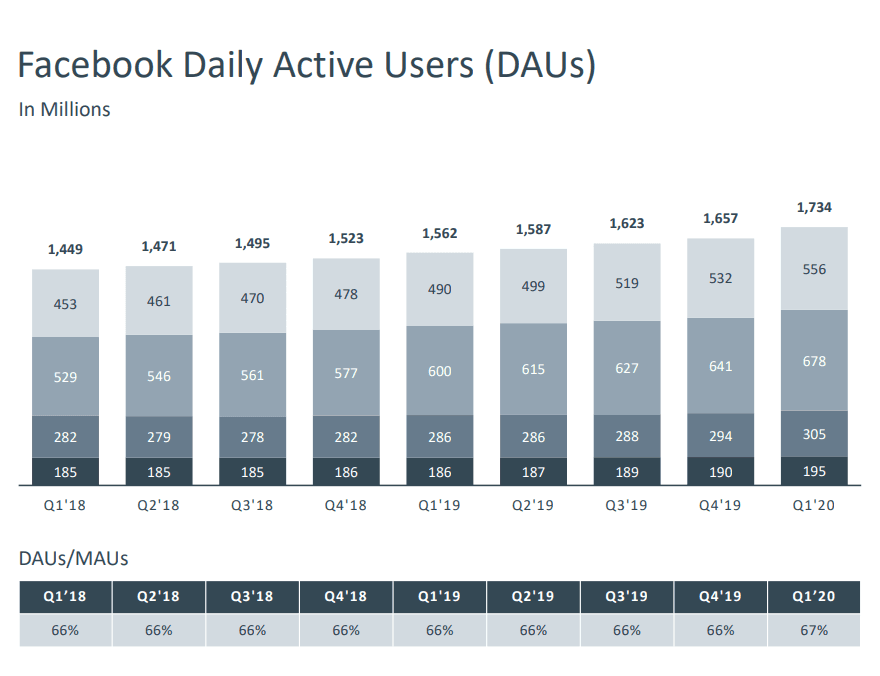

In Q1, Facebook added a total of 77 million daily active users across all its owned platforms.

To put that in context, that's roughly half a Twitter's worth of users gained, in a single quarter

This strength in user growth was particularly notable in the US - a relatively mature market for Facebook compared to the rest of the world, but which in Q1 booked the fastest quarter-over-quarter user growth it's seen since 2011.

All the while, user quality has actually improved as engagement rates ticked up from 66% to 67%.

While a 1% expansion may seem inconsequential in the abstract, it's significant for investors in Facebook who have grown accustomed to seeing engagement rates staying flat at 66% on the dot for the last 16 quarters (a period of time over which the company grew by nearly 1 billion users).

That said, we see this as clearly tied to current shelter-in-place measures, and would expect engagement rates to revert back towards 66% coming out of widespread quarantine efforts.

Signs of a stabilizing outlook

In terms of intra-quarter trajectory, Facebook reported seeing strong revenue growth until the last few weeks of the quarter, much like Google reported in its earnings release Tuesday.

But unlike Google, Facebook helpfully provided color on preliminary Q2 performance over the first few weeks of April.

After the sharp slowdown seen in late March, management is already reporting seeing ad revenue growth at back to flat (year-over-year) thus far in April.

We think this is very positive and bodes well should that trend continue through the rest of Q2.

Disciplined and long-term approach to costs

We were pleased to learn that while the company is taking steps to right-size its cost structure given the overall environment, it's still heavily committed to investing in its platform despite increased volatility on the top line.

As Zuckerberg put it on the call:

"Overall, I think during a period like this, there are a lot of new things that need to get built. And I think it's important that rather than slamming on the brakes now, as I think a lot of companies may, that it's important to keep on building and keep on investing for the new needs that people have, and especially to make up for some of the stuff that other companies would pull back on."

We believe this is the right move for the long-term and very emblematic of the long-term focus Zuckerberg and the rest of the management team operate under.

In other Titan portfolio company news:

Microsoft +2% after hours after demonstrating strong resilience to broader slowdown

- The company handily exceeded revenue and EPS estimates, while driving an impressive 1% and 2% beat on gross margins and operating margins, respectively

- Management noted seeing "minimal net impact" on its overall revenue as a result of COVID-19 - something we believe came as a shock to many investors

- Echoing comments made by Google's management team yesterday, the company reportedly saw accelerated adoption of its products as a result of recent economic shifts

- In the words of CEO Satya Nadella, recent trends have driven "two years' worth of digital transformation in two months"

ServiceNow +7% after hours on major earnings beat and full year outlook

- In its Q1 report, IT SaaS platform ServiceNow breezed past both revenue and EPS estimates (by +3% and +11%, respectively), while raising the stakes on its long-term outlook

- At a time when most companies are withdrawing full-year outlooks, the company committed to a fiscal year revenue guidance range just 2% lower than its pre-COVID forecasts, while reiterating its long-term $10 billion revenue target

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.