Amazon Q4 Earnings: Operating Leverage 101

Jan 31, 2020

The Results

On Thursday after hours, Amazon soared more than +10% after reporting Q4 earnings. The rally put Amazon above the elite $1 trillion valuation threshold once again, a watermark shared by several other Titan portfolio companies.

From the stock price performance, you might imagine Amazon absolutely crushed the quarter (and they did, in many important respects) but there's far more to the story here than you might think.

But first: the headline good news.

The Profit Surprise

Q4 represented an absolute blowout quarter for Amazon from a profitability perspective, with operating income and earnings per share exceeding analyst estimates by an incredible 44% and 60%, respectively.

However, what may surprise you is that revenue only exceeded estimates by approximately 2%.

How can this be?

In short, we believe much of the outperformance on the profitability side came from the rapid pace of growth in Amazon's still-nascent advertising business.

We've been tracking a noticeable acceleration in advertising density on Amazon's e-commerce platform throughout the back half of 2019, and that seems to have flowed directly into Amazon's bottom line profits in Q4, catching analysts (who may not have been focusing very much on a <10% revenue segment) off guard.

This is a phenomenon commonly referred to amongst investors as…

Operating Leverage 101

When a small, but high-margin business gets weaved into the business model of a large, but low-margin business, that can have an extremely dramatic impact on financial outcomes.

Take advertising for example. Although Amazon doesn't break out their advertising business specifically, assuming that segment occupies the majority of Amazon's "other" revenue line, at typical advertising margins, that segment could have wound up contributing the majority of Amazon's operating profits in the fourth quarter.

That's when advertising is still less than 10% of Amazon's overall business from a revenue perspective!

That's what we believe to be the beauty of Amazon's scale-driven business model. The more scale they attain, the stronger the operating leverage they will benefit from as they layer in new, high-margin business segments.

As these high-margin businesses throw off tremendous cash flow, Amazon becomes increasingly able to reinvest in their core platforms and customer experiences.

In this particular quarter, the operating leverage came from a surge in the advertising business at a time when analysts were all laser-focused on the incremental expenses coming out of Amazon's roll-out of its new one-day free shipping initiative.

Color us unsurprised at the street's surprise here.

The Takeaway

Aside from the big Q4 profit beat, we generally pleased with the rest of the earnings report.

While the forward operating income guidance of $3-4.2 billion felt a little light to us (especially after adjusting for a change in fixed asset depreciation methodology), Amazon historically has been quite conservative in its first quarter guidance.

In other words, we would not be surprised to see Amazon exceed the high end of the $1 billion+ wide operating profit range they put out for next quarter.

The stabilization around growth in AWS (Amazon's cloud services business and other major profit contributor) was also a nice to see as we believe many investors had been seeking clarity around the trajectory of AWS amidst noise of increasing competition from Microsoft's Azure and GCP.

On net, we felt like Q4 was solid, although the outsized stock price reaction seems to suggest a bit of a relief rally baked in. We'll continue to keep our eyes trained in on Amazon's growth trajectory, particularly in the all-important cloud and all-too-overlooked advertising segments in the coming quarters.

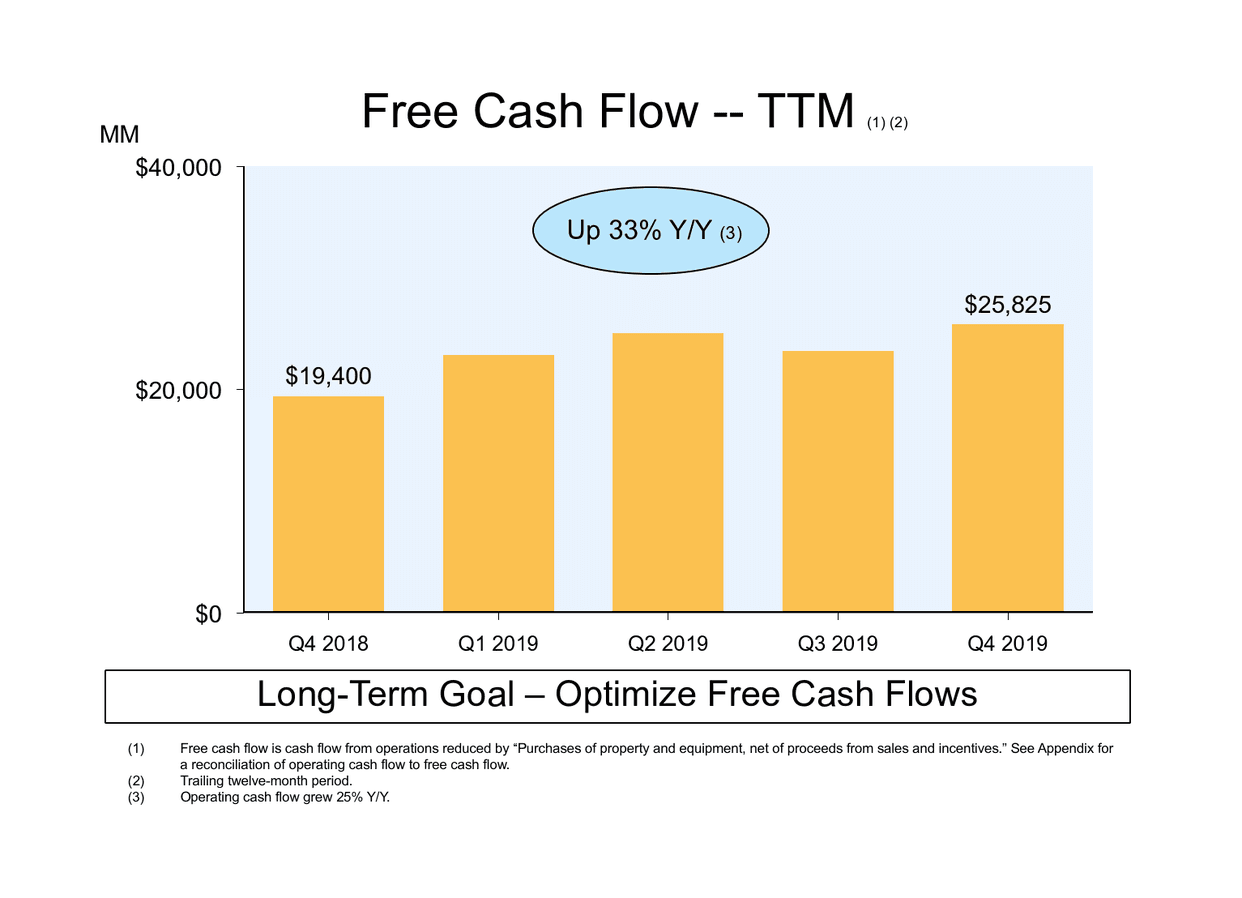

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.