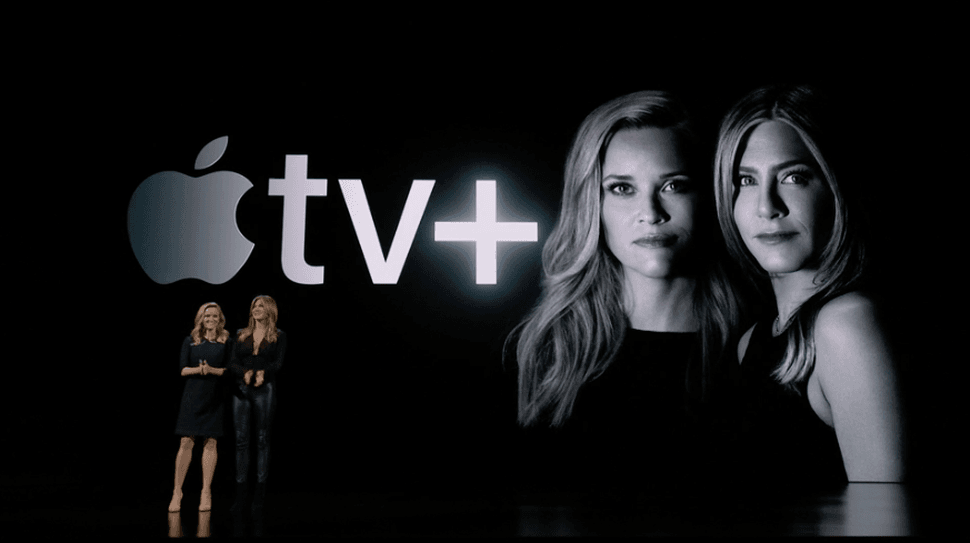

Apple Launches Streaming Video and Credit Cards

Mar 25, 2019

Rook to H7. Looks like Apple is also moving its chess pieces. You may have seen the press re: Apple TV+ and Apple Credit Card.

The long-term investor's 101: This enables Apple to cross-sell products and take share quickly. And with more products > more value to customers > more customers > more money > more products …. the network-driven flywheel continues.

Why this is good for Apple:

1 / Apple's vying to have more wallet share per customer. The average US consumer only spends a small portion annually in the Apple ecosystem ($40-50), but is spending multiples of that outside the phone. On a per customer basis, it makes sense that Apple would try to increase the amount they spend on the phone in their pocket vs. from their wallet…in their other pocket. Maybe even replace the wallet someday?

2 / Apple is late to the game on both fronts, but this shouldn't be a barrier to entry. There are dozens of cash-back credit cards and several content-streaming players. What gives? Usually scale is a real moat for a company. If we tried to start Netflix, we'd need (a) billions of dollars to film a Birdbox competitor and then (b) an audience of millions. Apple has both already. To hit this home further, Apple launched Apple Music 7 years after Spotify, but now has over 50M subscribers (vs. ~100M for Spotify).

3 / The subtleties: Apple's credit card shows it still has some of that Steve Jobs-ian inspiration. The physical credit card has no information on it other than your name. This is the core of Apple's ethos of simplicity, ever since its earliest days.

? / Several unanswered questions still remain:

- Is Apple conceding to Samsung? Apple's hardware sales (actual iPhones) have seen intense competition from Samsung. By their actions here, they're saying they need to diversify revenues from just selling iPhones to selling you things inside iPhones.

- What will be the actual pricing of the above services?

- How good will Apple's content be? While Apple has the money to pay people to make content, how compelling it turns out remains to be seen.

Cash Management

© Copyright 2024 Titan Global Capital Management USA LLC. All Rights Reserved.

Titan Global Capital Management USA LLC ("Titan") is an investment adviser registered with the Securities and Exchange Commission (“SEC”). By using this website, you accept and agree to Titan’s Terms of Use and Privacy Policy. Titan’s investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings and other information provided are for illustrative purposes only and are not to be considered investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services.

Please refer to Titan's Program Brochure for important additional information. Certain investments are not suitable for all investors. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Brokerage services are provided to Titan Clients by Titan Global Technologies LLC and Apex Clearing Corporation, both registered broker-dealers and members of FINRA/SIPC. For more information, visit our disclosures page. You may check the background of these firms by visiting FINRA's BrokerCheck.

Various Registered Investment Company products (“Third Party Funds”) offered by third party fund families and investment companies are made available on the platform. Some of these Third Party Funds are offered through Titan Global Technologies LLC. Other Third Party Funds are offered to advisory clients by Titan. Before investing in such Third Party Funds you should consult the specific supplemental information available for each product. Please refer to Titan's Program Brochure for important additional information. Certain Third Party Funds that are available on Titan’s platform are interval funds. Investments in interval funds are highly speculative and subject to a lack of liquidity that is generally available in other types of investments. Actual investment return and principal value is likely to fluctuate and may depreciate in value when redeemed. Liquidity and distributions are not guaranteed, and are subject to availability at the discretion of the Third Party Fund.

The cash sweep program is made available in coordination with Apex Clearing Corporation through Titan Global Technologies LLC. Please visit www.titan.com/legal for applicable terms and conditions and important disclosures.

Cryptocurrency advisory services are provided by Titan.

Information provided by Titan Support is for informational and general educational purposes only and is not investment or financial advice.

Contact Titan at support@titan.com. 508 LaGuardia Place NY, NY 10012.