The Slack S-1: An Analysis in Five Charts

Apr 30, 2019

On Friday, workplace messaging software business Slack filed to go public via a direct listing under the ticker SK. Here are 5 quick takeaways from its ~400-page S-1 filing.

In short, it's valuation has gotten pricier of late, but for good reason: the product is improving, driving accelerated customer spending, strong dollar retention, and shrinking operating losses.

How the product fares against competing offerings from Microsoft will be the major outstanding question for investors as the company debuts on public markets.

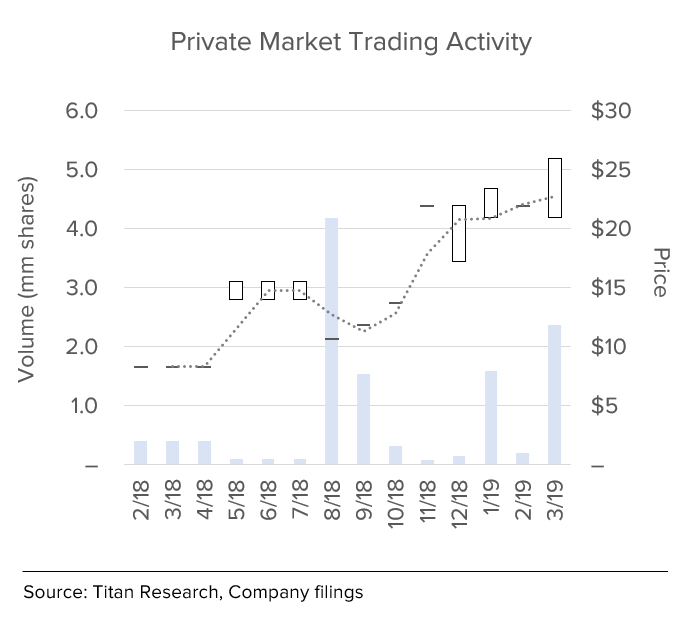

1.) Private market valuation has expanded rapidly ahead of direct listing.

Based on private market trades, Slack’s valuation has more than doubled over the last 3 quarters, with recent trades valuing the business at close to $17 billion, or an eye-popping 42x trailing sales.

2.) Sequential revenue growth has shown consistent strength over the past 1-2 years.

Over the past 6 quarters, revenue has grown consistently in the ballpark of 15-16% each quarter, with increasing strength in customer spending offsetting recent deceleration in customer growth.

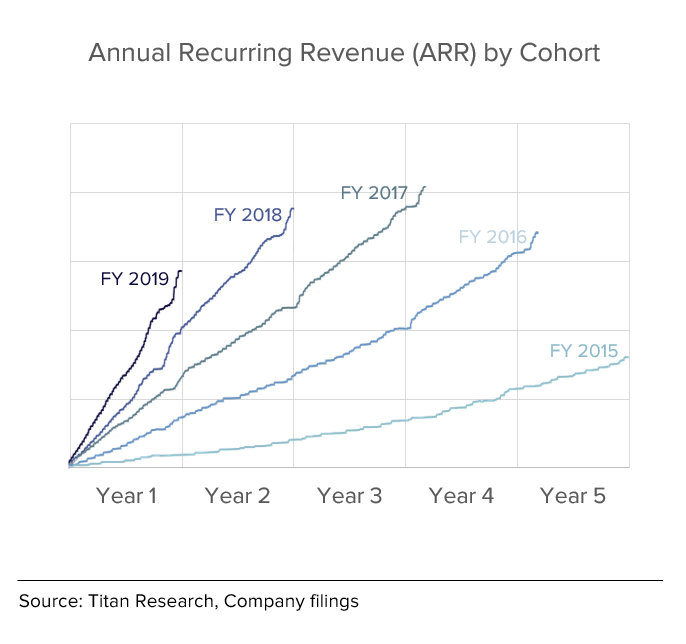

3.) New customers are ramping up their spending faster than older ones.

