Deep Dive on Disney

May 29, 2019

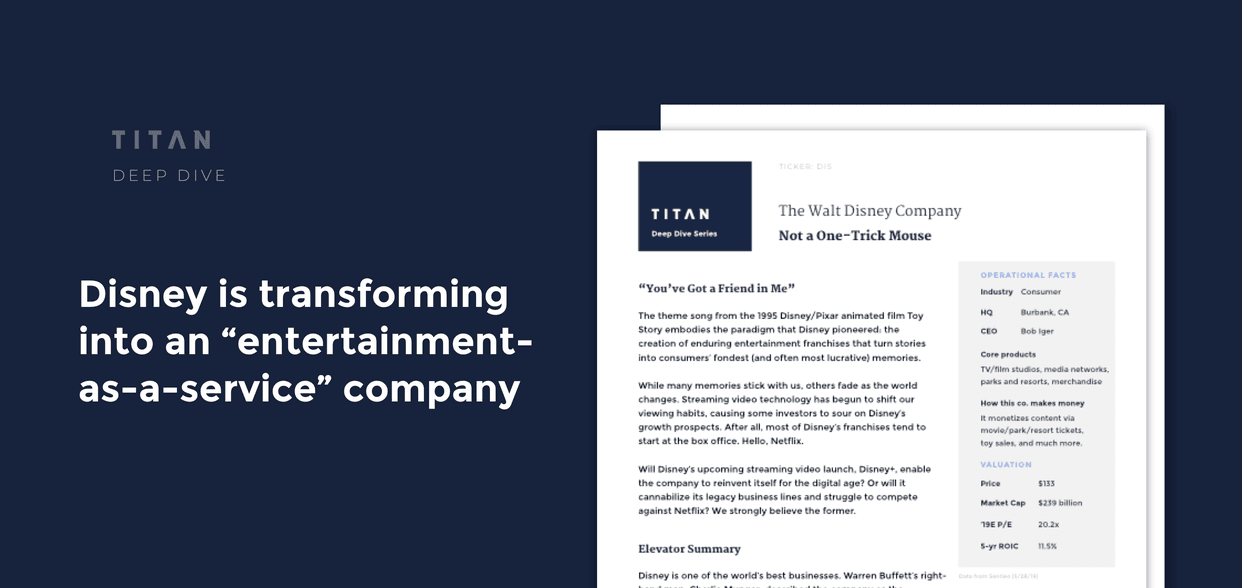

"You've Got a Friend in Me"##

- The theme song from the 1995 Disney/Pixar animated film Toy Story embodies the paradigm that Disney pioneered: the creation of enduring entertainment franchises that turn stories into consumers' fondest memories.

- Disney is one of the world’s best businesses. Warren Buffett’s right-hand man, Charlie Munger, described the company as the equivalent of “an oil company that can put the oil back in the ground after it is done drilling so it can drill again.”

The Market's Concerns about Disney##

- Streaming video technology has begun to shift our viewing habits, causing some investors to sour on Disney's growth prospects. After all, most of Disney's franchises tend to start at the box office.

- Disney’s stock has barely kept pace with the market over the past five years due to concerns about cord-cutting (e.g., consumers shifting from cable TV to streaming video like Netflix).

- Some investors have been worried that Disney’s own transition to the streaming video model via its upcoming Disney+ launch will require heavy investment and therefore depress its profits for years to come.

Our Contrarian View##

- We believe Disney is on the cusp of a transition to a more direct-to-consumer business model via Disney+ which should drive significant growth.

- Its re-organization around streaming services will unlock pricing power and improve unit economics, while putting to rest concerns about traditional media disruption and near-term profit weakness.

- At its current valuation, we think the stock appears attractively valued for long-term investors, with +30% potential upside in the next few years.

Read the Deep Dive##

You can read the full Deep Dive, along with our videos and podcasts, by joining Titan today.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.