Over the past 5 years, each successive vintage of customers has increased their spending faster than prior ones, an attractive dynamic that we believe demonstrates a long runway for market penetration and growth.

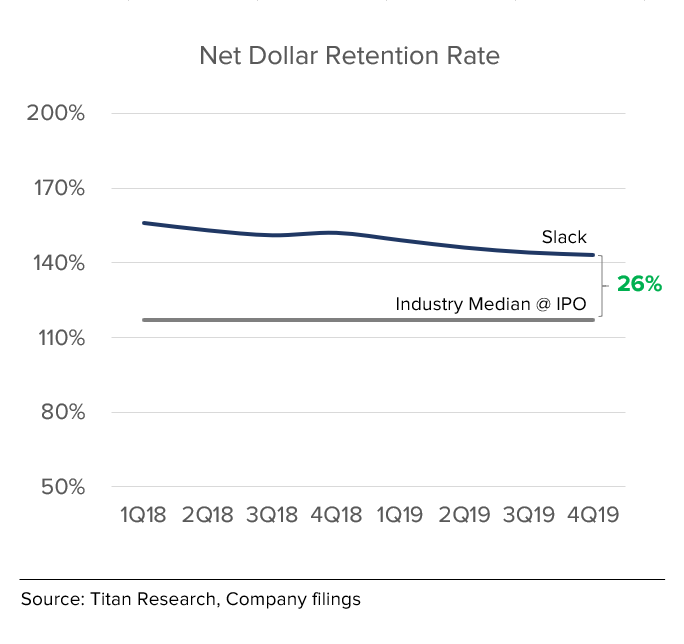

4.) Dollar retention metrics are at the high end of industry peers.

Slack has an attractive customer base that tends to increase its spending meaningfully every year, as evidenced by its strong net dollar retention rate figures. Over the past 2 years, they’ve averaged around ~150% for this key metric – firmly in the high end of most high-growth SaaS businesses we’ve seen at IPO.

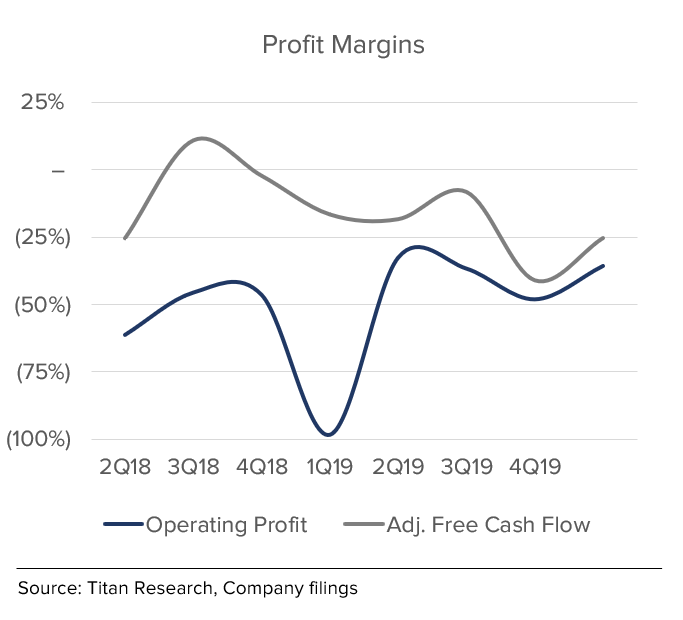

5.) Profitability appears on the horizon as operating losses shrink.

While Slack is still operating at a loss, we don’t believe profitability will be as foundational a concern for Slack as it has been for other recent high-profile IPOs. Over the past 3 years, it’s exhibited strong fixed cost leverage on the R&D and marketing side – a dynamic that has allowed it to end last year at a negative ~40% operating margin, after having reported a negative ~140% margin just two years prior.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.